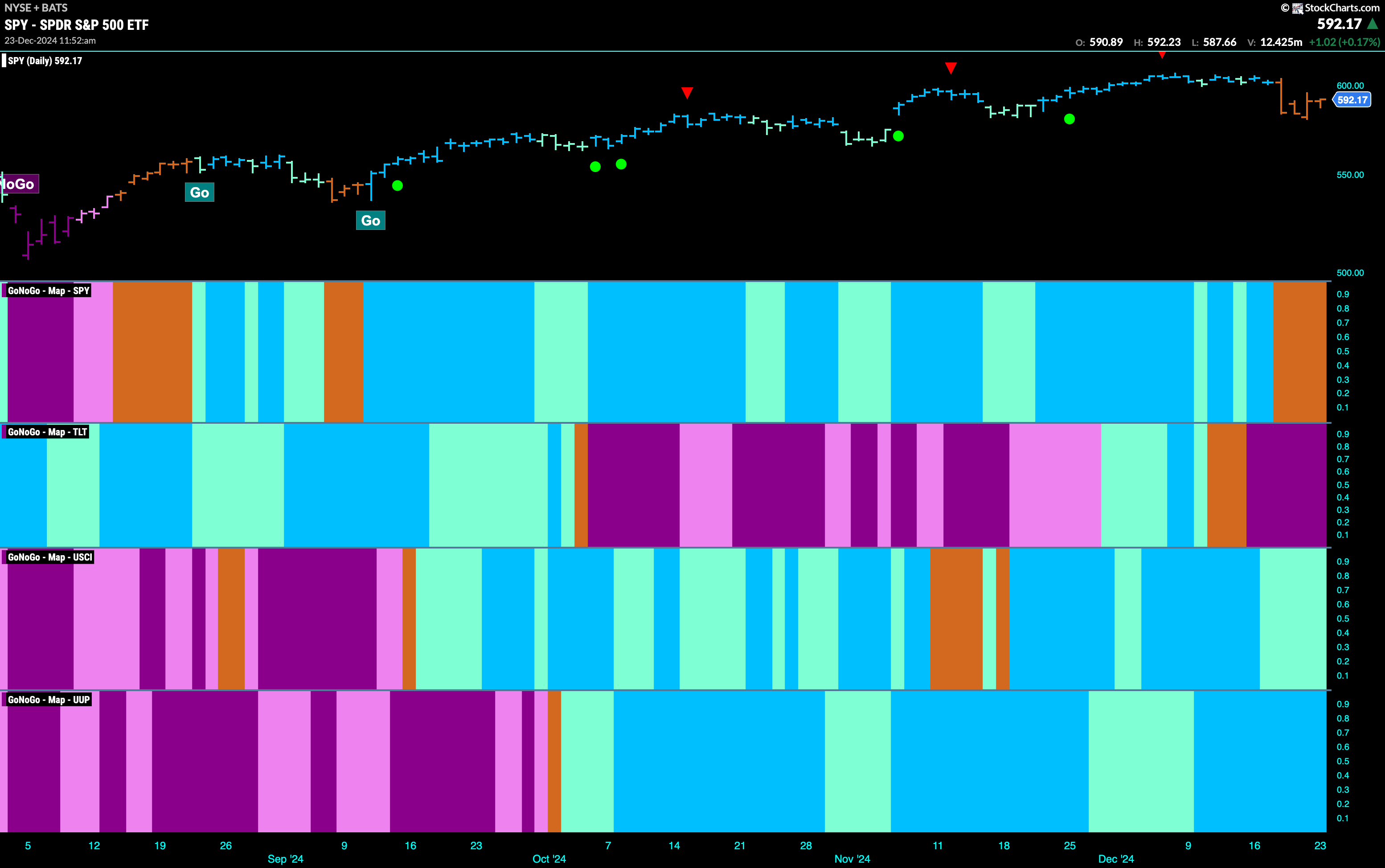

Good morning and welcome to this week’s Flight Path. The “Go” trend in equities gave way to amber “Go Fish” bars of uncertainty this week as price fell sharply. We have not seen any “NoGo” colors yet and price has stabilized somewhat. Treasury bond prices re-entered a “NoGo” and we have seen nothing but strong purple bars this entire week. U.S. commodities remained in a “Go” trend but the indicator painted weakness with a string of aqua bars. The dollar saw continued strength this week as GoNoGo Trend painted nothing but strong blue “Go” bars.

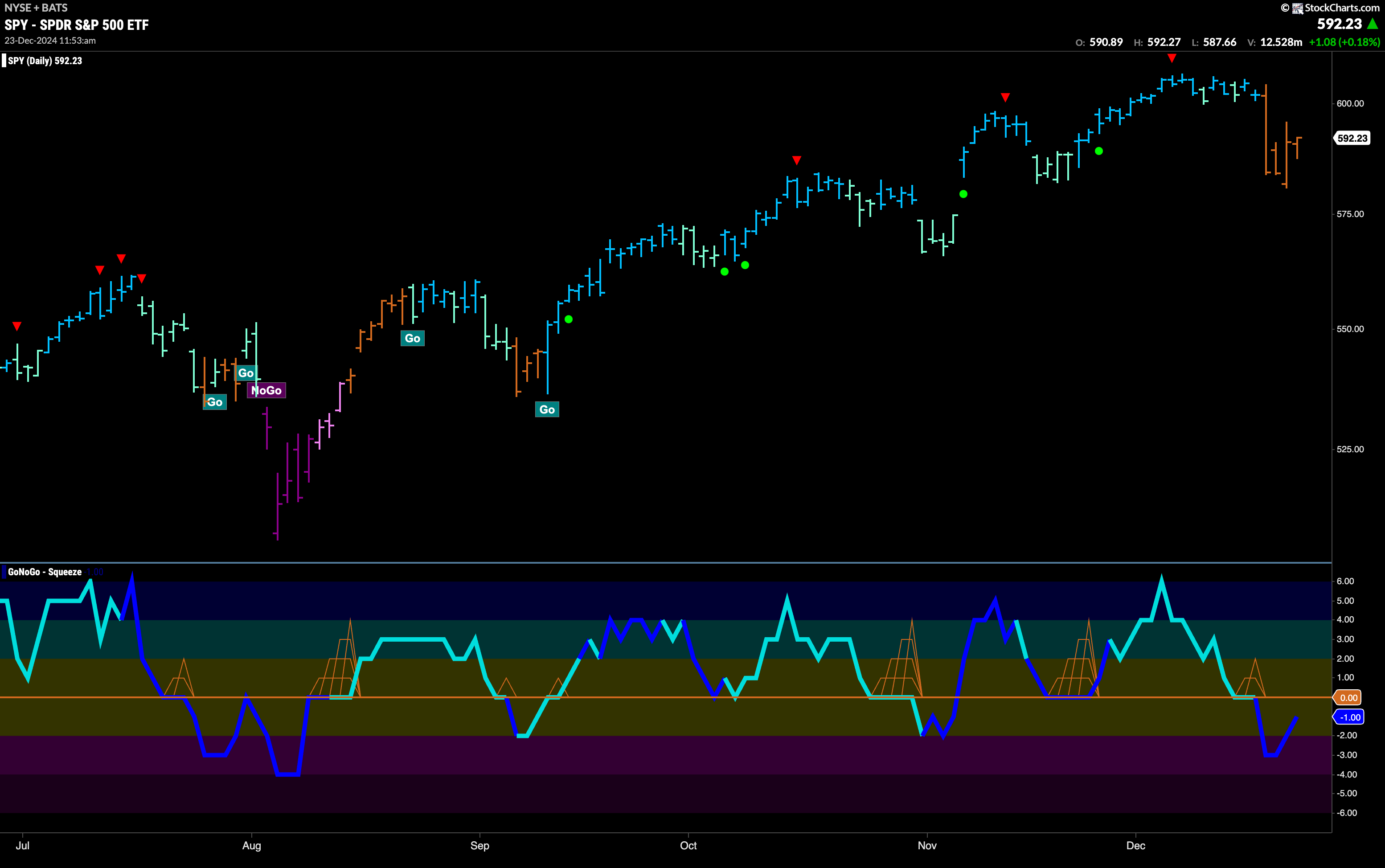

$SPY Shows a Little Weakness with Aqua Bars

The GoNoGo chart below shows that the “Go” trend ended abruptly last week as price fell sharply lower. We saw a string of amber “Go Fish” bars representing uncertainty with the state of the current trend. As price seems to be finding support we look to the oscillator panel and can see that it has broken down into negative territory and volume is heavy. We will watch to see if the oscillator returns to test the zero line from below and if it finds resistance.

On the longer term chart, the “Go” trend continues but we see weaker aqua bars now as the trend struggles a little after the most recent high. In the grand scheme of things pullbacks can be healthy parts of up trends and so we will look to see if GoNoGo Oscillator finds support at the zero level when it gets there. If the ‘Go” trend is to continue, it will be a good sign if momentum stays at or above the zero level.

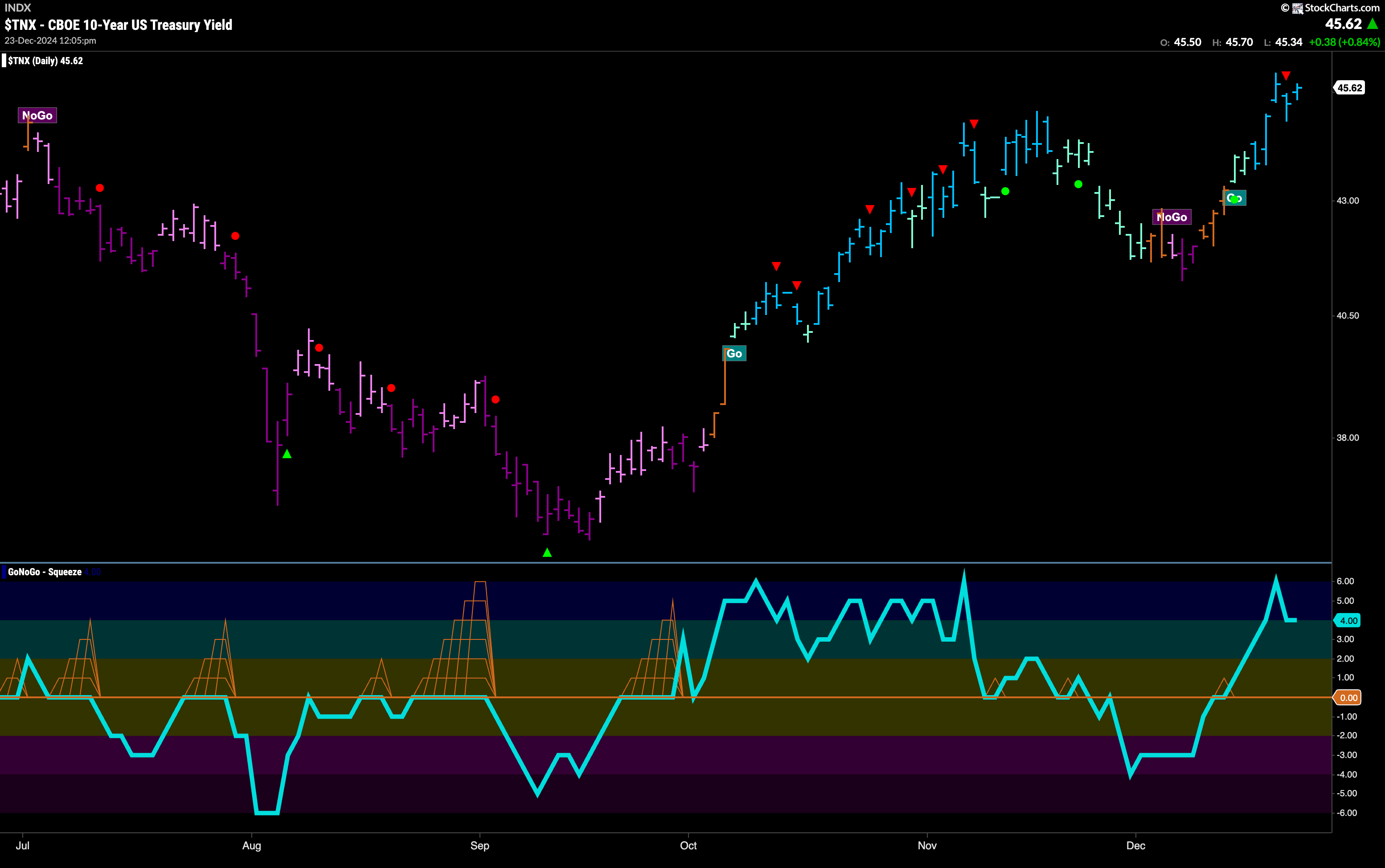

Treasury Rates Stay Strong in “Go” Trend

Treasury bond yields saw the new “Go” trend continue as price hit higher highs on strong blue “Go” bars. Momentum surged into overbought territory and has fallen slightly and so we see a Go Countertrend Correction Icon (red arrow) indicating that price may struggle to go higher in the short term.

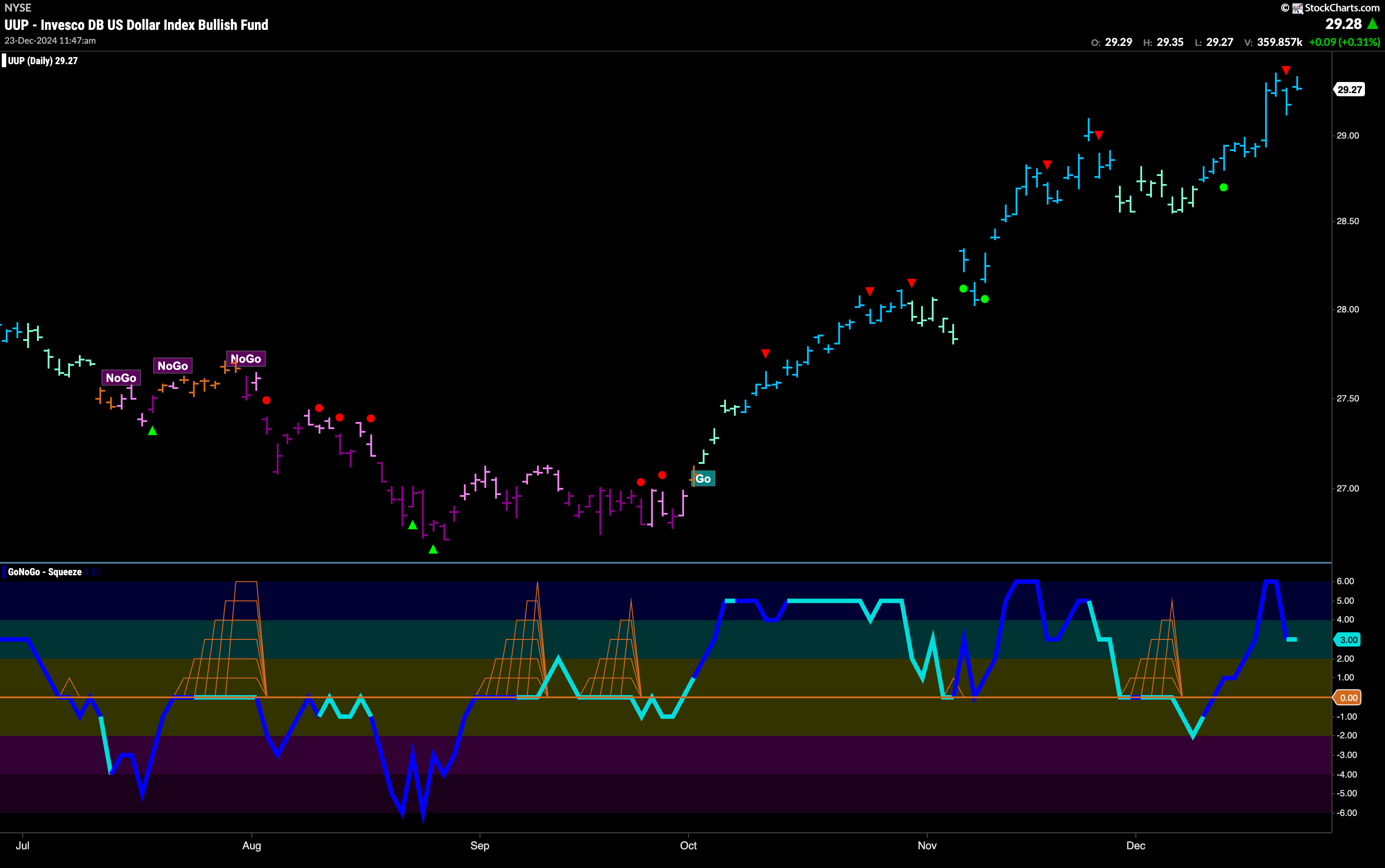

The Dollar’s “Go” Trend Continues

The dollar saw continued strength this week as GoNoGo Trend painted bright blue “Go” bars. This is as price has soared to even higher highs. We do see a Go Countertrend Correction Icon (red arrow) after this most recent high indicating that there may be some struggles to go higher in the short term. GoNoGo Oscillator is falling out of overbought territory.

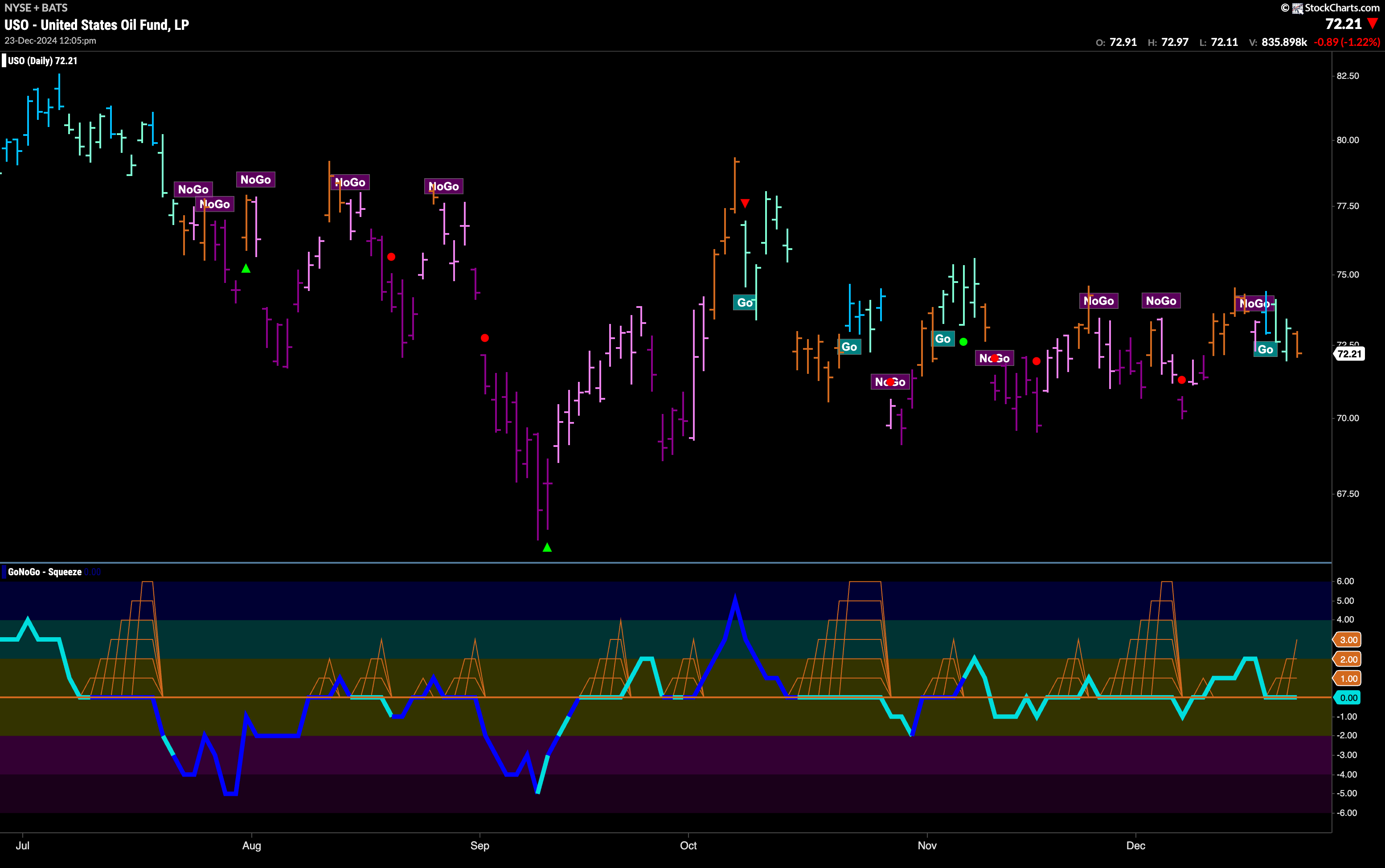

$USO Frustrates with Lack of Direction

After a few “Go” colors we see another amber “Go Fish ” bar. The “Go Fish” bars represent uncertainty and this is certainly what we see here with price range narrowing and neither side able to take control. GoNoGo Oscillator is once again riding the zero line and we see the beginnings of a small GoNoGo Squeeze. We will watch to see in which direction this Squeeze is broken.

“NoGo” Continues but There are Signs of Weakness

GoNoGo Trend shows that the “NoGo” trend continued this past week but we see some weaker pink “NoGo” bars as price bounces off a low. GoNoGo Oscillator is in negative territory and so momentum is confirming the trend as it is in the same direction. We will watch to see if price moves lower from here.

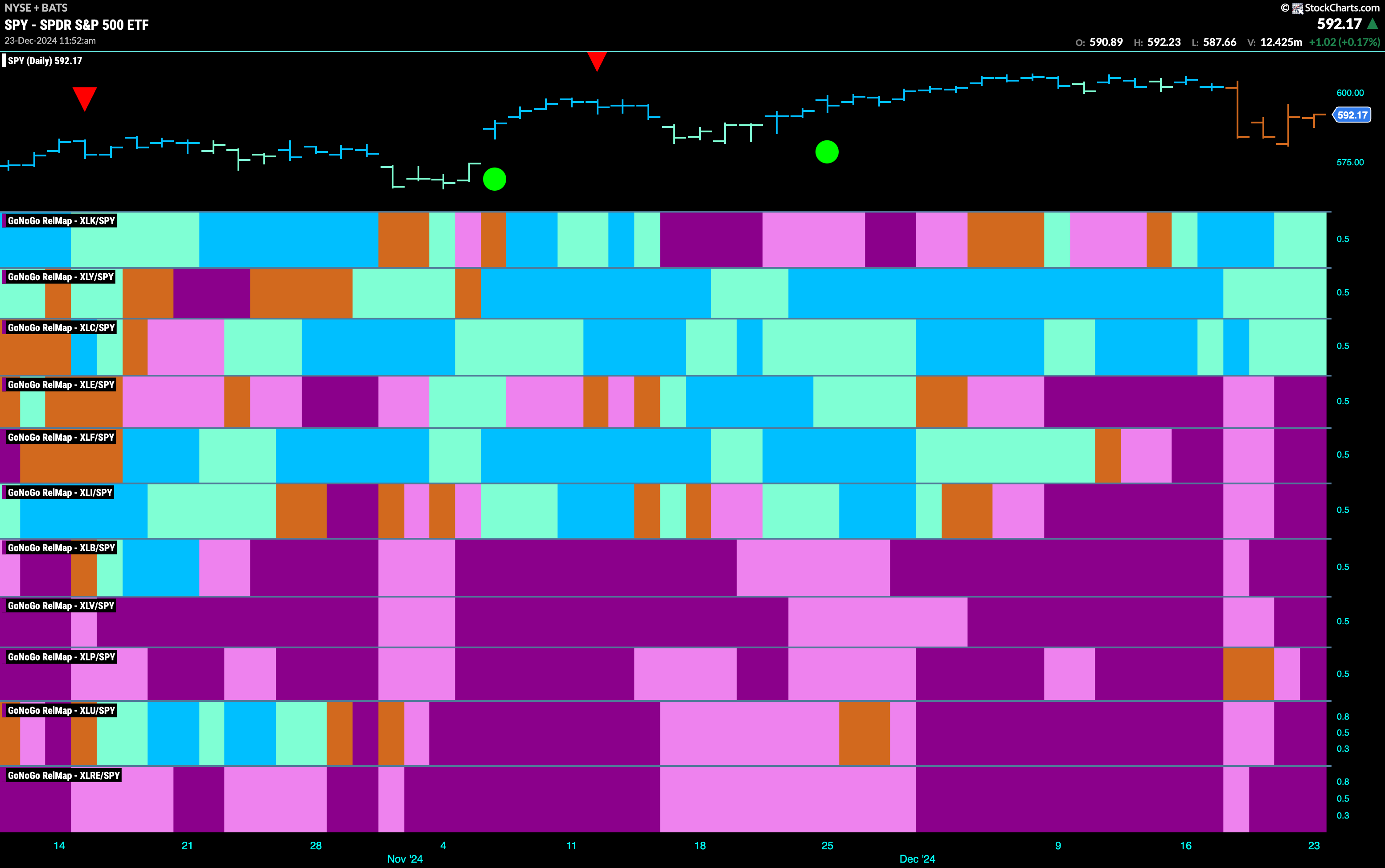

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 3 sectors are in relative “Go” trends. $XLK, $XLY, and $XLC, are painting relative “Go” bars.

Technology Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the technology sector this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLK. We saw in the above GoNoGo Sector RelMap that $XLK has returned as one of the relative out-performers in the S&P 500. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting “Go” bars for the entirety of the period in the chart below is the communications technology sub group.

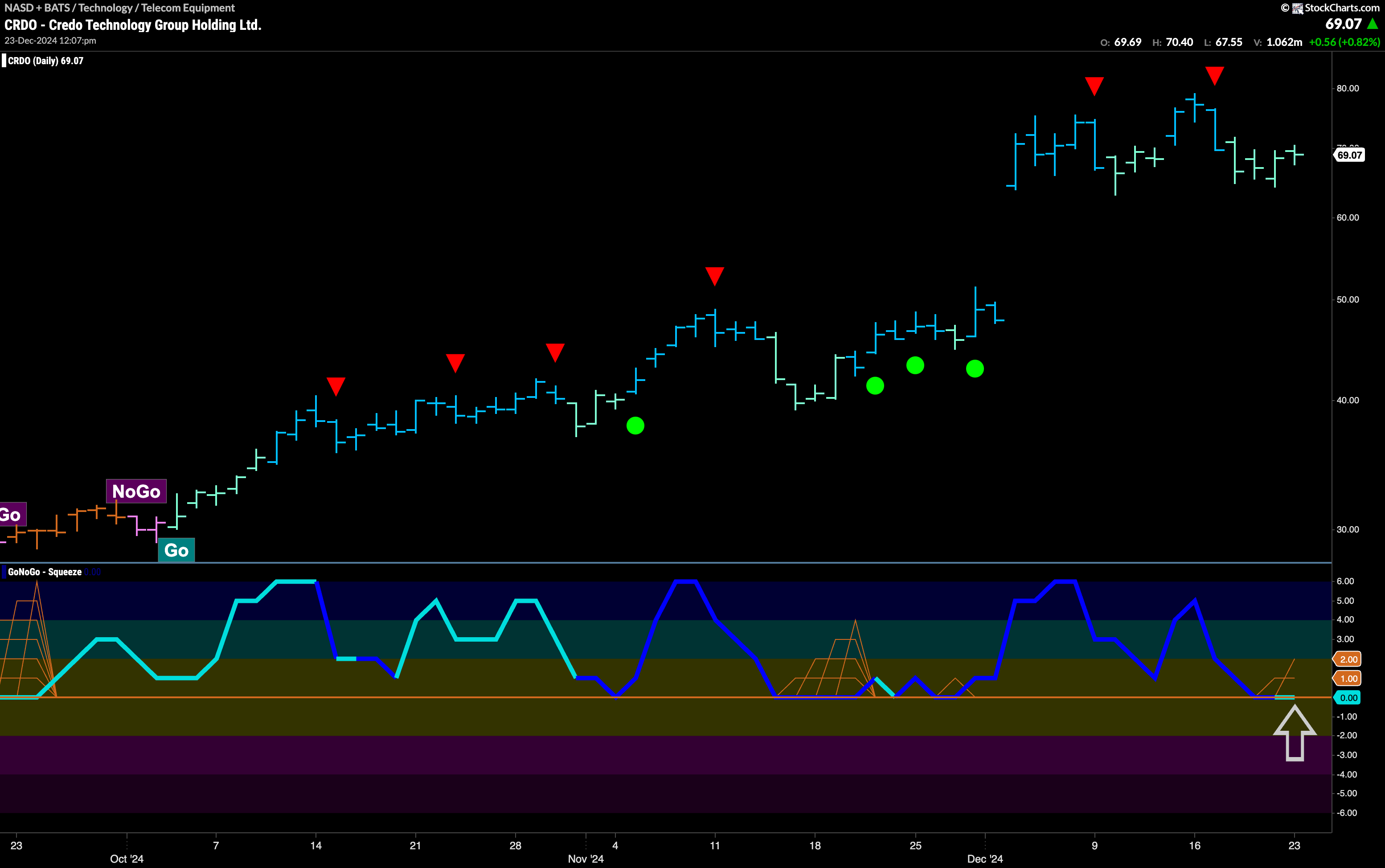

$CRDO Sets up For Run at Highs?

The chart below shows that price has been moving mostly sideways since gapping higher earlier this month. GoNoGo Trend has reflected that lack of strength with several weaker aqua bars. However, price seems to have found support at the upper bound of the gap and GoNoGo Oscillator has so far held the zero line. Now, the oscillator is riding that level, and we will watch to see in which direction it moves. If it finds continued support at zero, then we will know that momentum is resurgent in the direction of the “Go” trend and we can look for price to challenge for a new higher high.

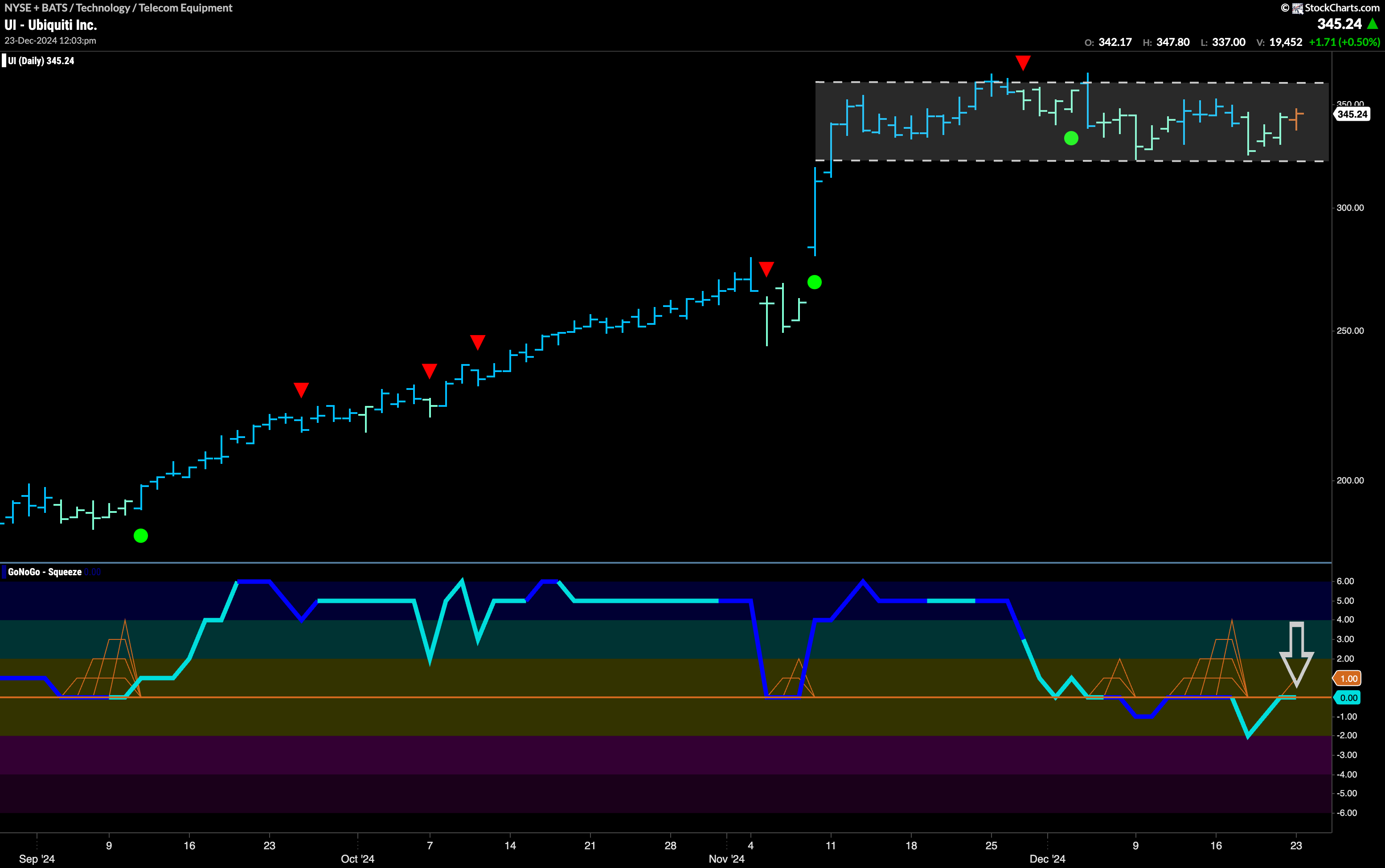

$UI Flashes Uncertainty with “Go Fish” bar

$UI had been in a strong trend for quite some time. In November we saw a strong move that took prices to new higher highs and since then price has consolidated sideways in a channel. During this period, GoNoGo Trend showed weakness with paler aqua bars and GoNoGo Oscillator was unable to stay at or above the zero line. With momentum out of step with the “Go” trend we finally see GoNoGo Trend paint an amber bar as GoNoGo Oscillator tests the zero line from below one more time. We will watch to see if this level acts as resistance and if so this will put further pressure on price.