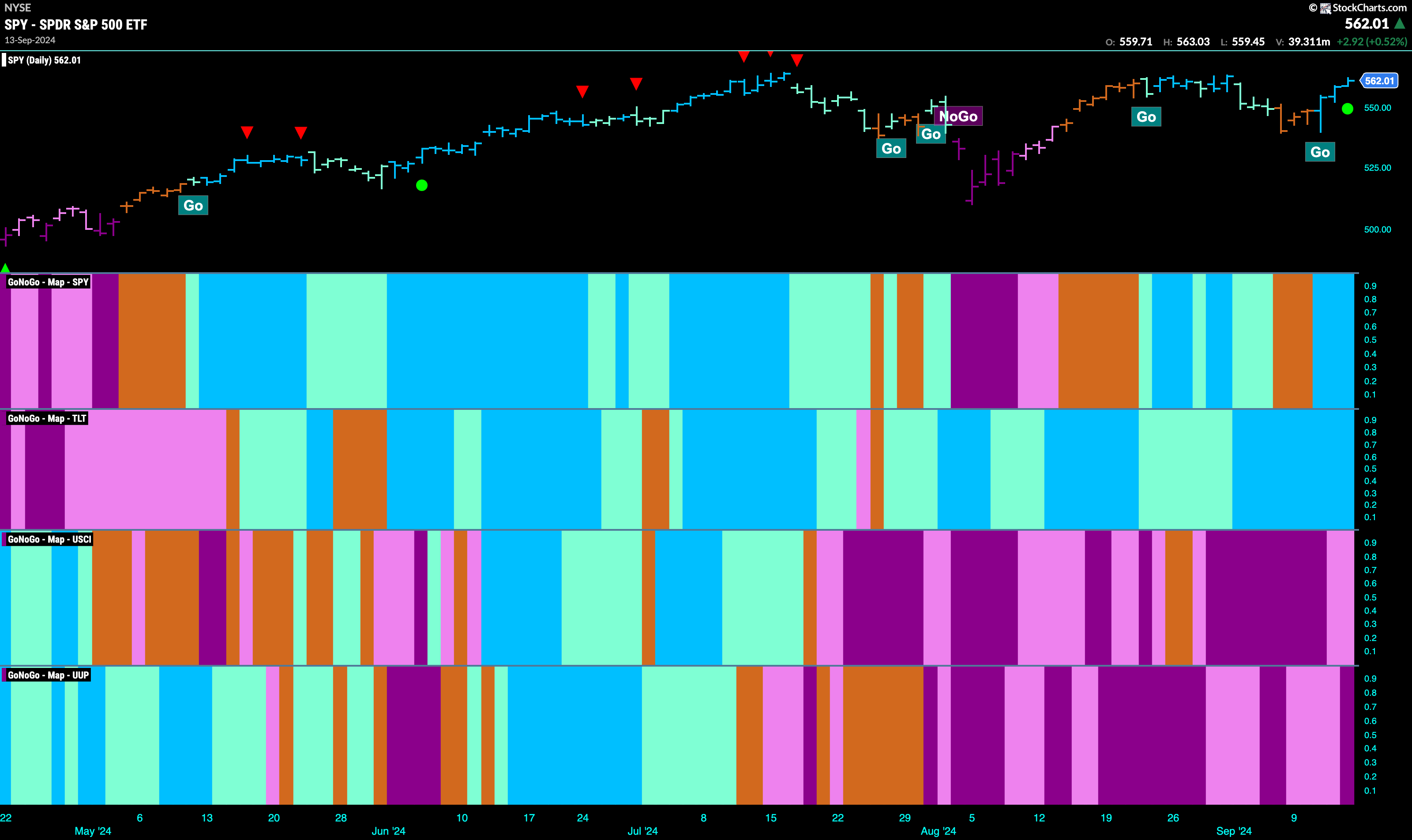

Good morning and welcome to this week’s Flight Path. Equities saw the “Go” trend return after a triplet of uncertain “Go Fish” bars. We saw blue “Go” bars from Wednesday on. Treasury bond prices remained in a strong “Go” trend painting blue bars the entire week. U.S. commodities remained in a “NoGo” trend this week but as the week came to a close we saw a couple of weaker pink bars. The dollar also saw its “NoGo” trend continue and after a string of weaker pink bars we saw a strong purple “NoGo” bar to end the week.

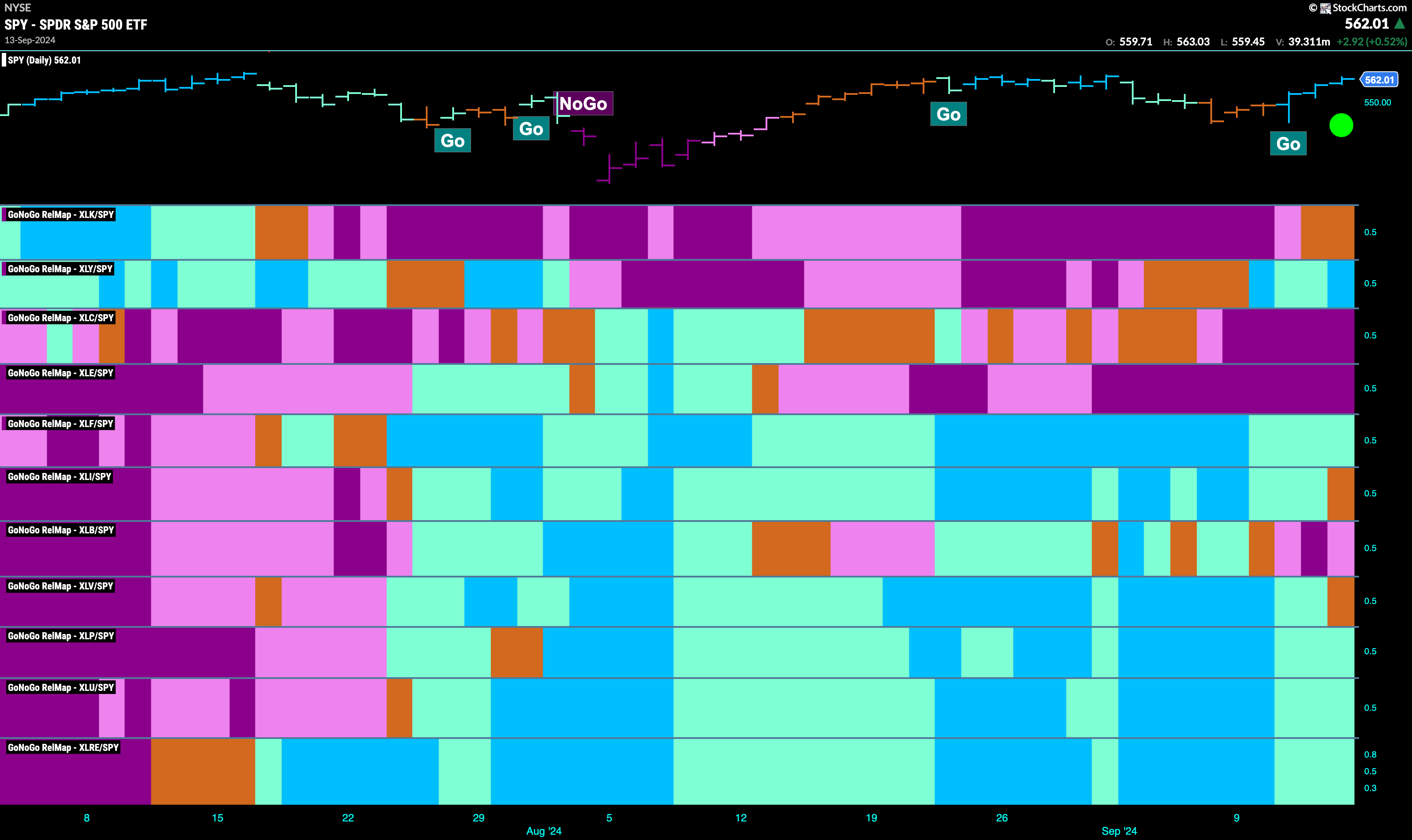

$SPY Recovers From Uncertainty

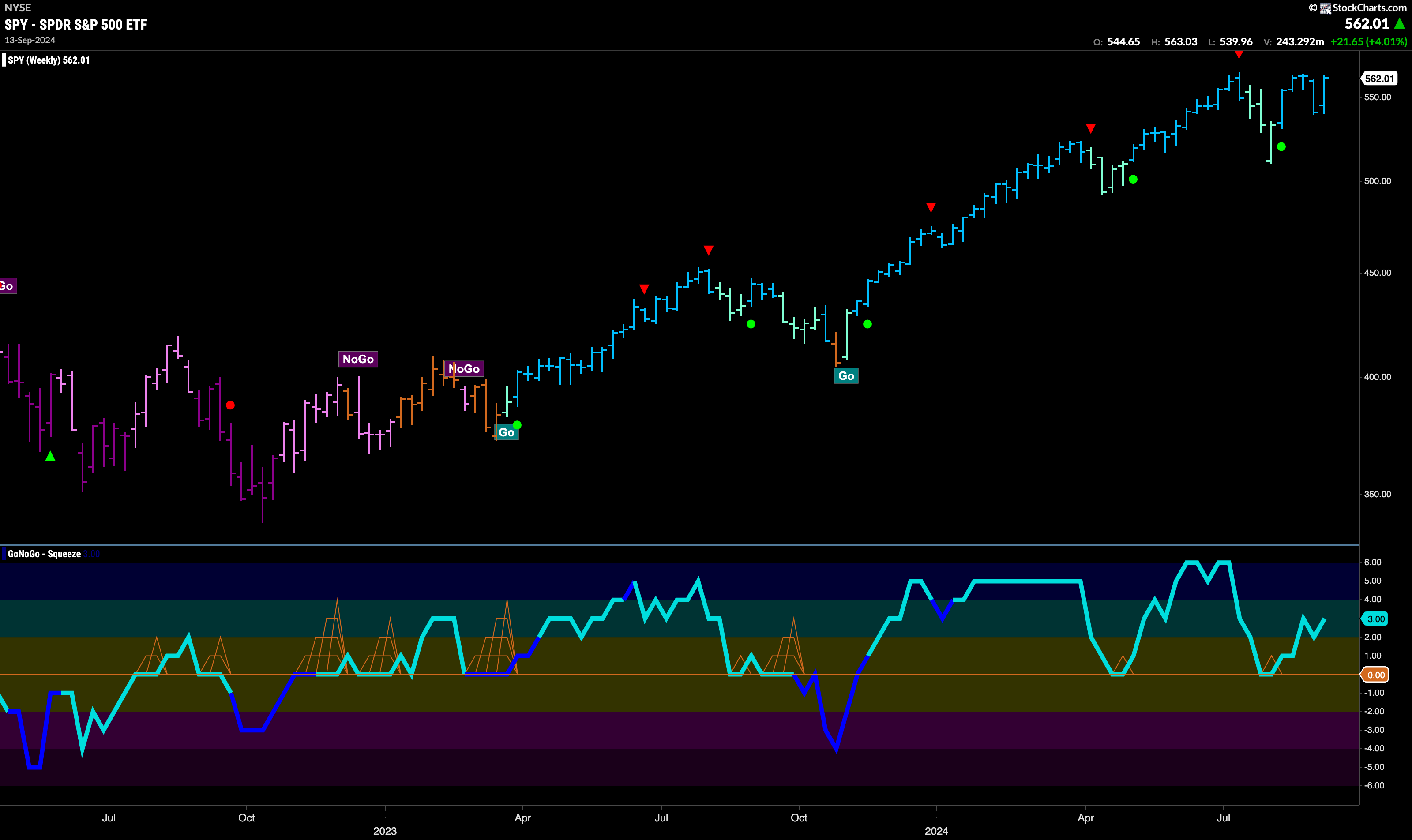

The GoNoGo chart below shows that after several amber “Go Fish” bars representing uncertainty the “Go” trend found its feet again this past week. Strong blue “Go” bars returned on Wednesday and we saw prices climb close to prior highs once again. If we turn our attention to the oscillator panel we can see that the oscillator broke through the zero line into positive territory after having spent a few days below that level. Now, with momentum resurgent in the direction of the “Go” trend, we see a Go Trend Continuation Icon (green circle) under the price bar. We will watch to see if this gives price the push it needs to make a new higher high.

The longer time frame chart shows a strong recovery last week. Price made up all of the lost ground and closed near the very top of the week’s trading range. Now, with another strong blue “Go” bar and momentum in positive territory but not yet overbought, we will watch to see if price can climb further from here.

“NoGo” Trend Continues in Force for Treasury Rates

Treasury bond yields painted strong purple “NoGo” bars again this week and we saw a new lower low as the August low provided little support. GoNoGo Oscillator in the lower panel was rallying toward the zero line but has turned around and is falling once again toward oversold territory. Momentum is well and truly on the side of falling prices.

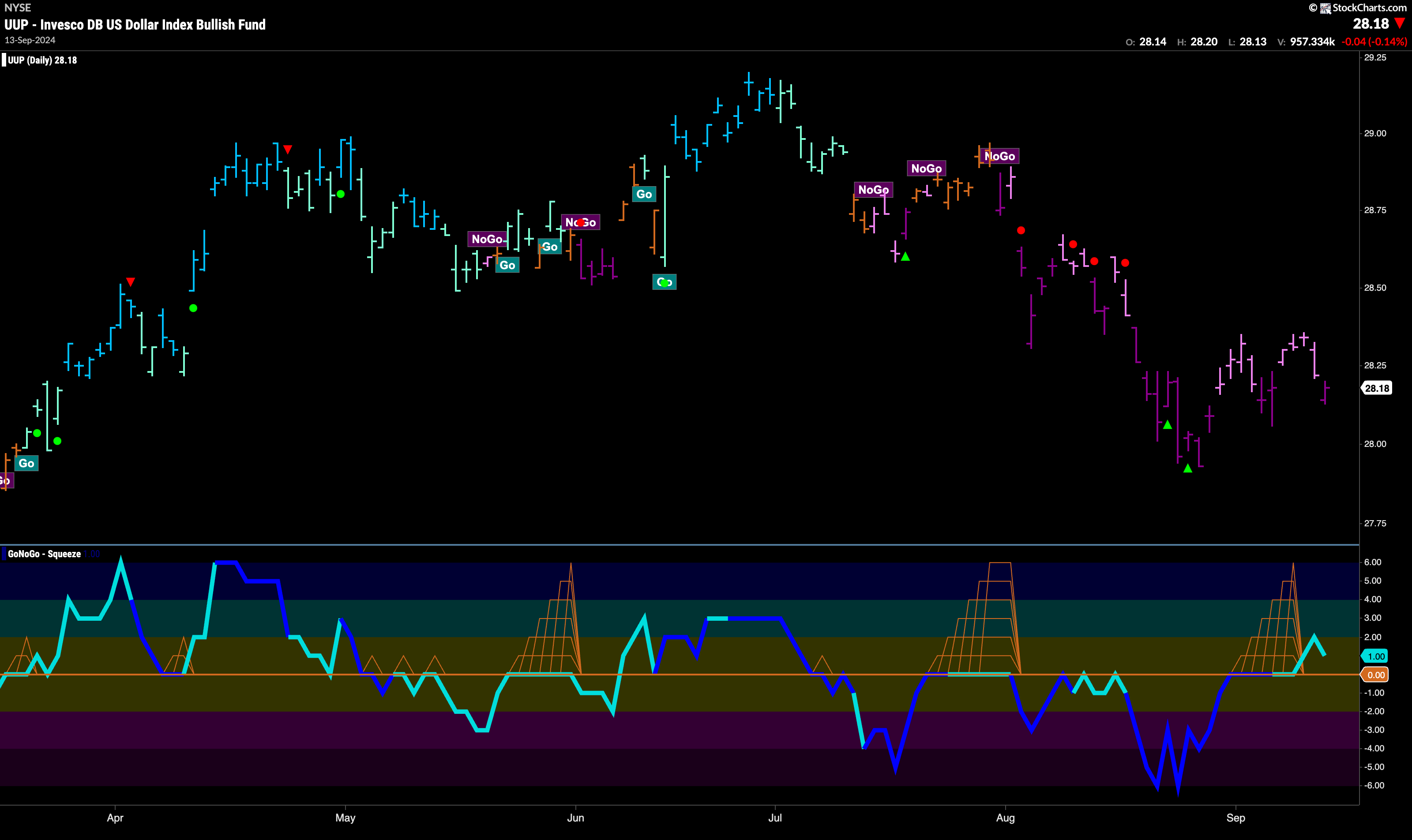

The Dollar’s “NoGo” Trend Survives Another Week

A strong purple “NoGo” bar returned at the end of the week after 4 straight weaker pink bars. Price failed to make a new higher high and rolled over mid week. Now, with a strong purple bar, we will look to see if price falls further. GoNoGo Oscillator is out of step with the trend which is interesting. Having broken out of a Max GoNoGo Squeeze into positive territory GoNoGo Oscillator is now at a value of 1. We will watch to see if this halts price’s move lower.

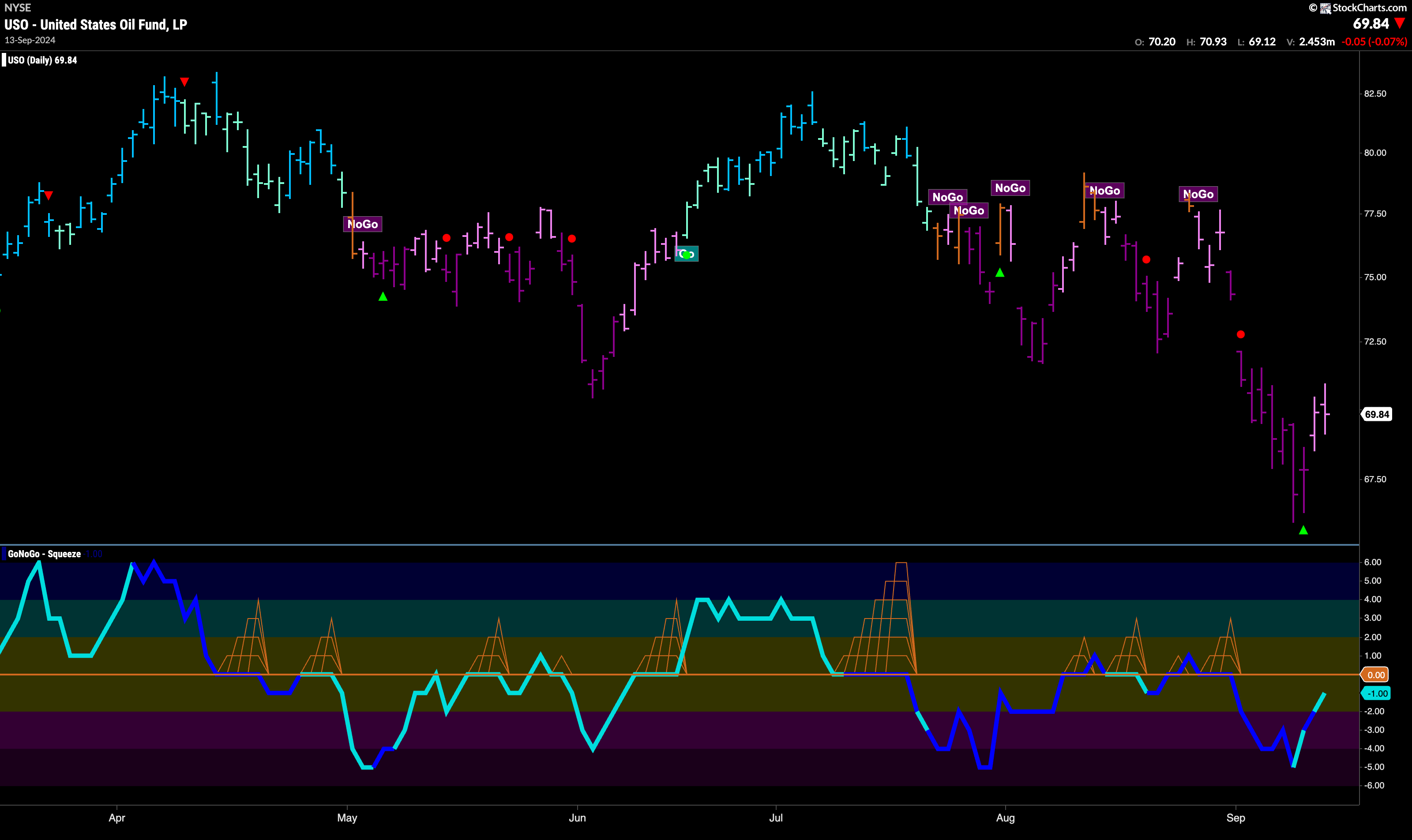

USO Rallies off Lows but Stays in Trend

$USO is still in a “NoGo” trend having crashed to a new lower low this week on strong purple bars. After that, during the second half of the week we saw price rally, and GoNoGo Trend paint a few weaker pink bars. GoNoGo Oscillator is in negative territory but rising toward the zero line. We will watch to see if it stays below that level in the coming days. At the moment, momentum is on the side of the “NoGo” trend.

Gold Makes a Break Higher in “Go” Trend

Gold had been threatening for weeks. We watched price consolidate at the highs and wondered if we would make a push higher. As price moved mostly sideways we saw GoNoGo Oscillator fall to test the zero line from above. It remained there as there was a tug of war between buyers and sellers at that level and we saw a Max GoNoGo Squeeze build. Late in the week, the Squeeze was broken into positive territory and that gave price the push it needed to break to new highs on strong blue “Go” bars.

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 5 sectors are in relative “Go” trends. $XLY, $XLF, $XLP, $XLU, $XLRE are painting strong blue bars.

Discretionary Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the Consumer Discretionary sector. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLY. We saw in the above GoNoGo Sector RelMap that $XLY was one of the new out-performers, performing strongly relative to the larger index. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting strong blue bars, in the 5th panel, the recreational services sub group is in a new, strong relative “Go” trend.

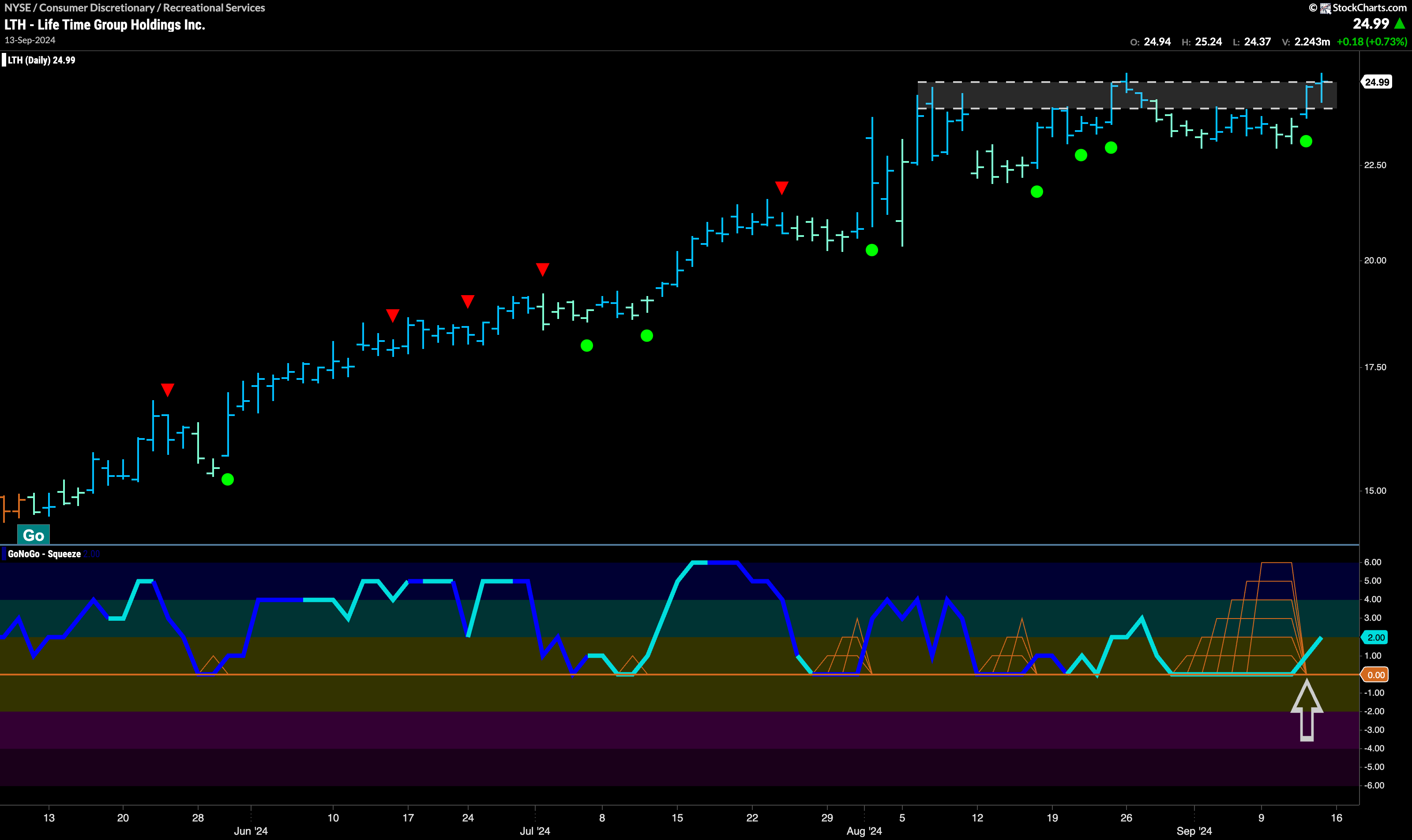

$LTH Making an Attempt at a Higher High

The chart below shows that price is in a “Go” trend and that price is threatening new highs. After moving mostly sideways since the high in early August, strong blue bars have returned and price is pushing up agains overhead resistance. During the last few weeks, GoNoGo Oscillator fell to test the zero line from above and it got stuck there, causing the climbing grid of GoNoGo Squeeze to rise to its Max. This Max GoNoGo Squeeze has now been broken into positive territory and that has triggered a Go Trend Continuation Icon (green circle) under price. We will watch to see if this will give price the push it needs to break to new highs.

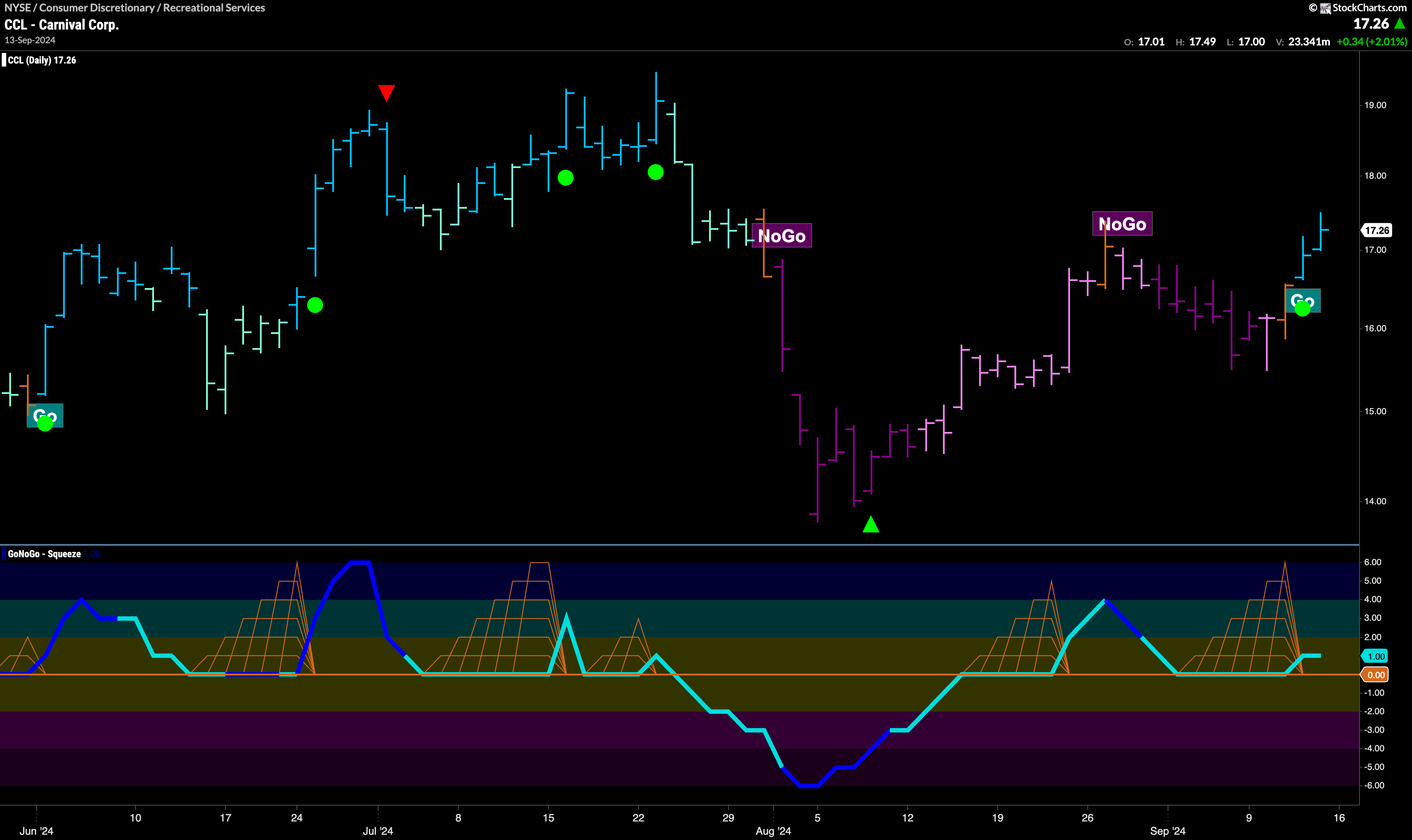

$CCL Enters New “Go” Trend

$CCL has entered a new “Go” trend having climbed out of the “NoGo” correction it was in. Last week we saw another higher low and then an amber “Go Fish” bar of uncertainty that often appears in transitions between trends. As the market was making up its mind, GoNoGo Oscillator was riding the zero line, and we saw a Max GoNoGo Squeeze that was ultimately broken into positive territory. This resurgent momentum in the direction of the new “Go” trend is a good sign and we will look for price to make a new higher high in the coming days.