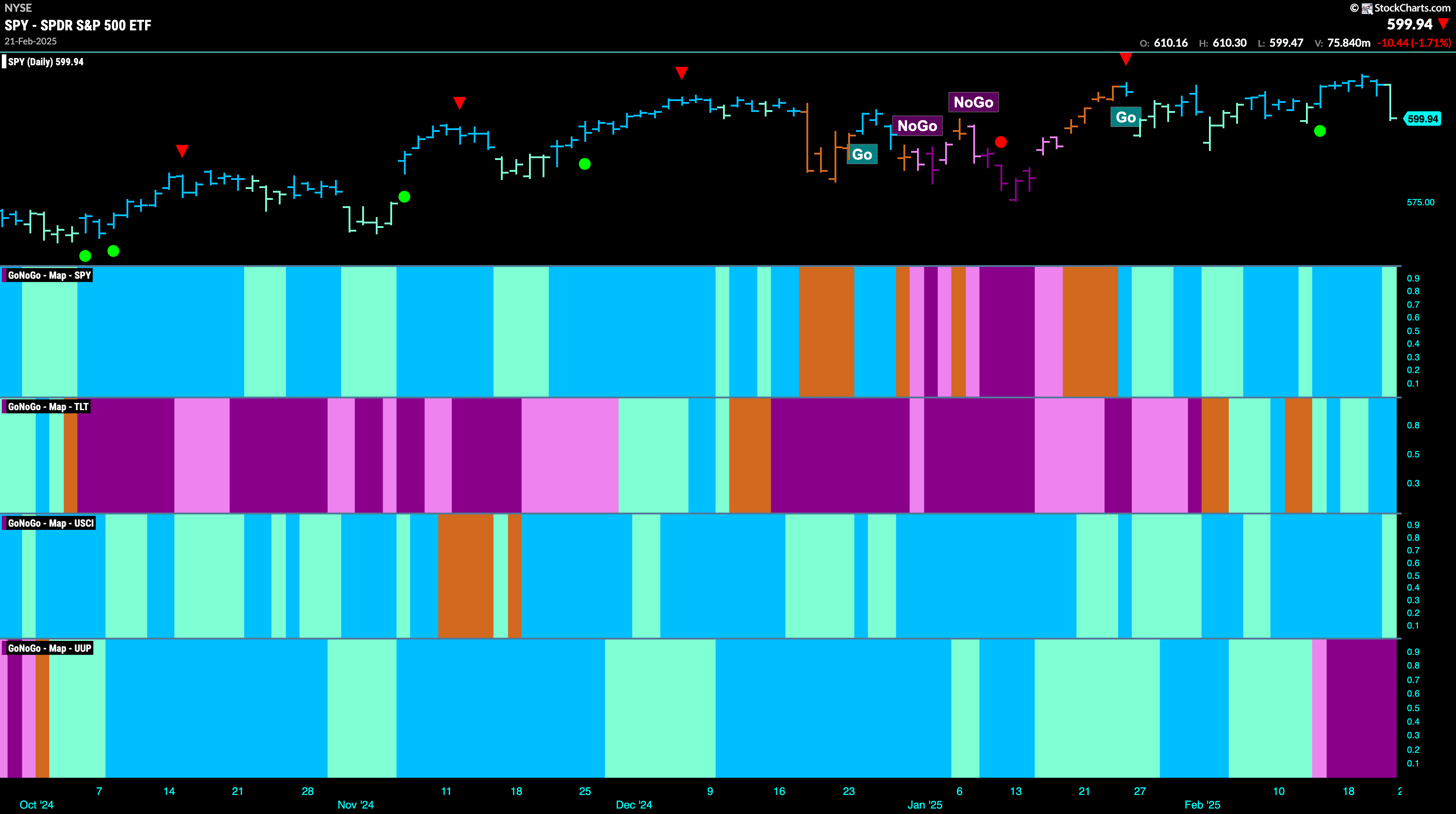

Good morning and welcome to this week’s Flight Path. The equity “Go” trend survived this week but we saw a weak aqua color as price fell sharply on the last day of the week. Treasury bond prices remained in a “Go” trend and we saw strength this week as the indicator painted strong blue bars. U.S. commodities likewise remained in a “Go” trend but as we see with equities a weaker aqua bar has appeared at the end of the week. The dollar shows that it is in a strong “NoGo” trend with a week of uninterrupted purple bars.

$SPY Fails After Edging to New Highs

The GoNoGo chart below shows that the “Go” trend is in place but the last bar of the week showed real weakness as price fell from the high and we saw the indicator paint a weaker aqua bar. GoNoGo Oscillator is testing the zero line from above where we will watch to see if it finds support. If it does, and rallies back into positive territory then we will be able to say that momentum is resurgent in the direction of the “Go” trend and we will look for price to make another attempt at a higher high.

The “Go” trend remains strong on the longer term chart. We see another strong blue “Go” bar even as we see the weakness on the daily chart. Range has compressed though and price movements are comparatively small. With no trip to overbought territory for several weeks, we see the oscillator falling again toward the zero line. It is imperative for the health of the “Go” trend that we see support at that level.

Treasury Rates Stabilize in “NoGo” Trend

GoNoGo Trend shows that after a few bars of uncertainty represented by “Go Fish” the market made up its mind this week with nothing but “NoGo” colors. The week ended with a few strong purple bars and rates are threatening to make a new lower low. GoNoGo Oscillator has been turned away by the zero line and so we know that momentum is resurgent in the direction of the “NoGo” trend. We will look to see if rates make a push for new lower lows in the coming days.

“NoGo” for the Dollar as It Moves to New Lows

After breaking decisively out of the Max GoNoGo Squeeze into negative territory, GoNoGo Trend painted a change in trend as we saw all “NoGo” bars this week. Now, with GoNoGo Trend painting strong purple bars, price has fallen to a new low. With momentum in negative territory but not oversold, we will look to see if it falls further this week.

$USO Continues to Struggle with Direction

$USO shows that the market is just not ready for a return to a “Go” trend as this week we saw a mix of “NoGo” and “Go Fish” bars. After the uncertainty shown by the amber bars we saw a hasty return to a strong “NoGo” bar. GoNoGo Oscillator shows that momentum was rejected by the zero line and is falling back into negative territory. This tells us that there remains downward pressure on oil prices. We will watch to see if the “NoGo” holds this week and if it pushes price to new lows.

Can Anything Stop $GLD’s Ascent?

The beginning of last week saw one weaker aqua bar that threatened to derail $GLD’s climb. This was quickly reversed and the next bar was once again strong blue. Now, with consecutive strong blue bars price is again edging to new higher highs. GoNoGo Oscillator remains in overbought territory and volume is heavy. We will look to see if prices can consolidate at these elevated levels this week.

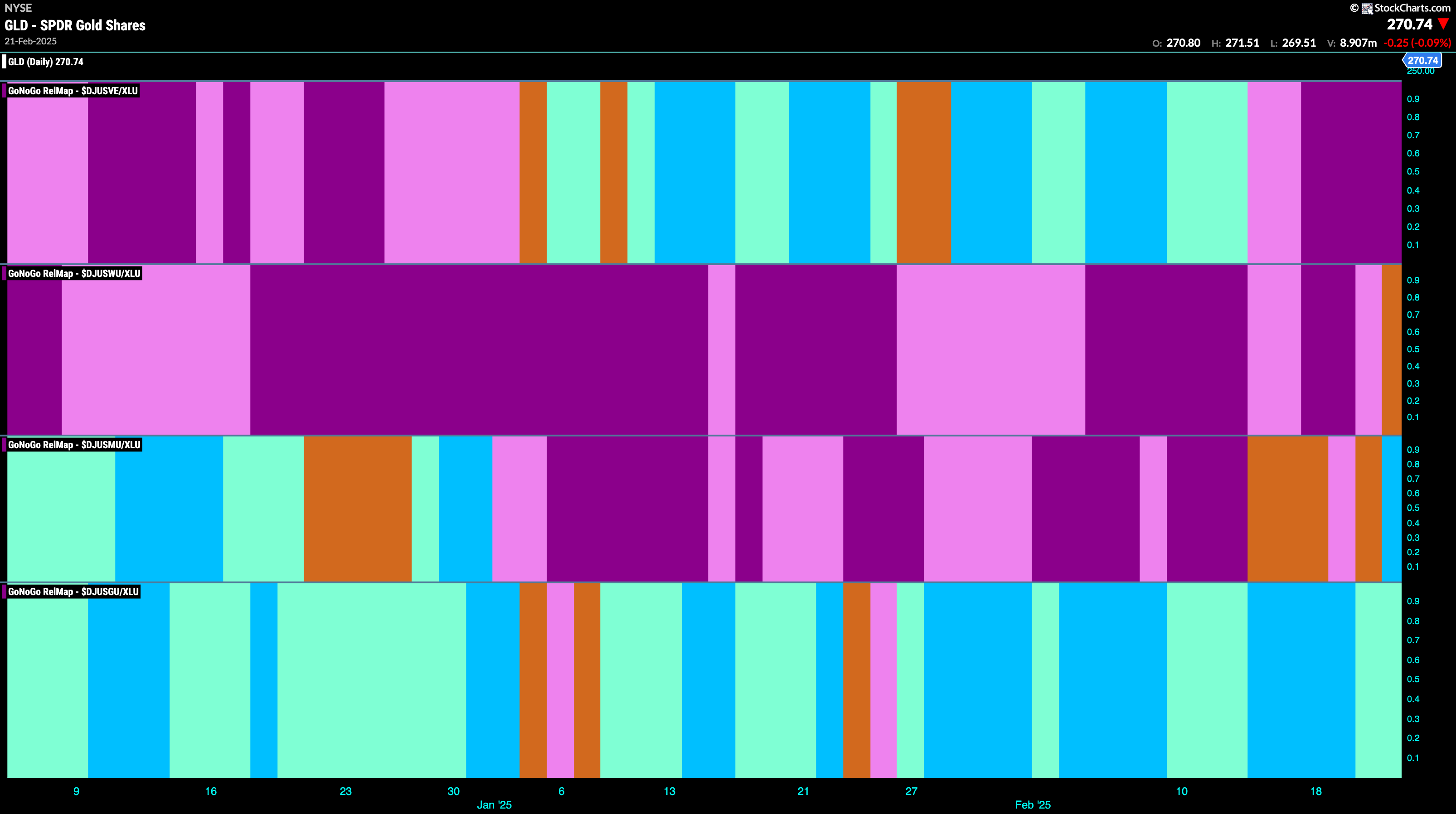

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 7 sectors are in relative “Go” trends. $XLC, $XLF, $XLB, $XLV, $XLP, $XLU, and $XLRE are painting relative “Go” bars.

Utilities Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the utilities sector this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLU. We saw in the above GoNoGo Sector RelMap that $XLU is strong relatively speaking as it paints bright blue relative “Go” bars to the S&P 500. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. We see new, strong blue “Go” bars in the 3rd panel which represents the relative trend of the multi-utilities sub group.

$CNP Looks Strong after Breaking to New High

GoNoGo Trend paints a run of strong blue “Go” bars after price broke above strong horizontal resistance. We saw GoNoGo Oscillator break out of a Max GoNoGo Squeeze which gave price the push it needed to break higher. Now, GoNoGo Oscillator is in overbought territory and on heavy volume. We will watch to see if price retraces at all from here should momentum drop. If it does, we will expect the concept of polarity to explain potential support at the horizontal level that was resistance before.

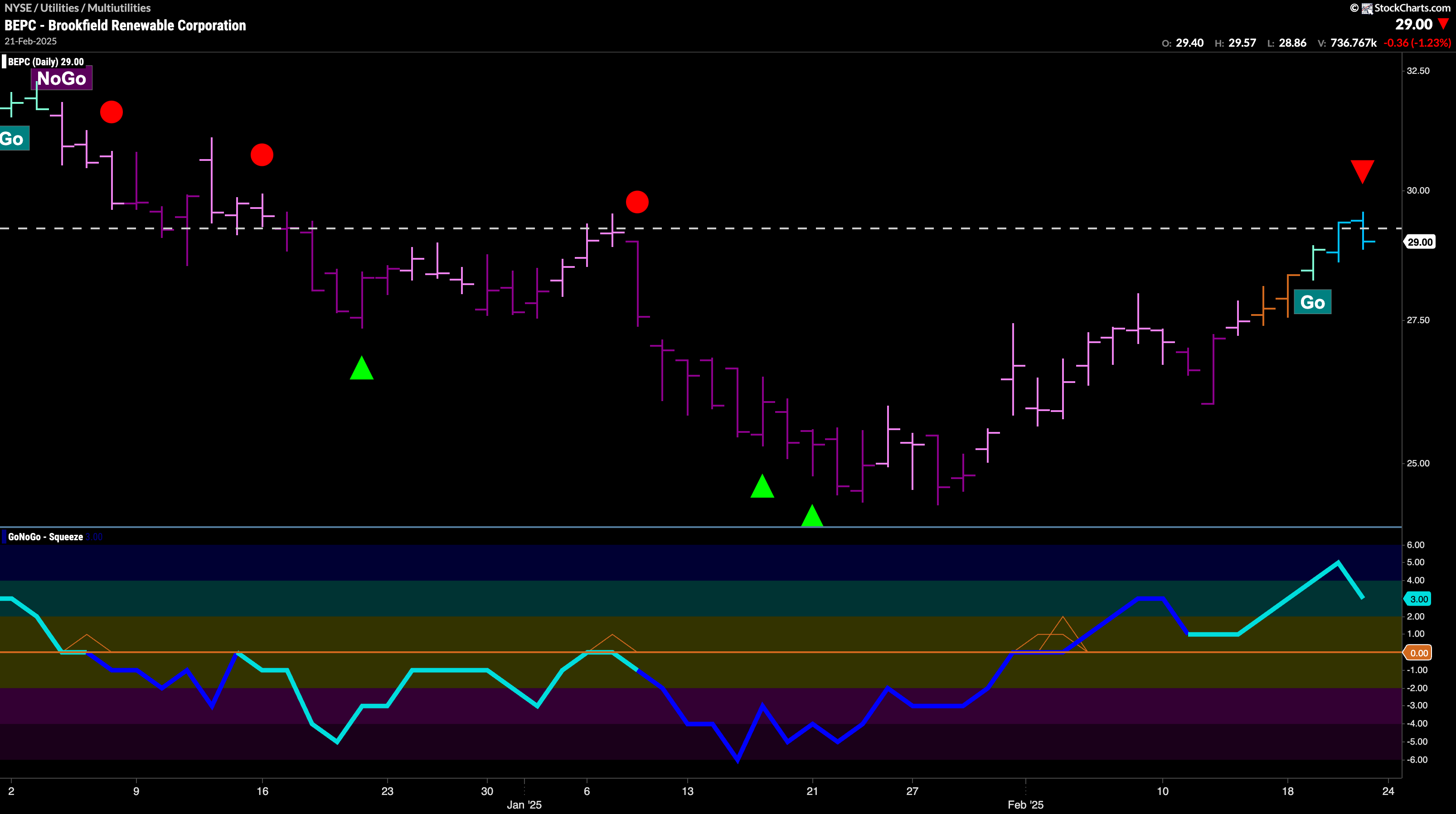

$BEPC Enters New “Go” Trend at Resistance

$BEPC has entered a new “Go” trend but must deal with overhead resistance that we see on the chart. GoNoGo Oscillator is falling toward the zero line and it will be important to see that it finds support should it drop to that level. If the oscillator can remain in positive territory then we would know that momentum is in line with the new “Go” trend and we may expect price to set new highs in the coming days or weeks.