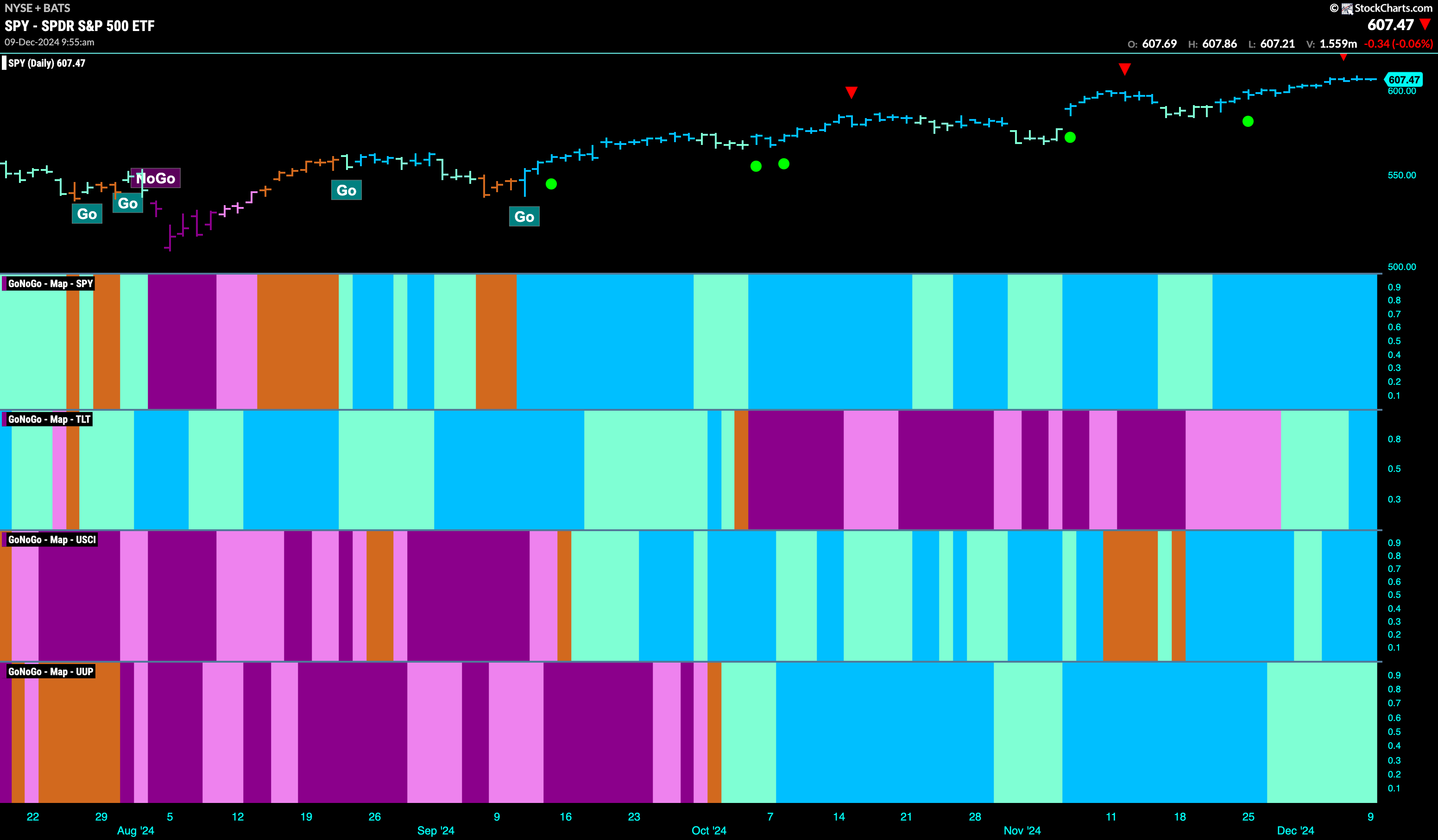

Good morning and welcome to this week’s Flight Path. The “Go” trend in equities continued again this past week and we saw a full week of uninterrupted bright blue bars. Treasury bond prices painted “Go” bars and the week ended with strong blue bars. U.S. commodities also remained in a “Go” trend with the indicator painting strong blue bars. The dollar likewise was able to hold on to its trend but we saw a string of weaker aqua “Go” bars this week.

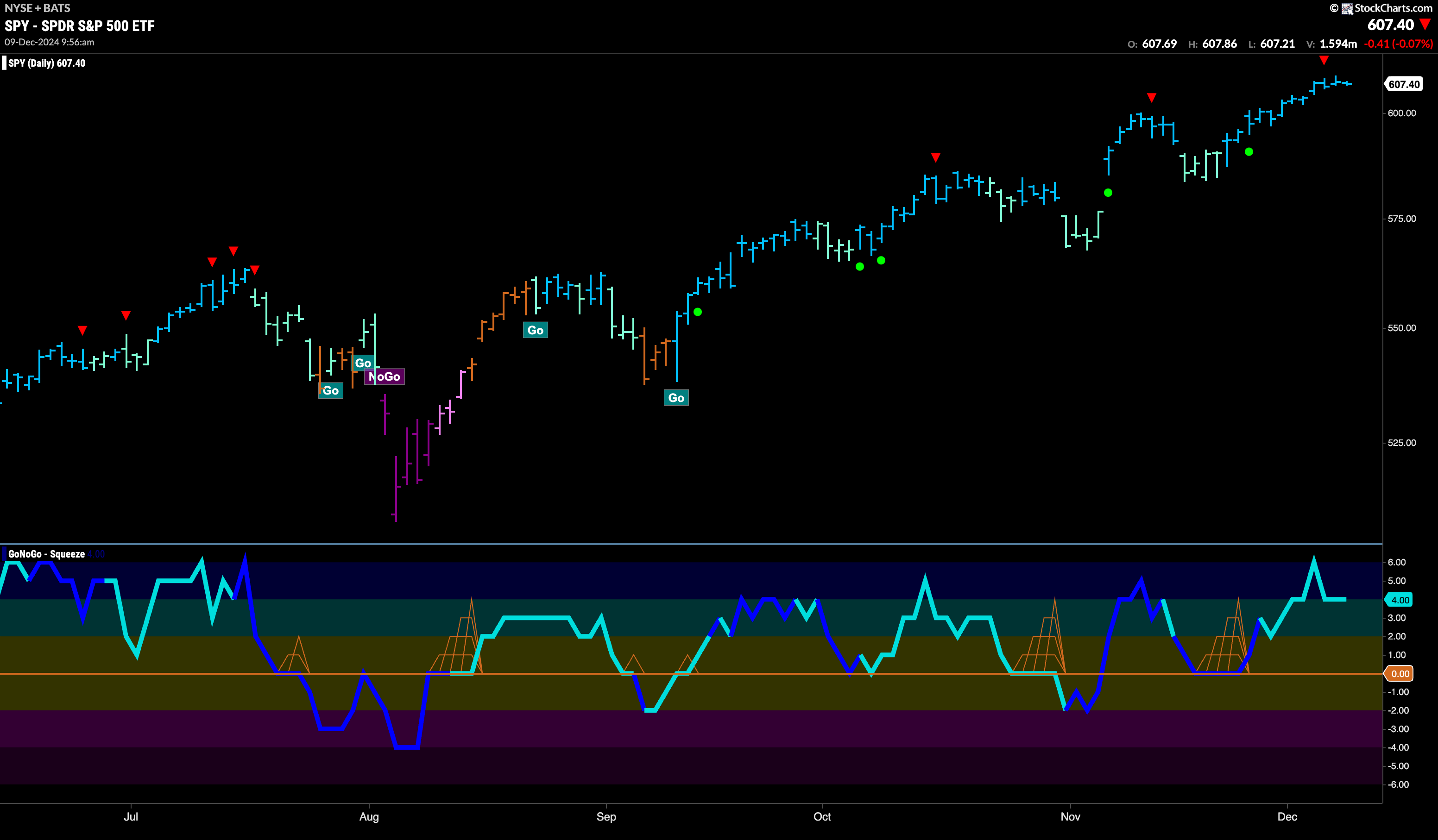

$SPY Sees Another Strong week of “Go” bars

The GoNoGo chart below shows that price continued to rally this week as the indicator painted nothing but strong blue “Go” bars again. We do see a Go Countertrend Correction Icon (red arrow) at the most recent high which warns us that price may struggle to go higher in the short term. We see that GoNoGo Oscillator has fallen out of overbought territory and is now resting at a value of 4. There is still therefore strong momentum that is confirming the underlying “Go” trend.

On the longer term chart, the trend continues to be strong. Last week saw another higher weekly close albeit on a smaller bar. We will watch to see if price can edge higher again this week. The oscillator panel shows that momentum has been able to remain positive for several months now. It is currently at a value of 5. If momentum wanes, we will look to see if it finds support at the zero level again.

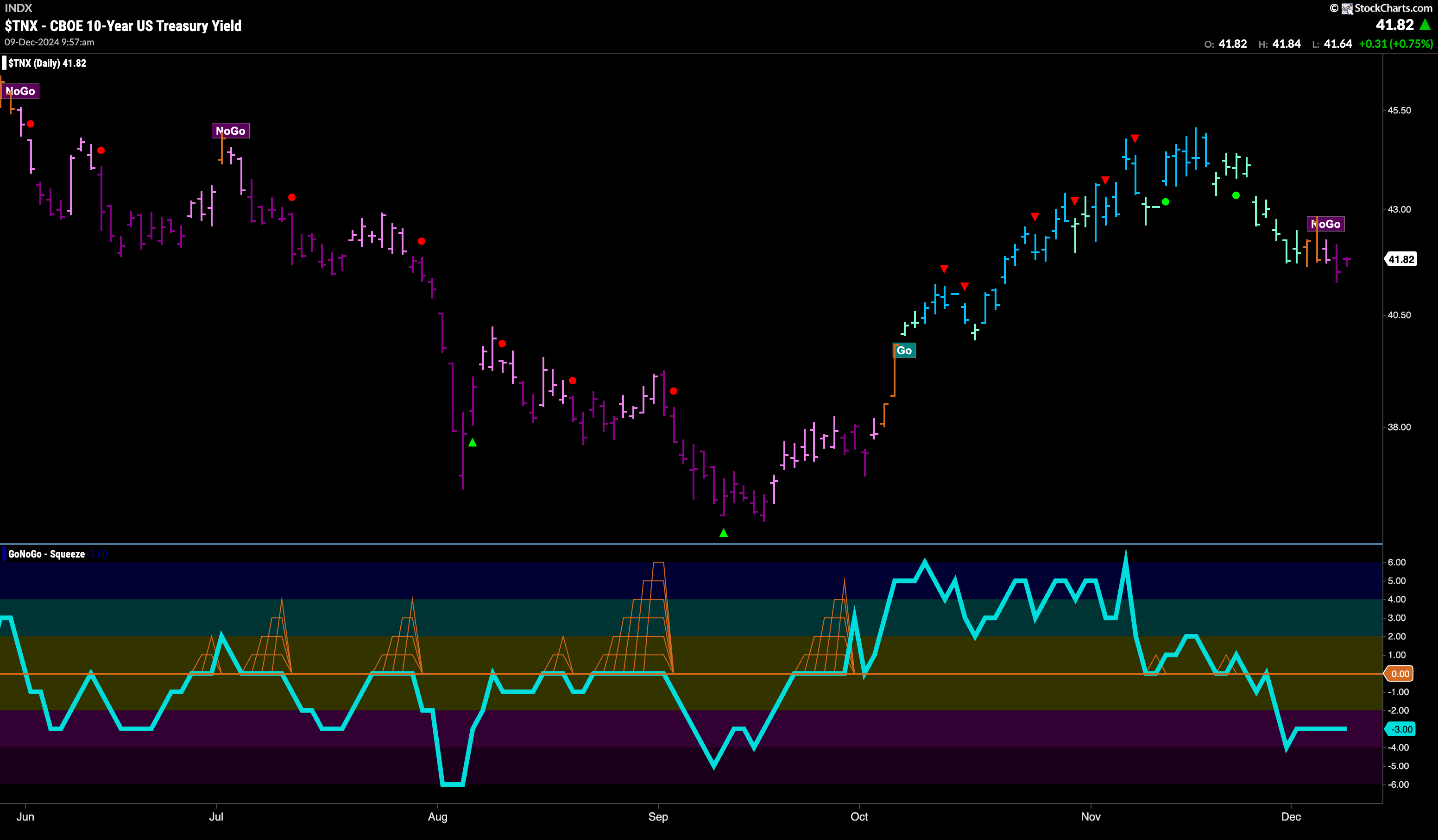

Treasury Rates Fall out of the “Go” Trend

Treasury bond yields completed the transition from a weaker “Go” to strong “NoGo” bars this week. With a couple of amber “Go Fish” bars that expressed uncertainty we can see that the “NoGo” took hold first with a pink bar. This came after GoNoGo Oscillator suggested as much when it failed to find support at the zero line just over a week ago. Now we see that momentum is negative at a value of -3 and confirms the new “NoGo” trend in price.

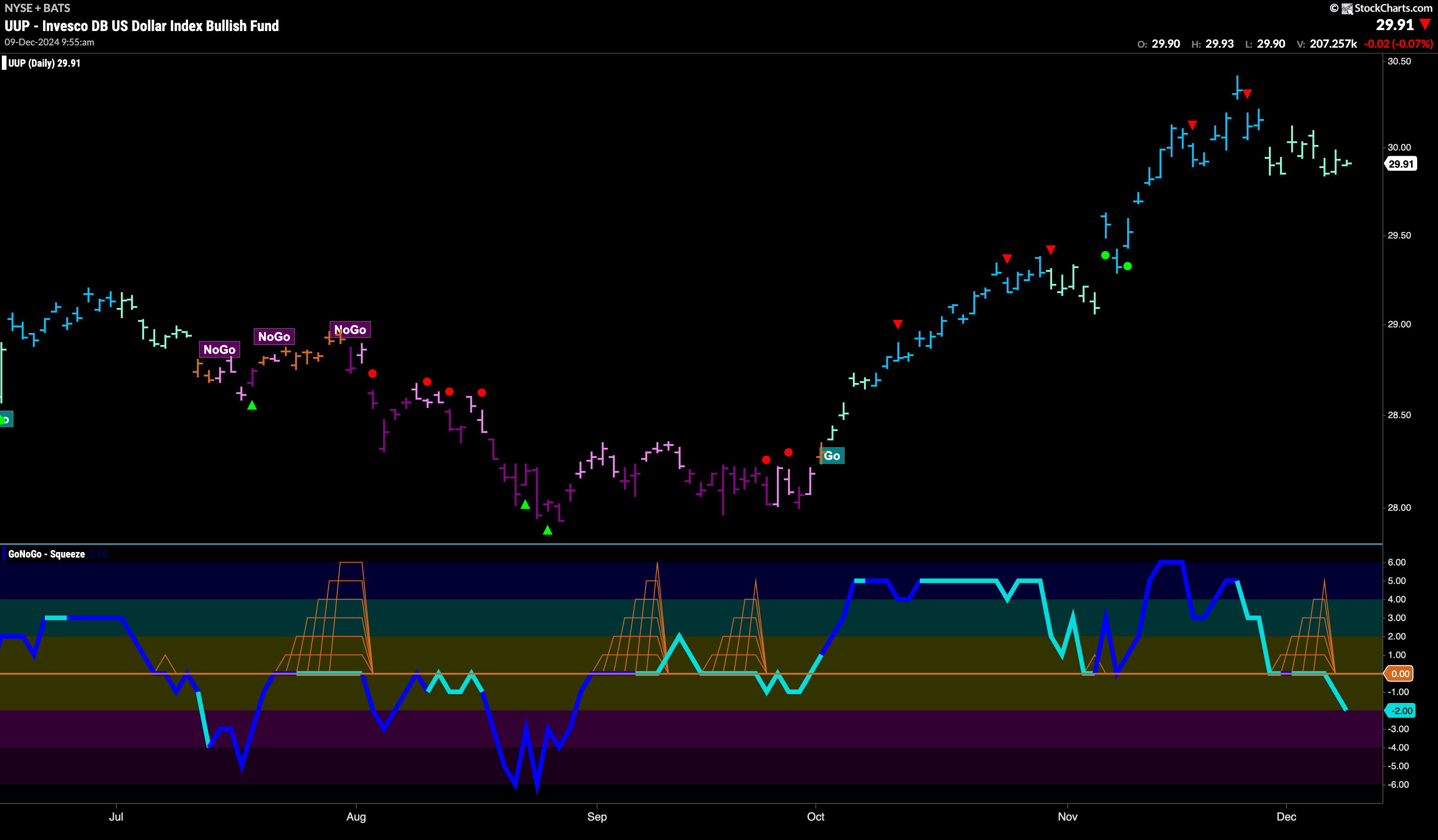

The Dollar Still Rests in “Go” Trend

We saw the dollar spend another week moving sideways this week and GoNoGo Trend painted a string of weaker aqua “Go” bars. We turn our eye to the lower panel and we can see that GoNoGo Oscillator has failed to find support at zero after having been stuck there for several bars. The Oscillator has now broken out of a GoNoGo Squeeze into negative territory which tells us that momentum is out of line with the “Go” trend. We will watch to see if this leads to further price deterioration.

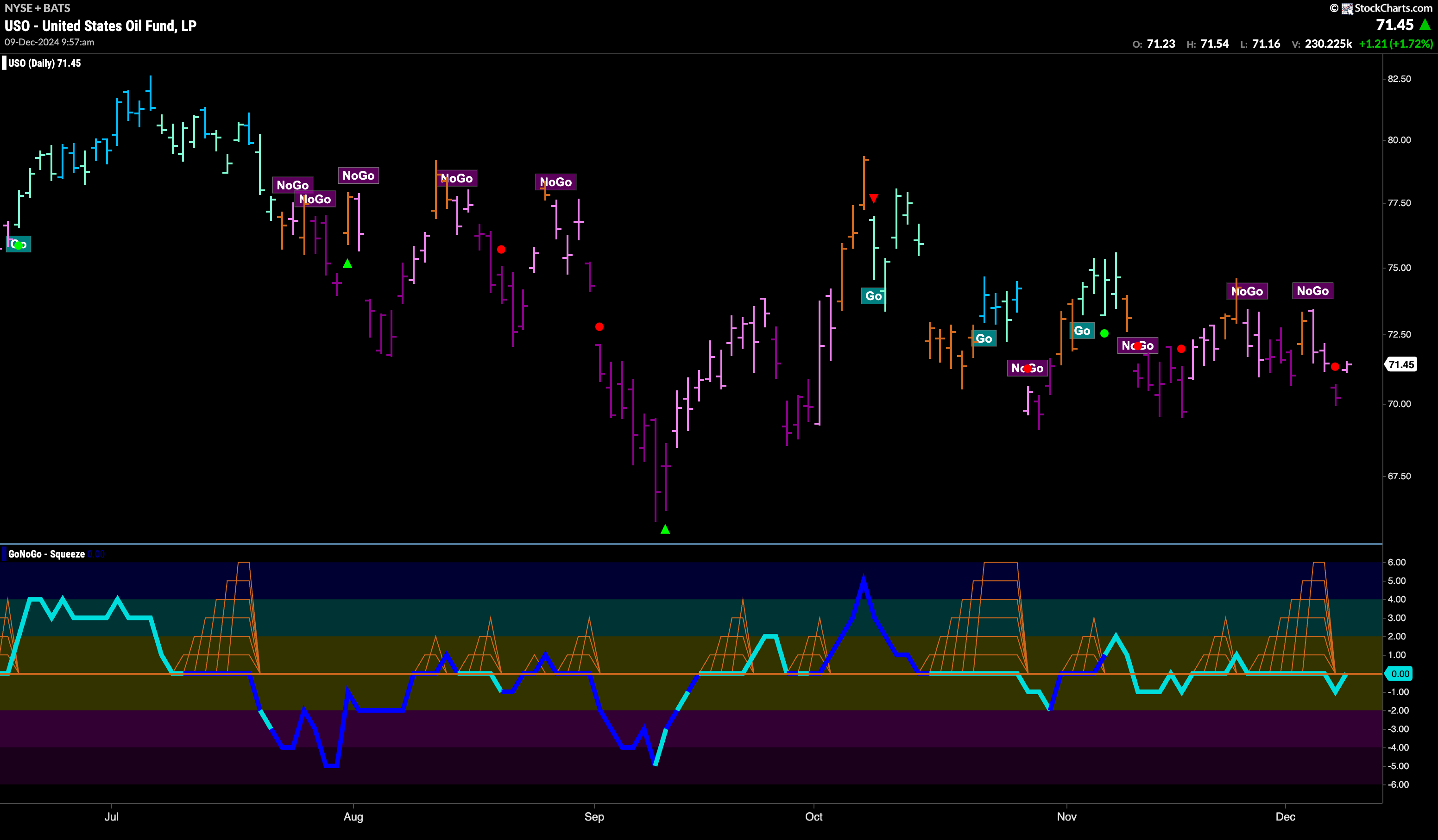

USO Flirts with Uncertainty Before “NoGo” Returns

An amber “Go Fish” bar represented uncertainty on the first bar of the week but it was quickly followed by first pink then strong purple “NoGo” bars. As the “NoGo” strengthened we saw GoNoGo Oscillator break out of a Max GoNoGo Squeeze into negative territory confirming the underlying “NoGo” trend we see in price. The oscillator has quickly retested that level and we will watch to see if it finds resistance going forward. If it does then we can expect price to make an attempt at another leg down.

“NoGo” Threatened with Uncertainty

After a week of mostly strong purple “NoGo” bars we see a new amber “Go Fish” bar suggesting that there is some market uncertainty surrounding the health of the current “NoGo” trend. We look to the oscillator panel and see that the GoNoGo Oscillator is breaking out of an extended Max GoNoGo Squeeze into positive territory. This gives some weight to the idea that the “NoGo” trend may be in trouble. With positive momentum, we will watch to see if a new “Go” trend appears.

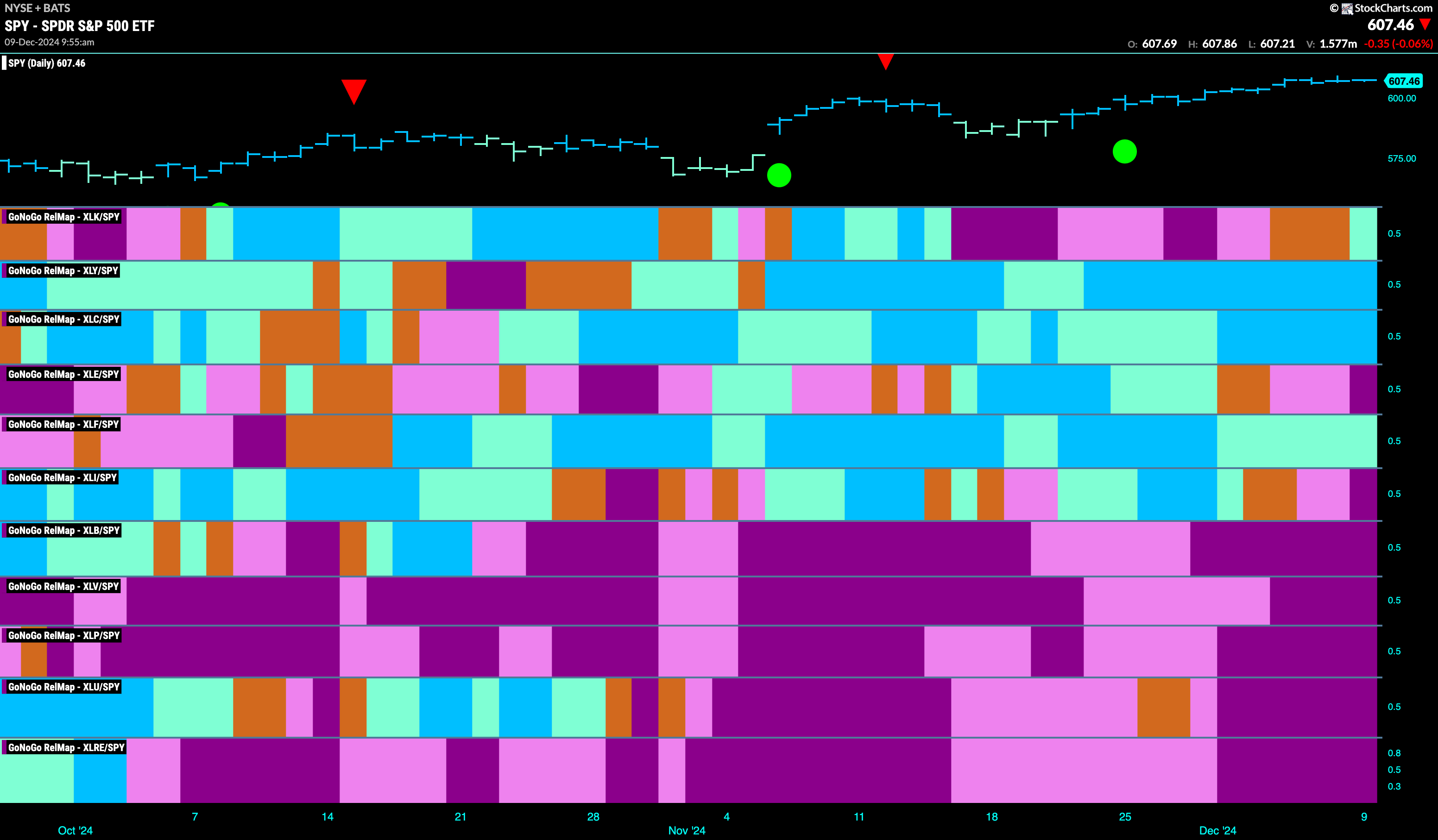

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 4 sectors are in relative “Go” trends. $XLK, $XLY, $XLC, and $XLF, are painting relative “Go” bars.

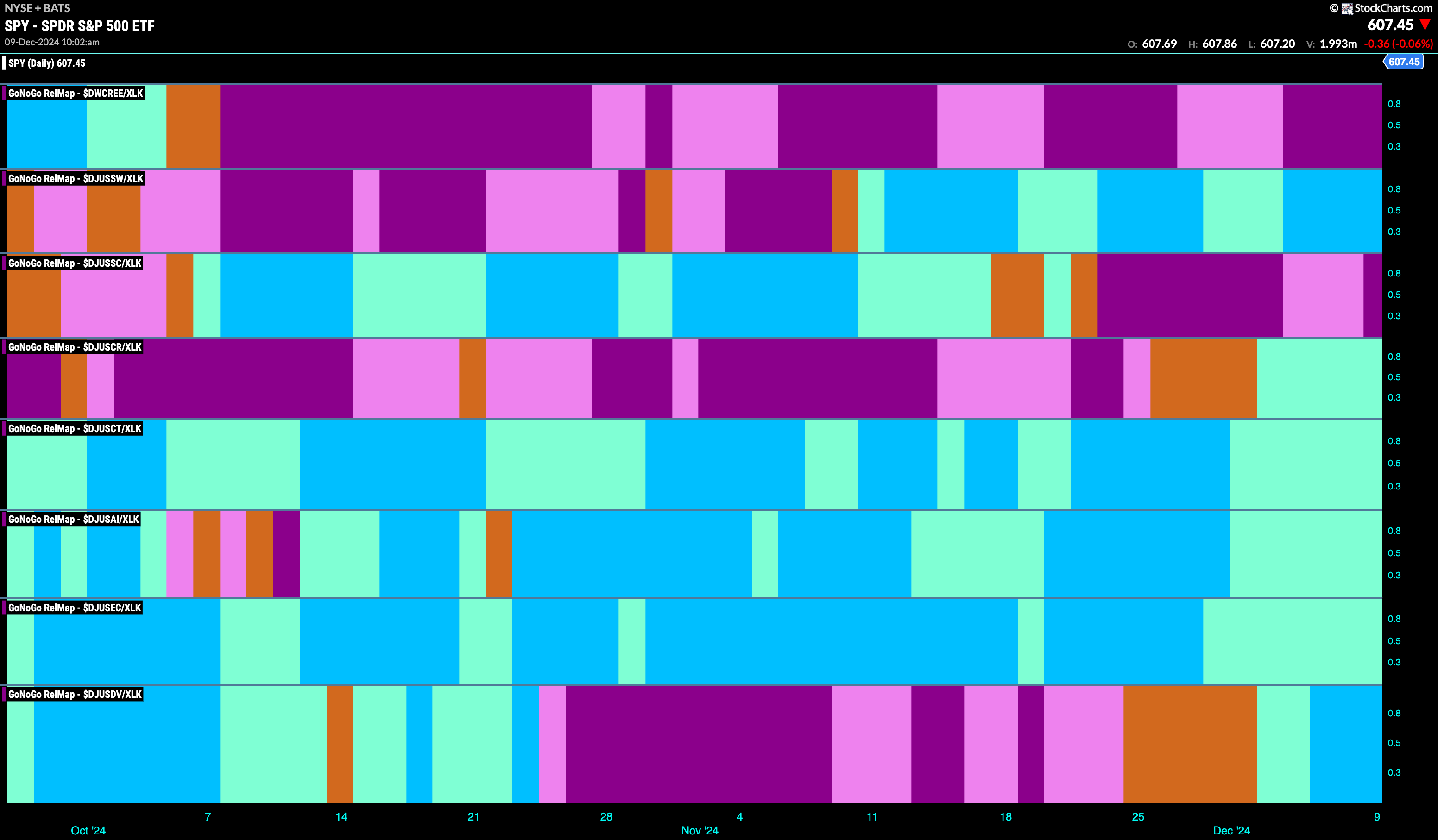

Technology Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the technology sector this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLK. We saw in the above GoNoGo Sector RelMap that $XLK is a new out-performer as it paints a fresh aqua “Go” bar. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting strong “Go” bars in the second panel is the software index sub group.

$MSFT Shows Momentum In Line with “Go” Trend

The chart below shows a longer term view of the trend of $MSFT. GoNoGo Trend is painting aqua “Go” bars and we see price has been moving mostly sideways since the latest higher high. We look at the GoNoGo Oscillator and we can see that it is breaking out of a Max GoNoGo Squeeze into positive territory. This indicates that the bulls have won the virtual tug of war at this level and we will watch to see if this gives price the push it needs to make an attack on a new higher high in the coming weeks and months.

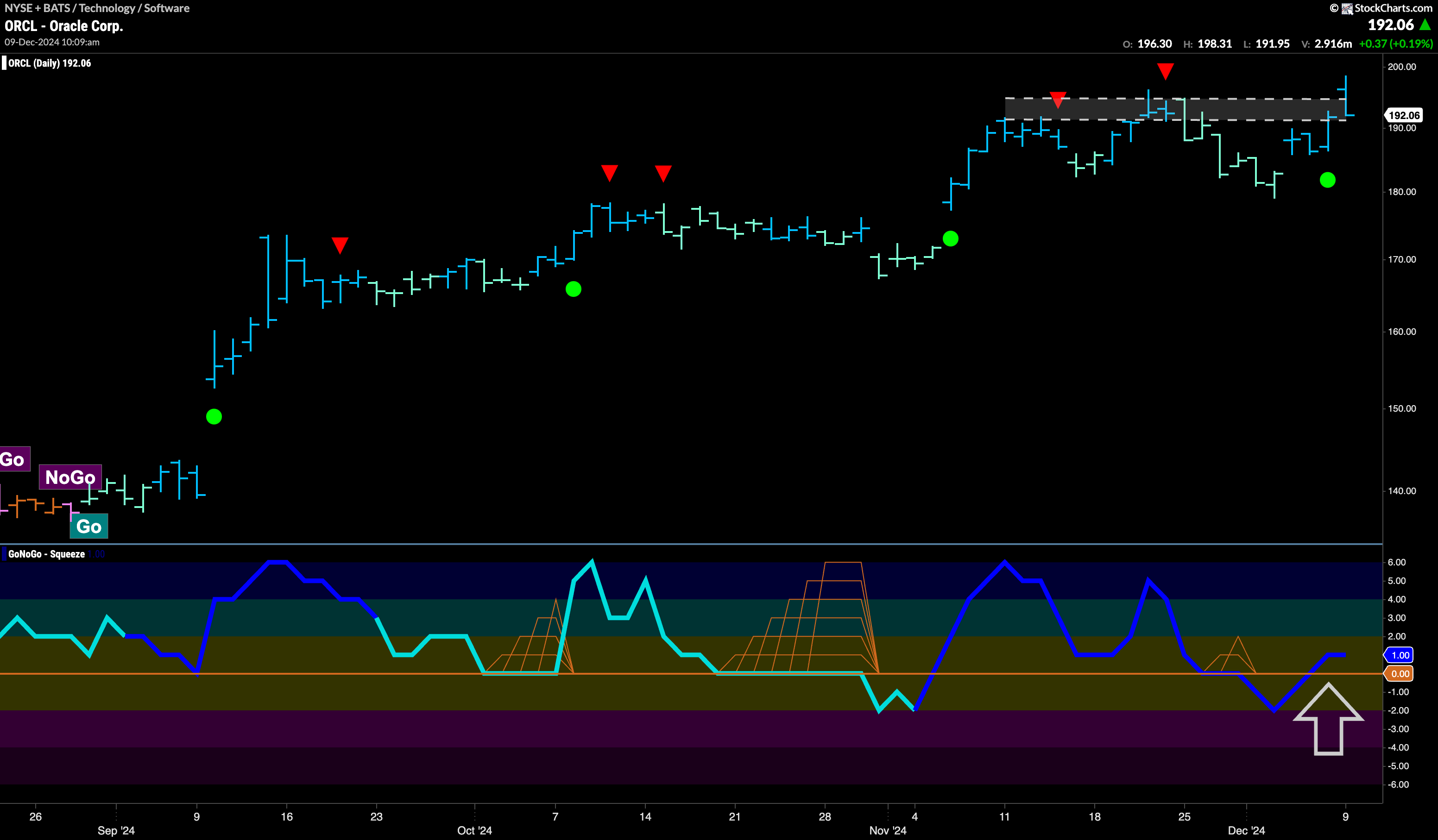

$ORCL Tries to Consolidate Break

$ORCL has been in a “Go” trend for several months as the GoNoGo Trend indicator has painted only blue and aqua bars since September. After the last high we saw a Go Countertrend Correction Icon (red arrow) indicating that price would struggle to go higher in the short term. Indeed, we saw the indicator paint a string of weaker aqua bars and GoNoGo Oscillator fall below the zero line. Importantly, as GoNoGo Trend showed a return to strong blue bars, GoNoGo Oscillator broke back into positive territory. With momentum now resurgent in the direction of the “Go” trend, we will watch to see if price can consolidate at these levels and find support at prior highs.