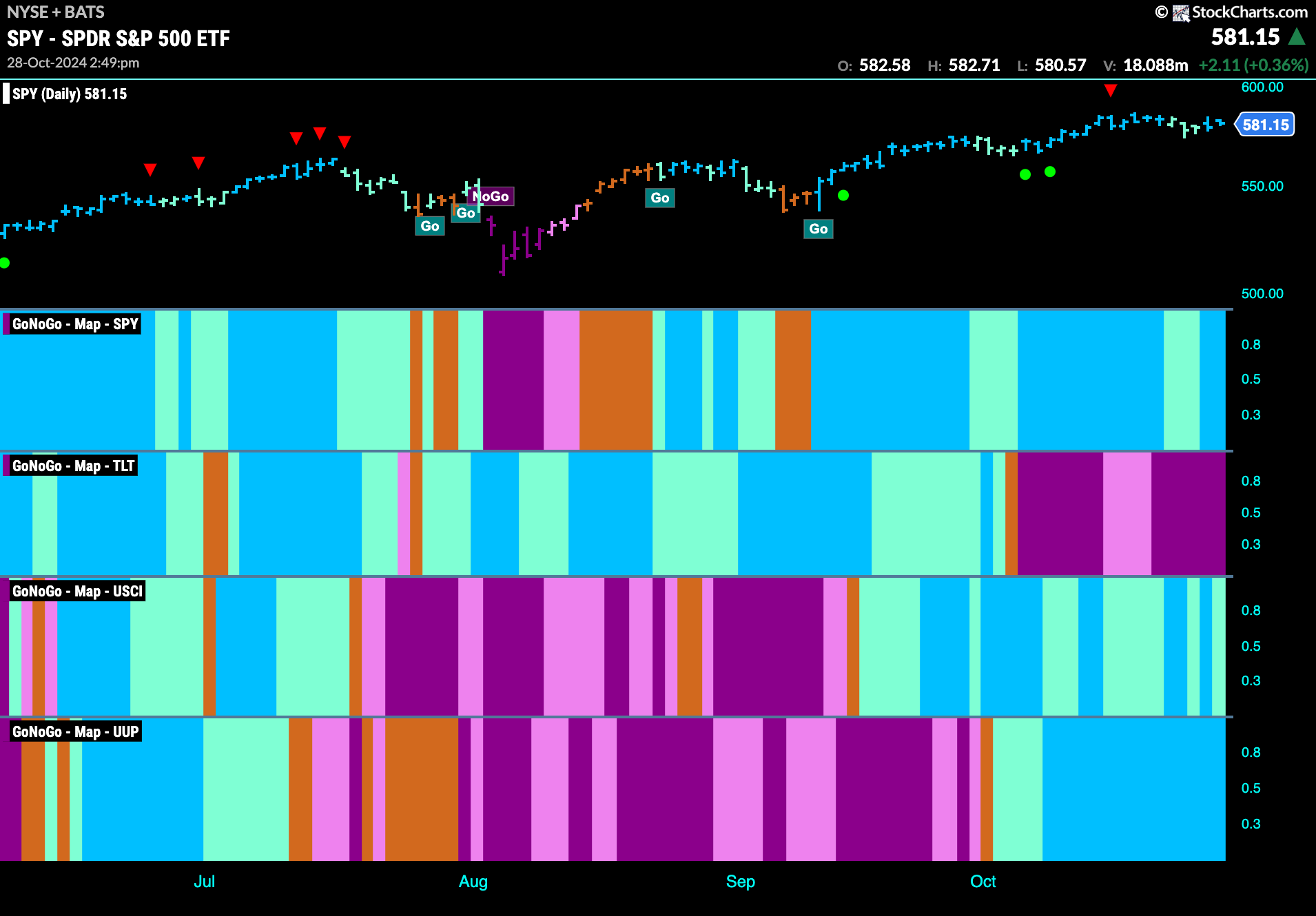

Good morning and welcome to this week’s Flight Path. Equities saw the “Go” trend continued this week and after a few weaker aqua bars saw strong blue bars return. Treasury bond prices painted strong purple “NoGo” bars the entire week. U.S. commodities remain in a “Go” trend but we see intermittent aqua bars representing weakness. The dollar saw another week of uninterrupted bright blue bars as the “Go” trend remained strong.

$SPY Remains in “Go” Trend and Strength Returns

The GoNoGo chart below shows that after hitting a high a couple of weeks ago we saw a Go Countertrend Correction Icon (red arrow) indicating that price may struggle to go higher in the short term. Following that, GoNoGo Trend painted a few weaker aqua bars as price fell from the high. GoNoGo Oscillator has fallen to test the zero line from above and we will watch to see if it finds support.

The longer time frame chart tells us that the trend remains strong but this is the second week in a row where we were unable to make a new higher weekly close. Last week we saw a Go Countertrend Correction Icon (red arrow) suggesting that it may be hard for price to go higher. Indeed, this week we have seen price remain below the high. GoNoGo Oscillator has fallen out of overbought territory but is still in positive territory at a value of 3.

Treasury Rates Make Another Higher High

Treasury bond yields saw the “Go” trend continue this week as the indicator paints strong blue bars. After last week’s Go Countertrend Correction Icon (red arrow), price barely paused as it races to another new high. GoNoGo Oscillator is now moving back toward overbought territory at a value of 5.

The Dollar Remains in a Strong “Go” Trend

Last week we saw a Go Countertrend Correction Icon (red arrow) telling us that price may struggle to go higher in the short term. As is sometimes the case in strong trends, price blew right past this warning and we saw strong blue “Go” bars and new highs this week. GoNoGo Oscillator has remained elevated this week as it stays in overbought territory.

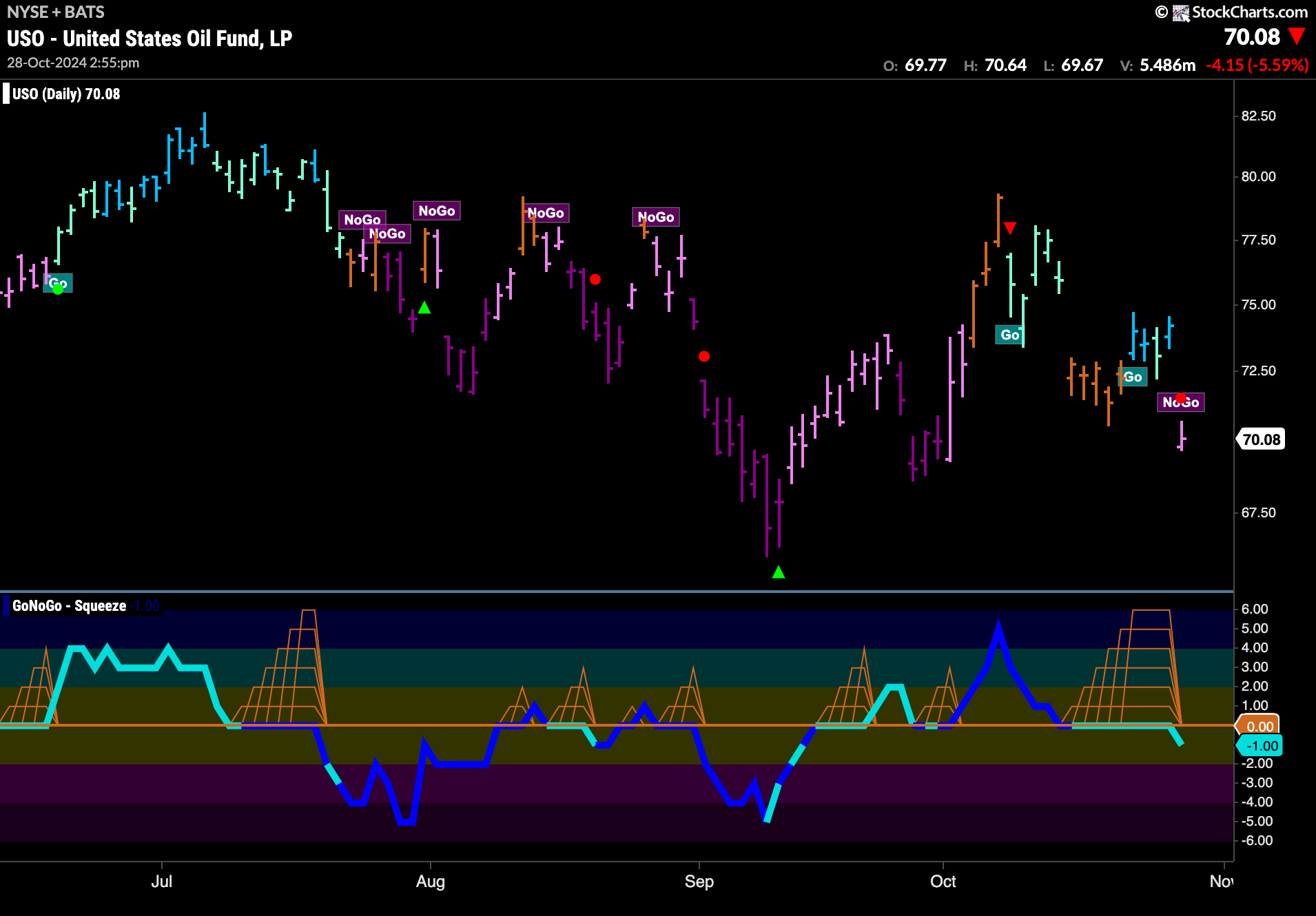

USO Shows Choppiness as Trend Changes Again

$USO fell out of the new “Go” trend on the last day of the week and the indicator is now painting a weak pink “NoGo” bar as price seems to be making a lower low. GoNoGo Oscillator has broken out of a Max GoNoGo Squeeze into negative territory. This tells us that momentum is in the direction of the new “NoGo” trend and so we will see if this pushes price further lower this week.

Gold Prices Remain Elevated

GoNoGo Trend paints another week of strong blue “Go” bars as price remains close to the highs. We have moved mostly sideways since the last Go Countertrend Correction Icon (red arrow). GoNoGo Oscillator has fallen out of overbought territory and has flattened out at a value of 3. If momentum remains positive it is in line with the underlying “Go” trend and we will watch to see if price can make a new higher high.

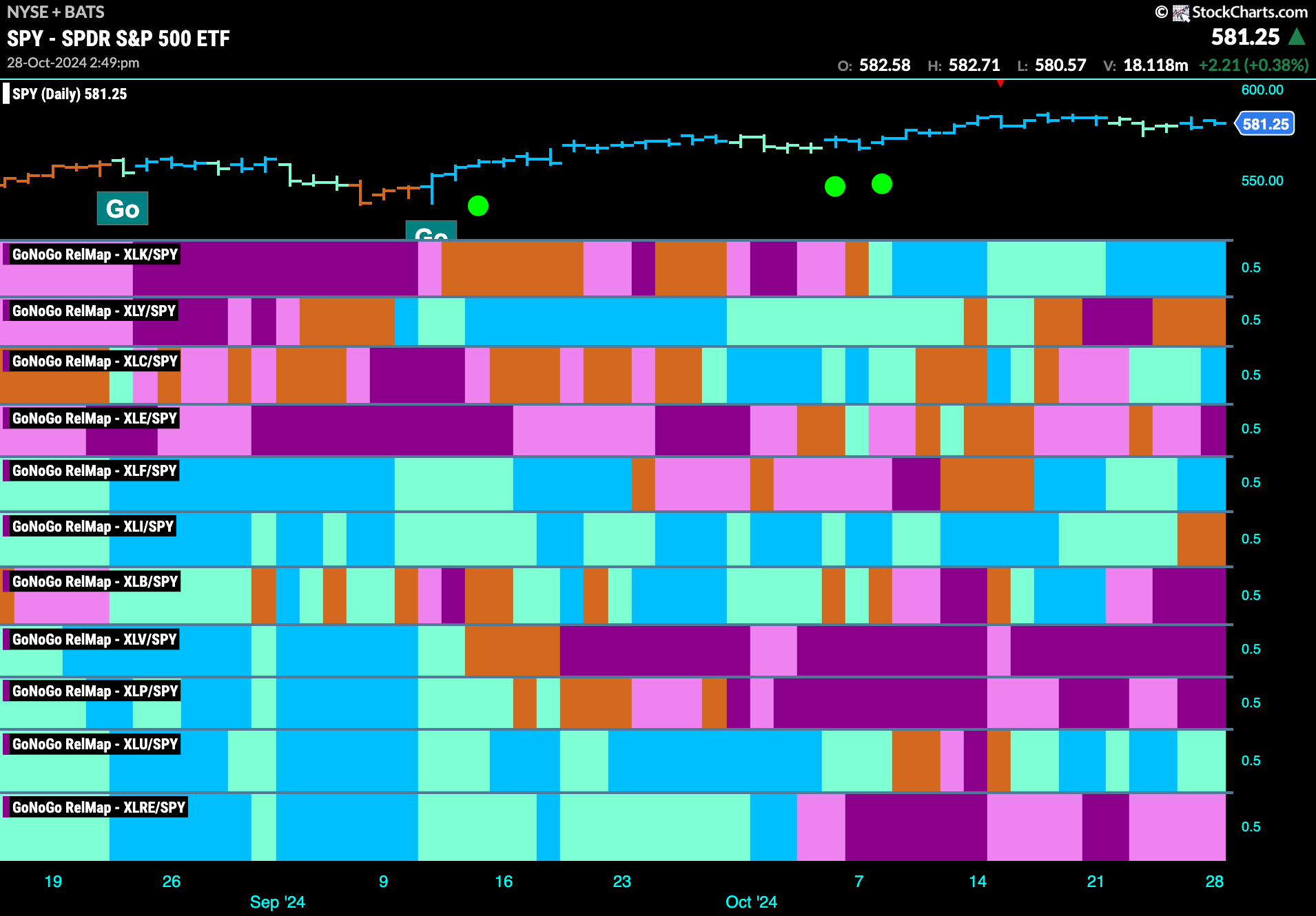

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 4 sectors are in relative “Go” trends. $XLK, $XLC, $XLF, and $XLU, are painting relative “Go” bars.

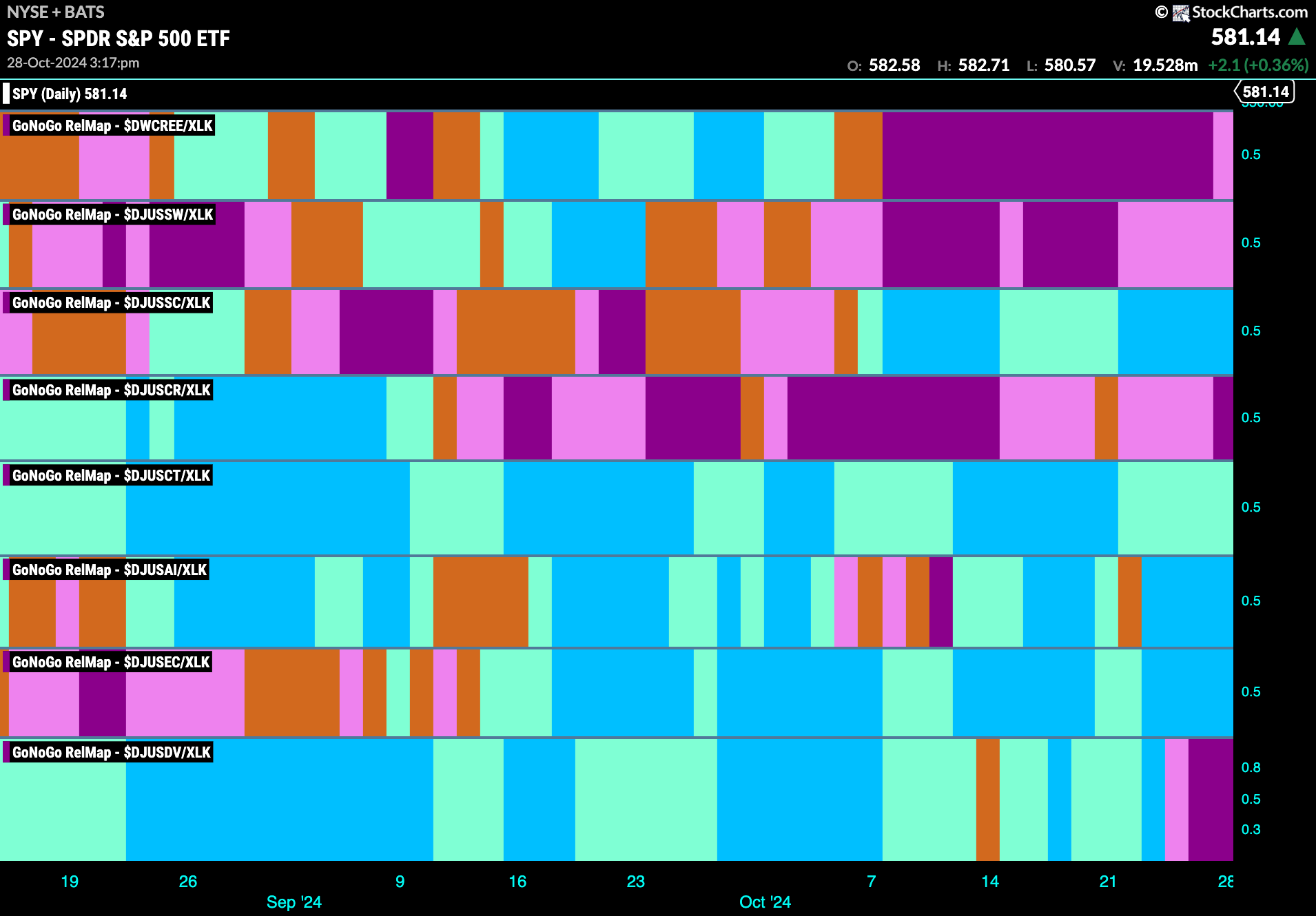

Technology Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the technology sector. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLK. We saw in the above GoNoGo Sector RelMap that $XLK is performing strongly relatively to the $SPY, with GoNoGo Trend painting strong blue “Go” bars. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting strong blue “Go” bars in the 3rd panel is the semiconductor sub index.

$NVDA Consolidates at Highs

The chart below shows that $NVDA has managed to hold on to its “Go” trend and we see price consolidating above prior highs. This comes after breaking above downward sloping resistance a few weeks ago. GoNoGo Oscillator has been at or above zero during this most recent “Go” trend and now we watch as it approaches the zero level again. If it finds support at that level, we will expect price to make another attack on higher highs.

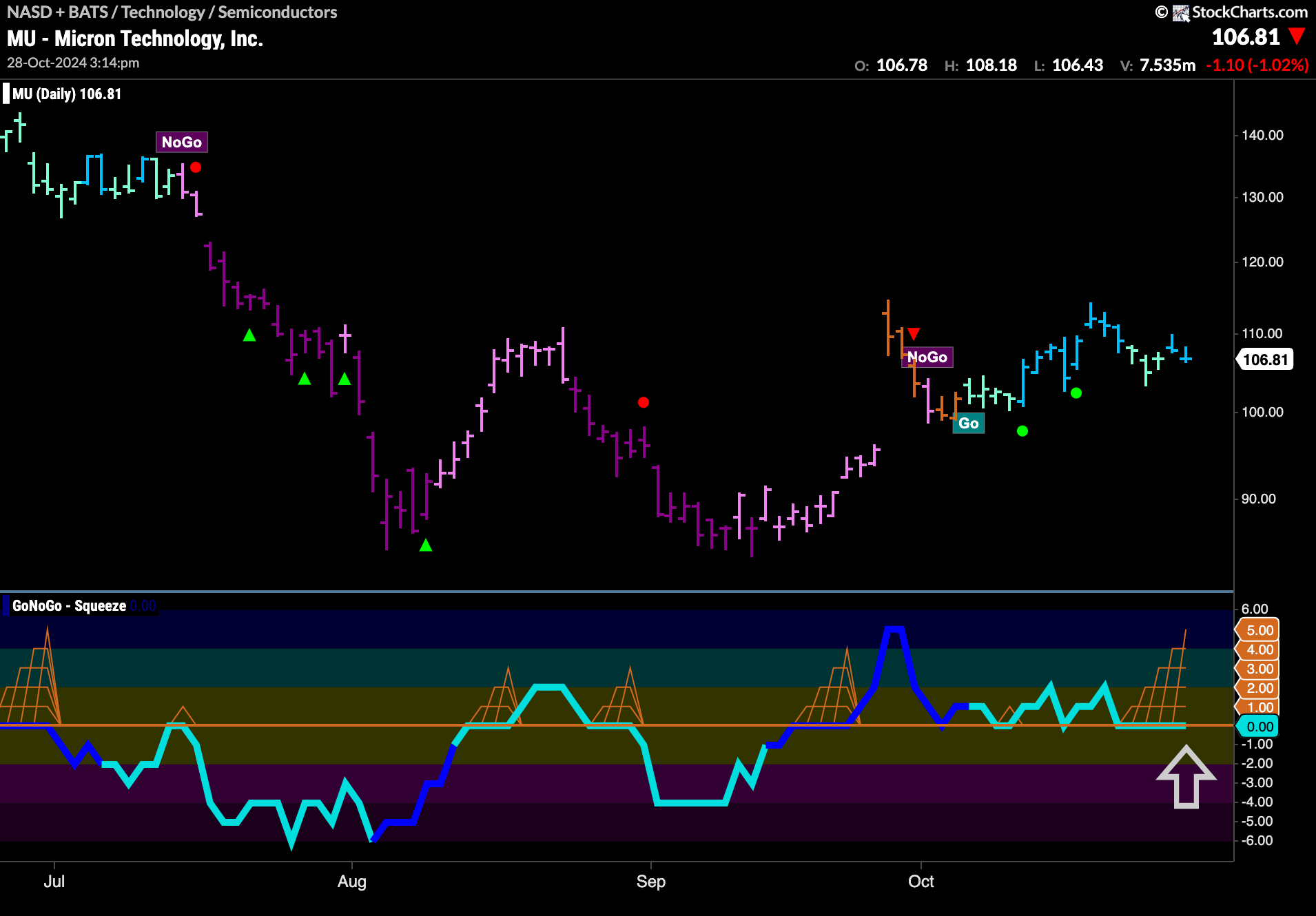

$MU in “Go” Trend Looking for Support

$MU has been in a “Go” trend since earlier this month after finding support at the lower bound of the gap. Since that time, GoNoGo Oscillator has been at or above the zero line confirming the new “Go” trend. Now, with GoNoGo Trend painting strong blue bars we see the oscillator riding the zero line and a GoNoGo Squeeze rising to its Max. We will watch to see if the Squeeze will be broken back into positive territory. If it is, we will know that momentum is resurgent in the direction of the trend and we will look for an attempt at new highs.