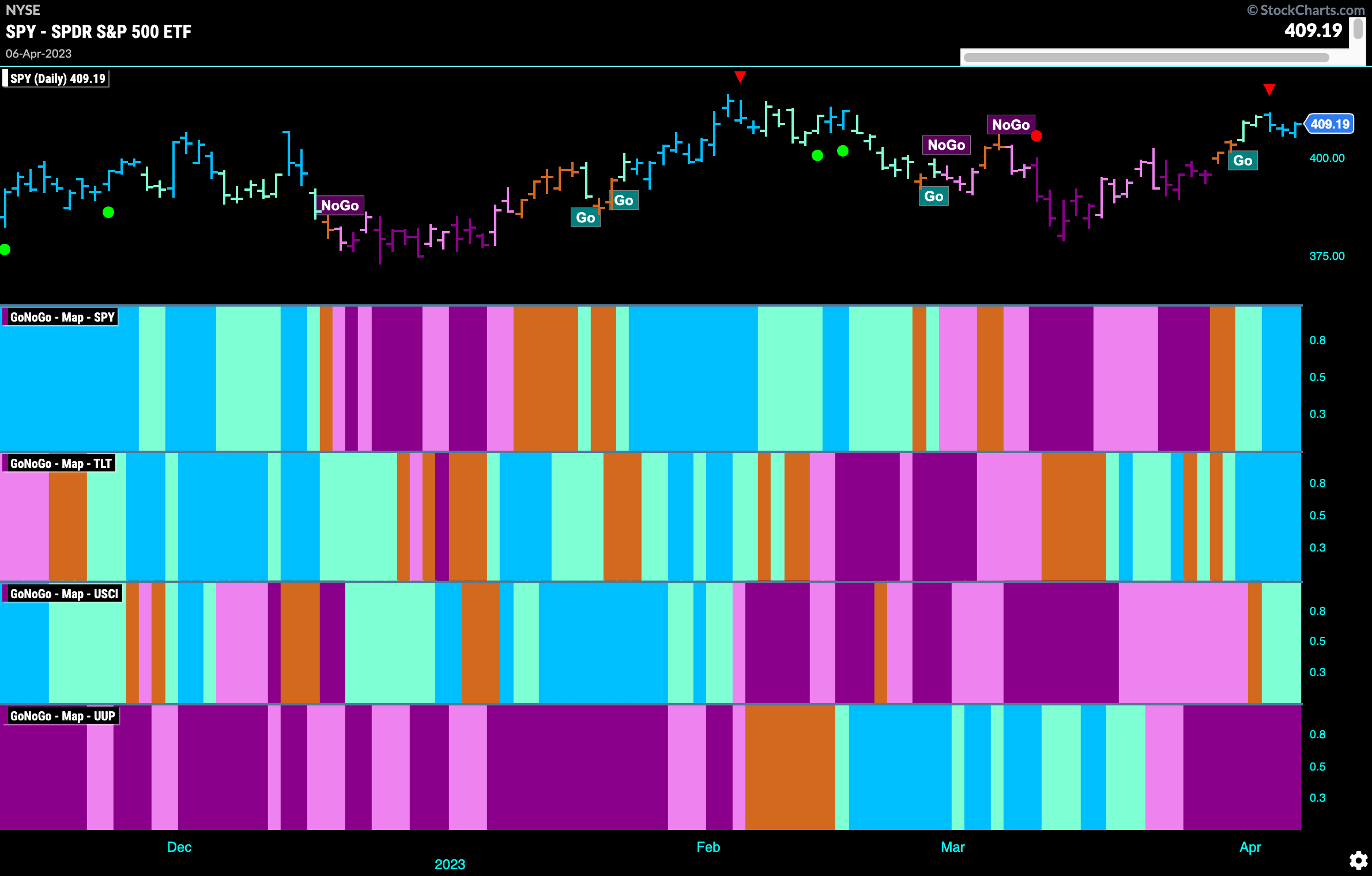

Good morning and welcome to this week’s Flight Path. Let’s take a look at the GoNoGo Asset map below. Equities remain in the “Go” trend as we start the new week. Treasury bond prices are likewise in a strong “Go” and commodities have entered a weak aqua “Go” trend. The dollar remains embroiled in a strong “NoGo”.

Equities Paint Strong Blue “Go” Bars

After breaking out of the Max GoNoGo Squeeze a week ago, we have seen a string of “Go” bars painted by GoNoGo Trend. While price failed to end the week higher, it is seeing brighter blue bars as price tries to climb to test prior highs from earlier this year.

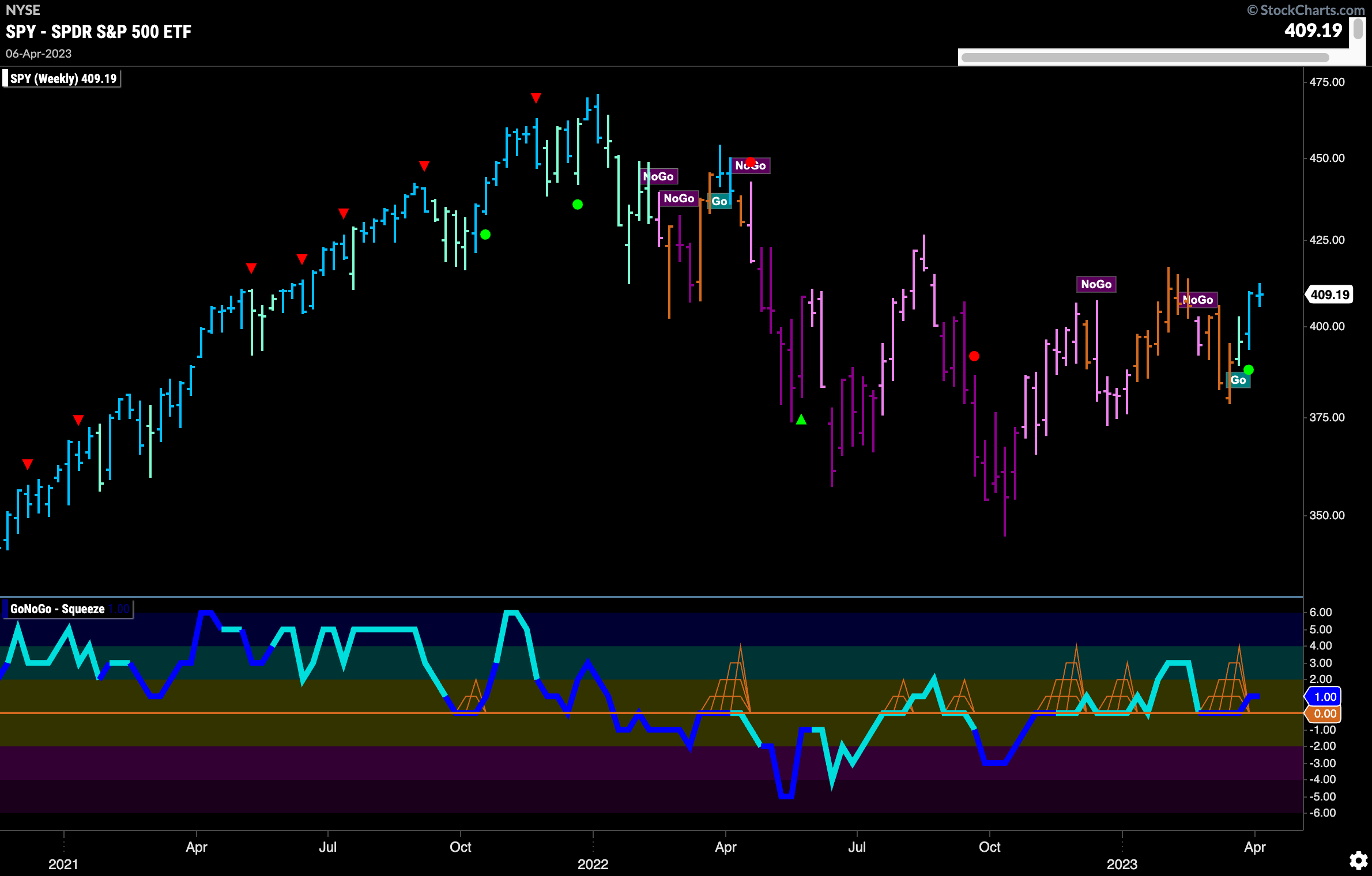

The weekly chart shows the “Go” trend remains in place with another strong blue “Go” bar painted. Those astute candlestick chartists will notice last week’s candle represents a “doji” (uncertainty) with the open and close at similar levels. GoNoGo Oscillator shows that momentum is on the side of the “Go” trend as it breaks out of a small GoNoGo Squeeze into positive territory.

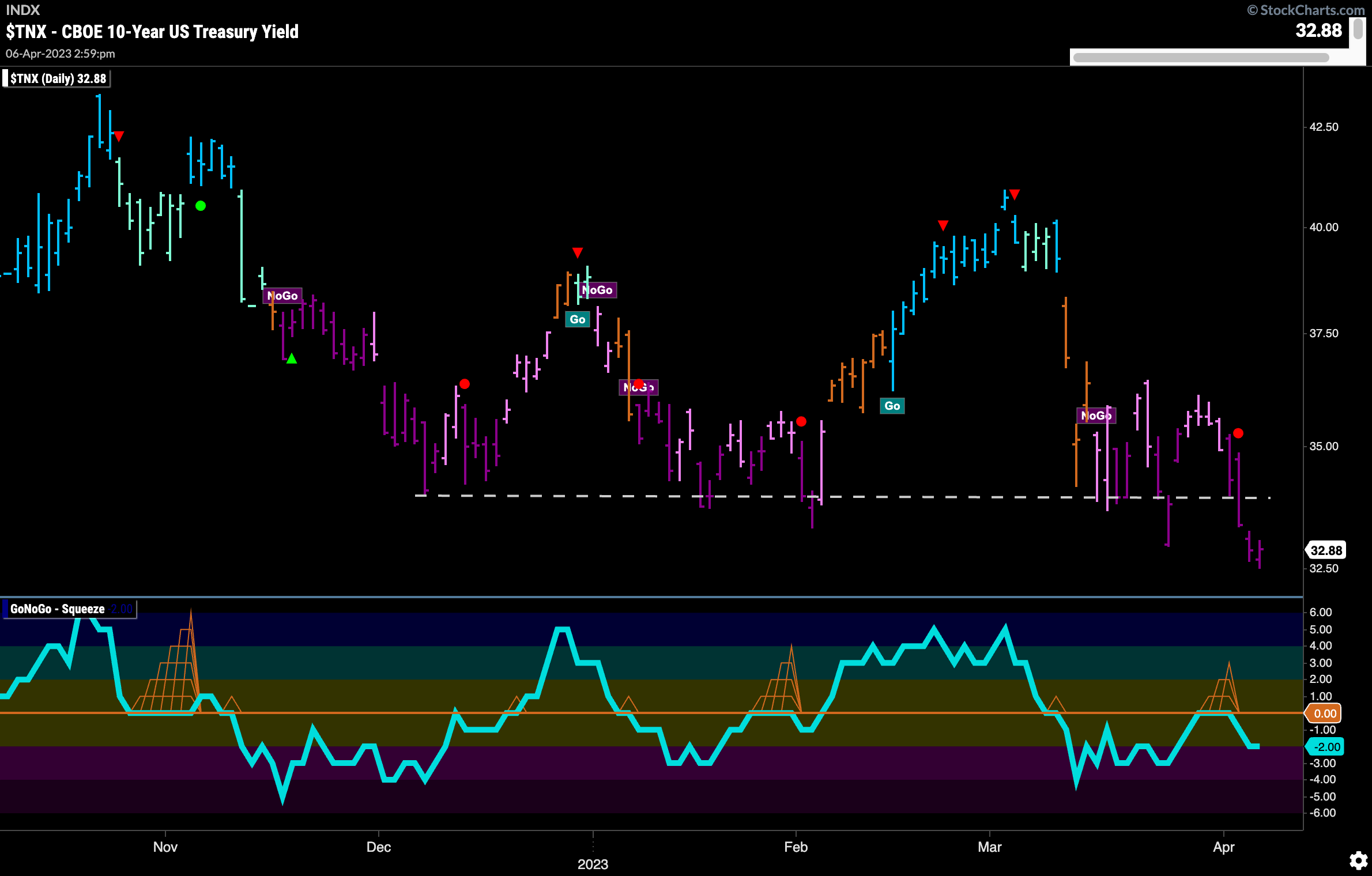

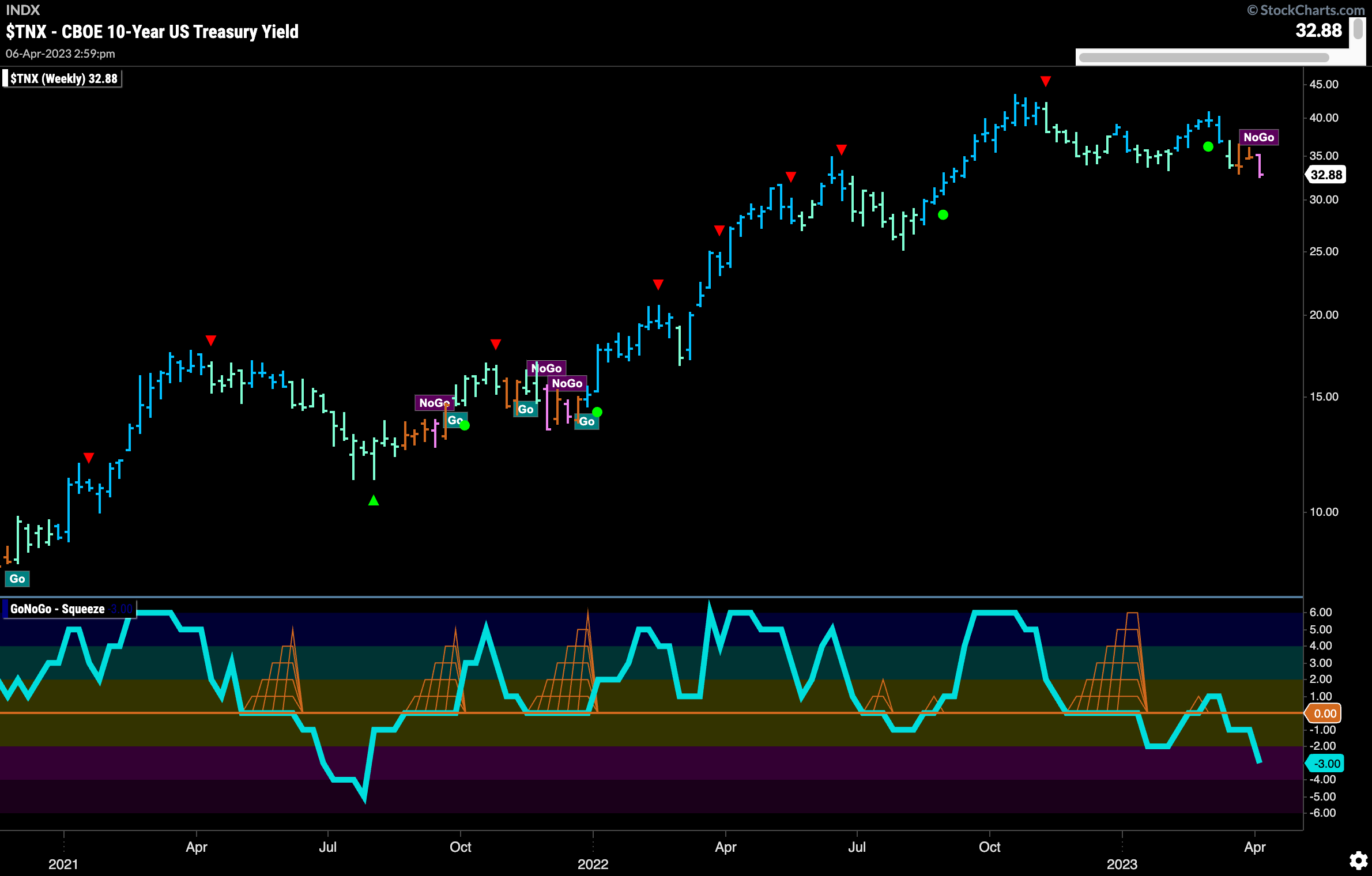

Treasury Rates Fall to New Lows

Treasury rates painted mostly strong purple “NoGo” bars this week as price tested and then fell below horizontal support. As this happened, GoNoGo Oscillator confirmed by testing the zero line from below and then being rejected, falling back into negative territory. This tells us that momentum is resurgent in the direction of the current “NoGo” trend.

The weekly chart now sees the trend line up with that of the daily periodicity. Last week saw a first pink “NoGo” bar as GoNoGo Trend cycled out of “Go Fish” into a “NoGo” color for the first time since late 2021. GoNoGo Oscillator is below zero and falling, confirming that momentum is on the side of this new “NoGo”.

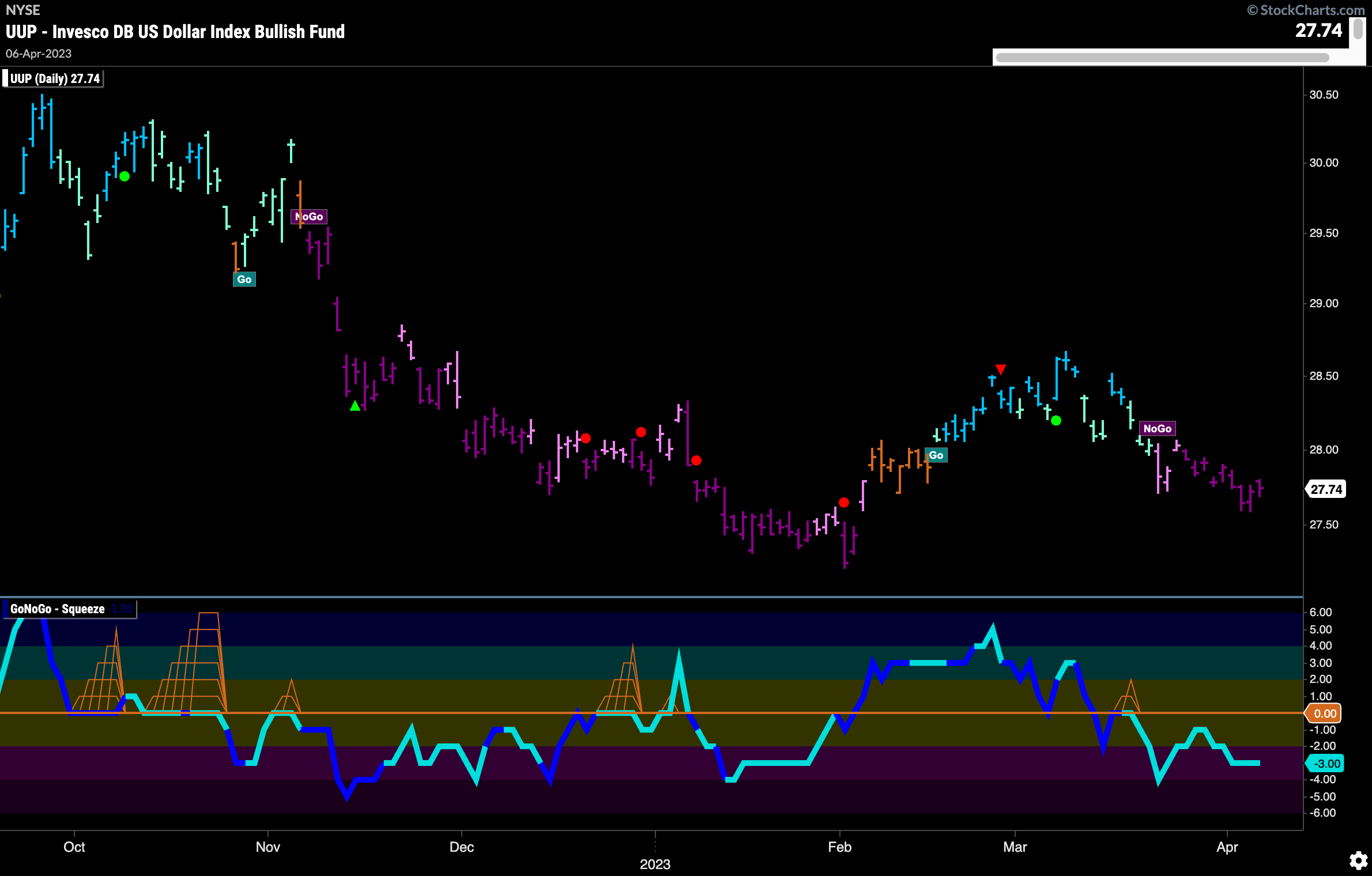

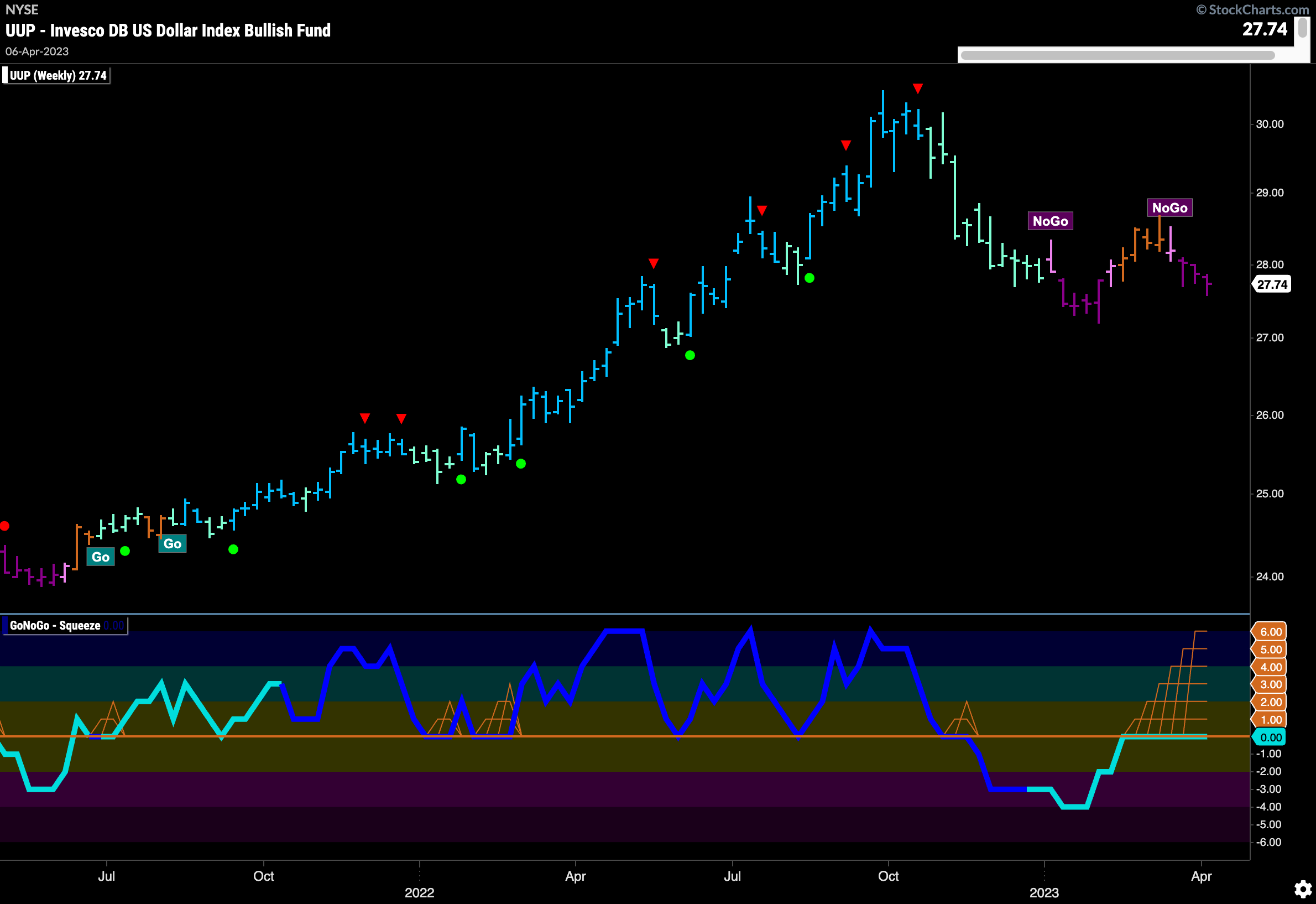

Dollar Continues in “NoGo” Trend

GoNoGo Trend painted uninterrupted strong purple “NoGo” bars this week as prices continued to move lower. In striking range of the February lows, we will watch to see if these levels are tested. GoNoGo Oscillator is in negative territory but not oversold.

The weekly chart shows little change from where we were last week. Prices have moved slightly lower, and GoNoGo Oscillator remains at zero and a Max GoNoGo Squeeze is in effect. We will watch to see if prices can test prior lows. This would be more likely should GoNoGo Oscillator fail at the zero line and get turned away into negative territory again.

Oil’s Gap Higher Puts Price at Resistance

$USO saw a jump higher last week and a return to a pink “NoGo” bar. This price action is testing the downward sloping resistance line that has been in place since the summer of last year. As price runs up agains resistance, so does GoNoGo Oscillator in the form of the zero line. Quickly returning to that level, we will watch to see if it gets rejected and is sent lower or if it can break through into positive territory. We would need to see that second scenario play out if we are to expect price to move above its own resistance.

Gold Sets New High

$GLD saw a new high this week as GoNoGo Trend painted consistent strong blue “Go” bars after the Go Trend Continuation Icon (green circle) we saw mid week. GoNoGo Oscillator fell to the zero line and found support immediately, bouncing back into positive territory.

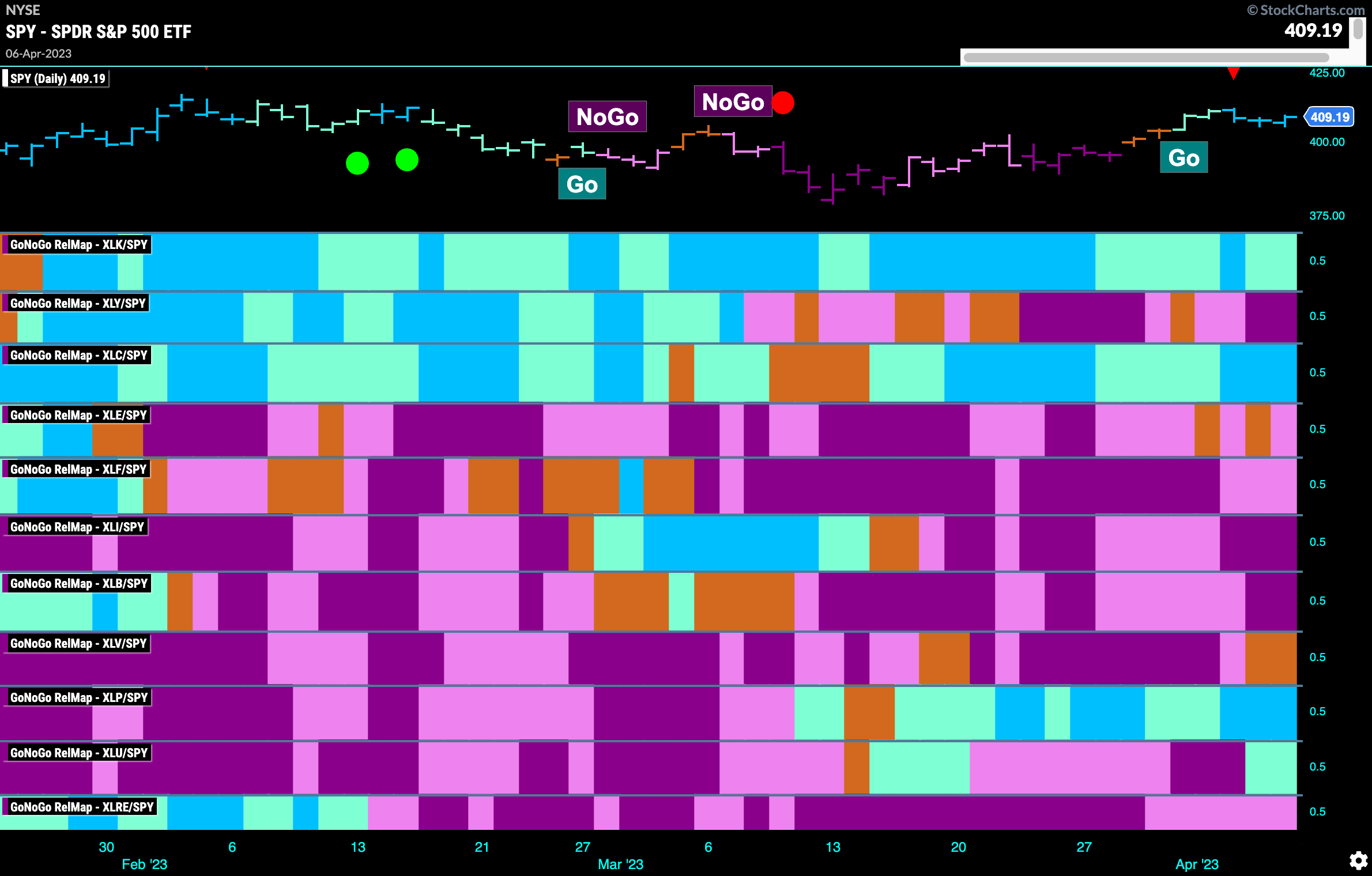

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. Looking at this map, we can quickly see where the relative outperformance is coming from as well as which sectors are lagging on a relative basis. 4 sectors are outperforming the base index this week. $XLK, $XLC, $XLP, and $XLU are painting “Go” bars.

Utilities Moves Sharply Higher

The utilities sector is starting to outperform the broader index on a relative basis. We saw from the Sector RelMap above that it is the 4th sector to show leadership. Looking at the GoNoGo chart below we can see that it broke above downward sloping resistance on amber “Go Fish” bars which were quickly followed by aqua “Go” bars and finally the strong blue trend color. GoNoGo Oscillator is overbought now, and we will look for price to consolidate these gains before mounting an attack on prior highs from late last year.

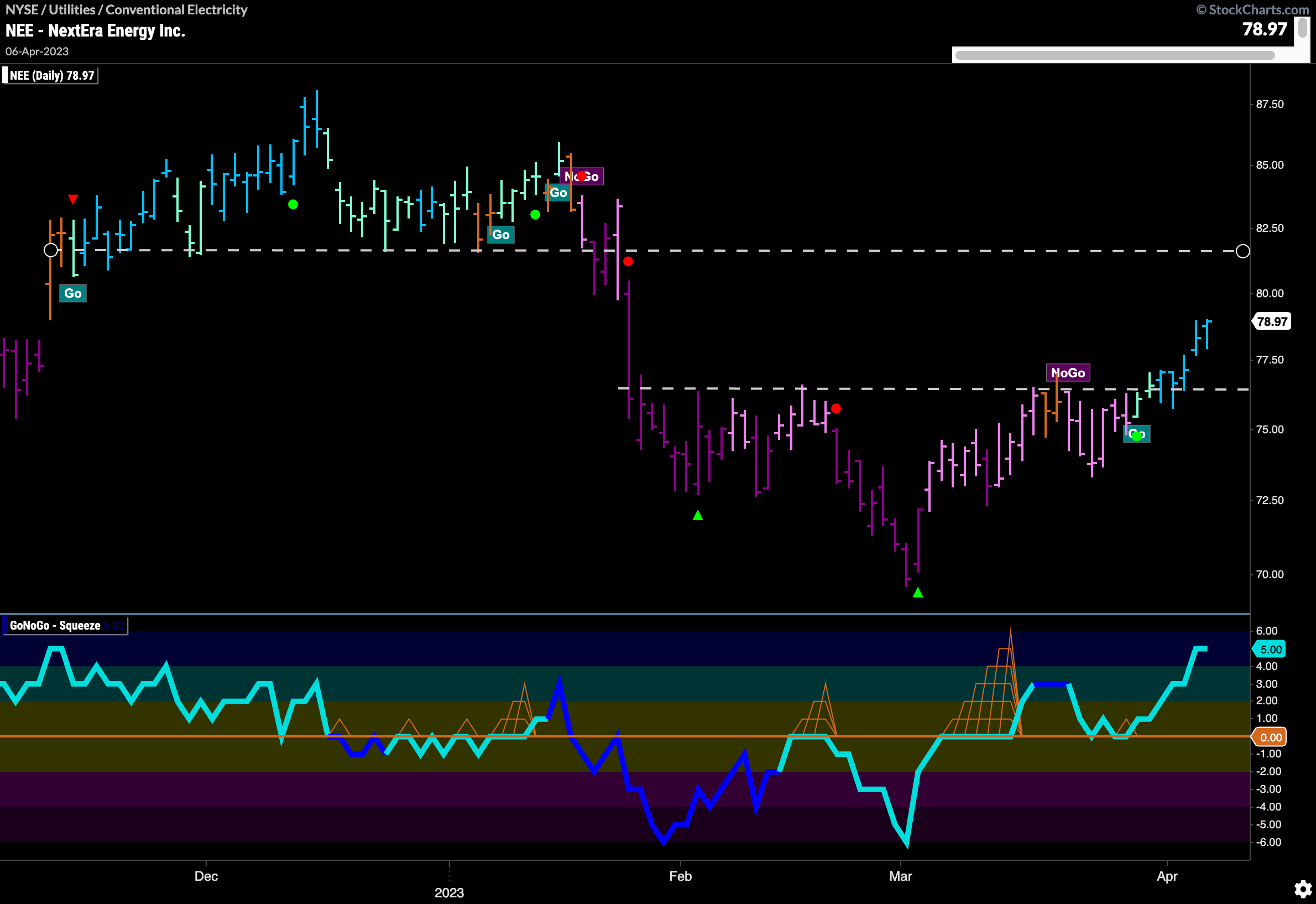

Next Era Energy With a Little Room To Run

The chart below shows the GoNoGo Chart of $NEE. We can see that it has entered a “Go” trend and is participating in the larger sector outperformance we mentioned above. This chart shows that there is some space before the natural resistance that comes from the horizontal level on the chart. We will look for price to rally to test this level and then expect some resistance at what was consistent earlier support.