Good morning and welcome to the first Flight Path of the new year! Happy 2025! The “Go” trend in equities first gave way to amber “Go Fish” bars and then this week we saw the trend change to a “NoGo”. With price trying to find support at the prior low we see GoNoGo Trend painting a weaker pink bar. Treasury bond prices remained in the “NoGo” trend and the week ended with some strong purple bars. U.S. commodities saw nothing but strength this week with an uninterrupted spell of bright blue “Go” bars. Likewise, the dollar saw the “Go” trend remain strong once again.

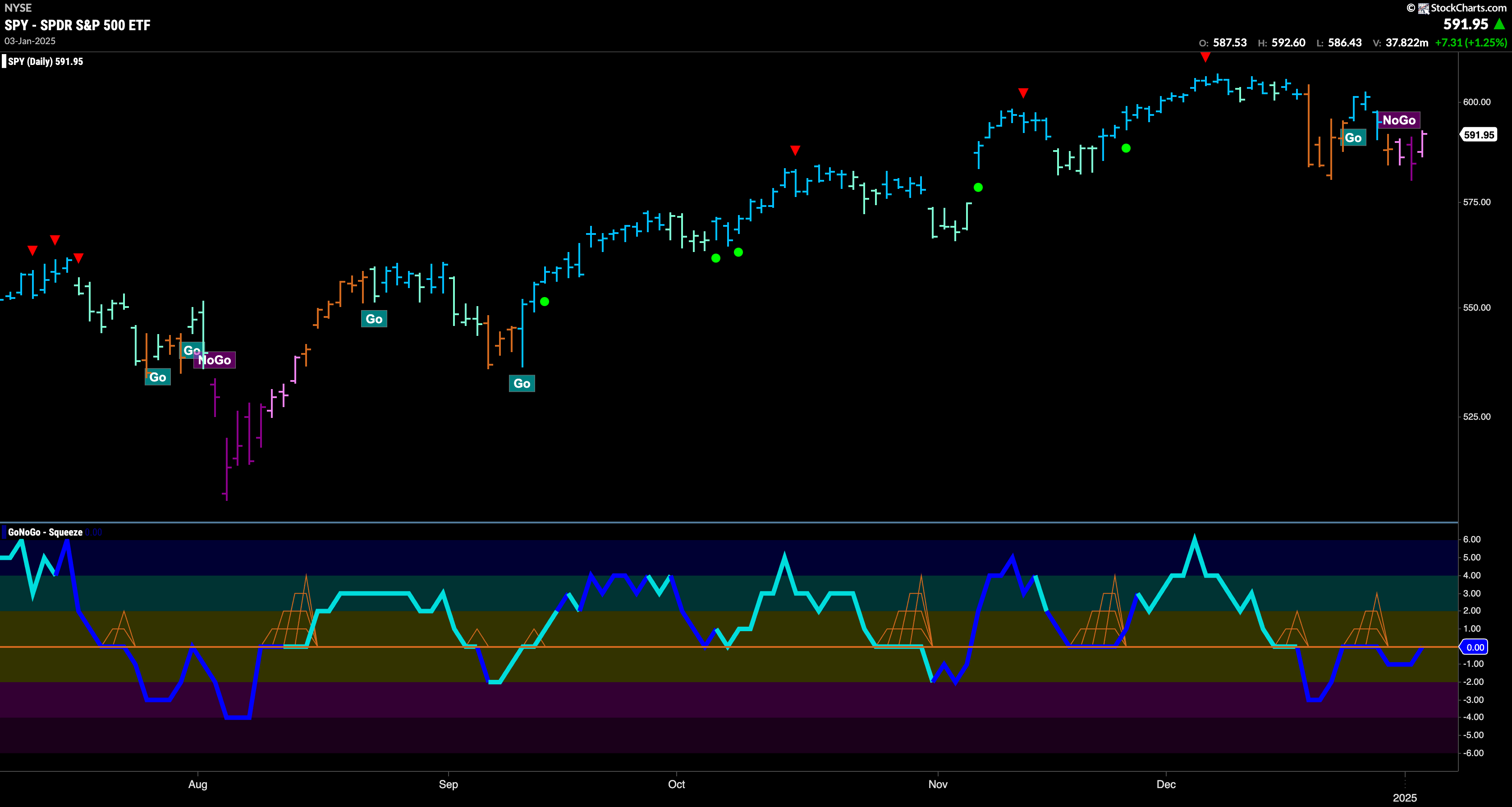

$SPY Drops into “NoGo” Trend this Week

The GoNoGo chart below shows that the “Go” trend fell into a “NoGo” trend after struggling to return to a “Go” the week before. There is some support seen on the chart at prior low levels and price is trying to find support there. With the indicator painting a weaker pink bark we will watch to see if price holds at support here. GoNoGo Oscillator is testing the zero line from below on heavy volume. If momentum can turn positive quickly that would give price a chance to return to “Go” colors.

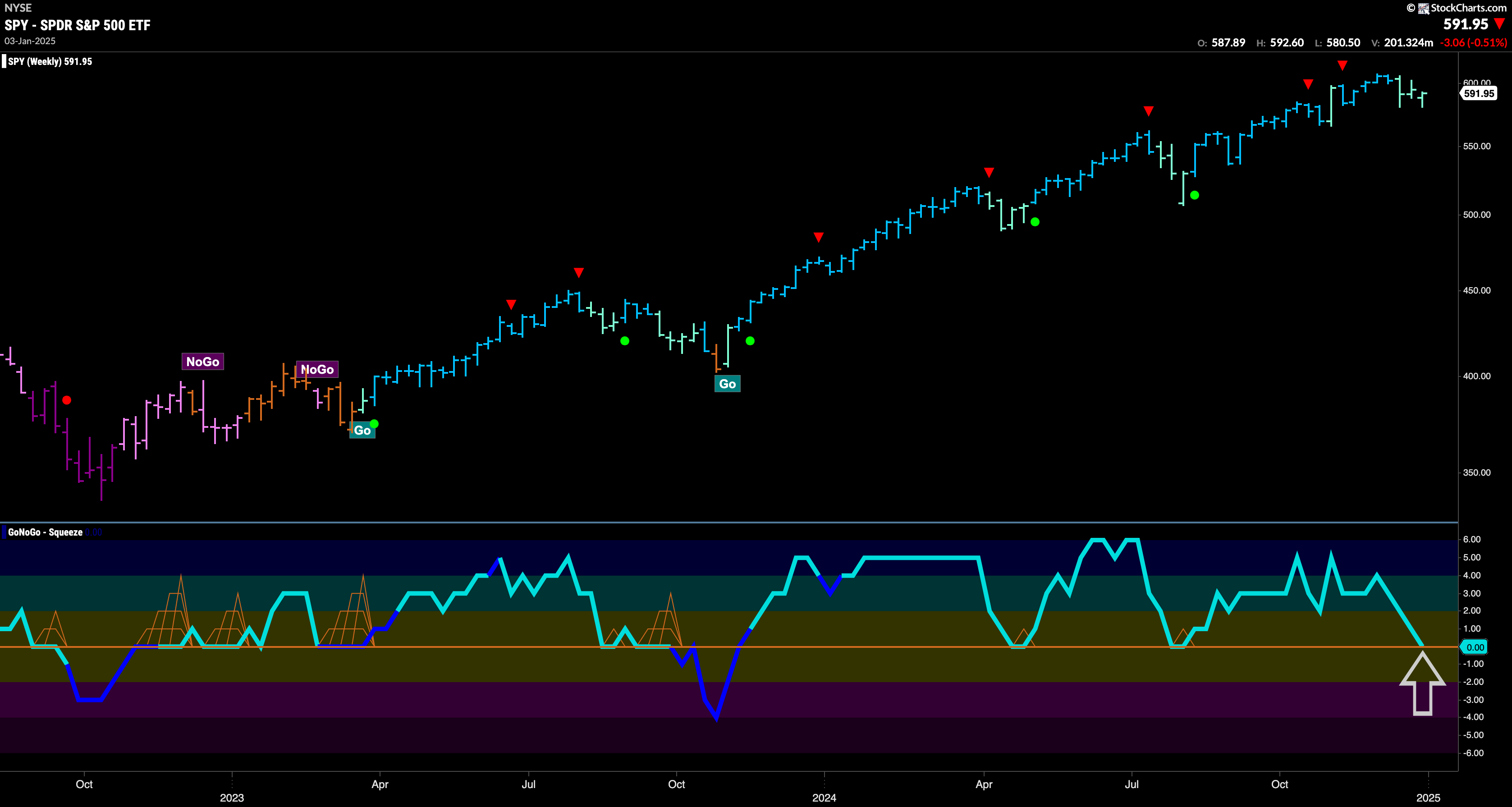

On the longer term chart, GoNoGo Trend has painted a third week of weakness with another aqua bar. This is an important moment in the longer term trend of the domestic market. GoNoGo Oscillator has fallen to test the zero line from above where we will look to see if it finds support. If the oscillator can bounce off zero back into positive territory that would signal that momentum is still on the side of the underlying “Go” trend and we could expect the trend to hold. If the oscillator breaks down into negative territory that could be a sign of a deeper move lower in price.

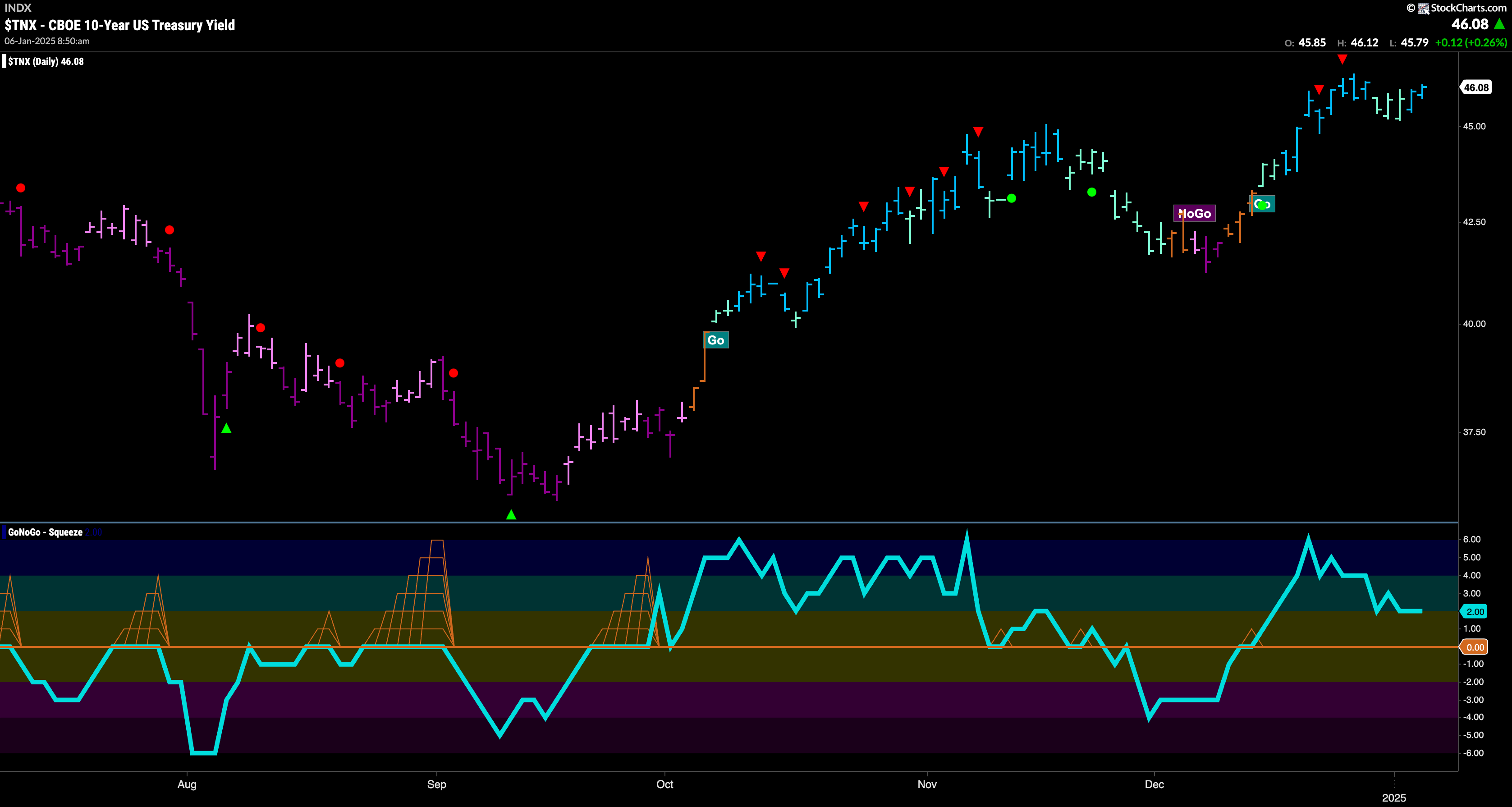

Treasury Rates Stay in “Go” Trend

GoNoGo Trend shows that rates remained in a “Go” trend this week and in fact we saw that trend strengthen later in the week as it rallied off support and is now again testing prior highs with strong blue “Go” bars. GoNoGo Oscillator has fallen from overbought territory but is still at a positive value of 2. We will watch to see if rates can consolidate at these levels and if so set up for an attack on a new higher high.

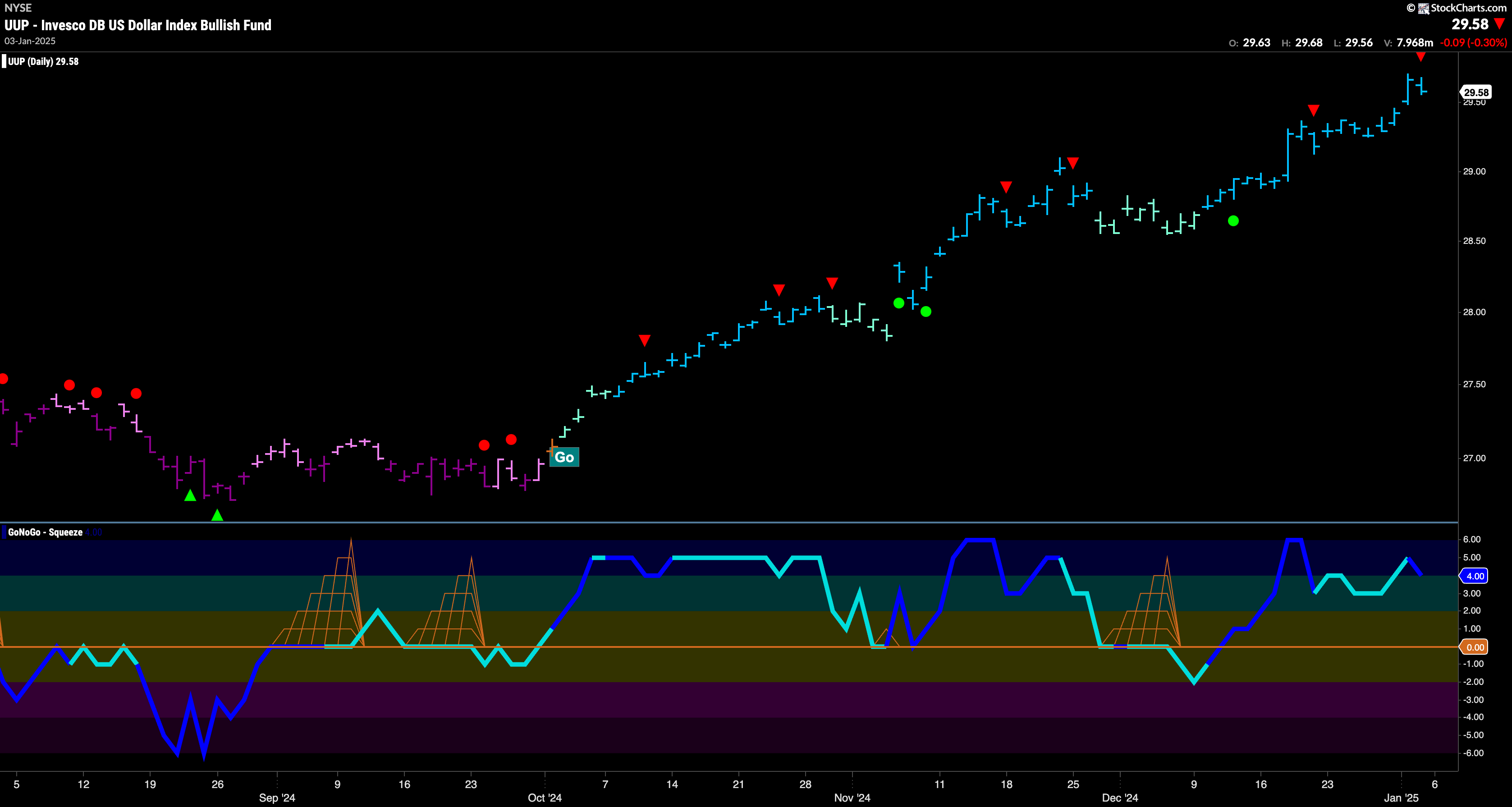

The Dollar Sees More Strength at new Highs

GoNoGo Trend painted another string of strong blue “Go” bars this week as price climbed to another higher high. GoNoGo Oscillator is retreating from overbought territory and so we see a Go Countertrend Correction Icon (red arrow) suggesting that in the short term price may struggle to go higher. As the oscillator falls closer to the zero line we will look to see if it finds any support.

$USO Tries to Break above Strong Resistance

We saw a continued run of strong blue “Go” bars this week as price rallied sharply and is now testing horizontal resistance that we see on the chart. GoNoGo Oscillator is at a max value of 6 and so we saw a lot of enthusiasm at these levels. We will watch to see if this can be maintained and if price can break through to new highs in the coming days and weeks. If momentum wanes, we may see price retreat back to the comfort of the sideways range it has been in for so long.

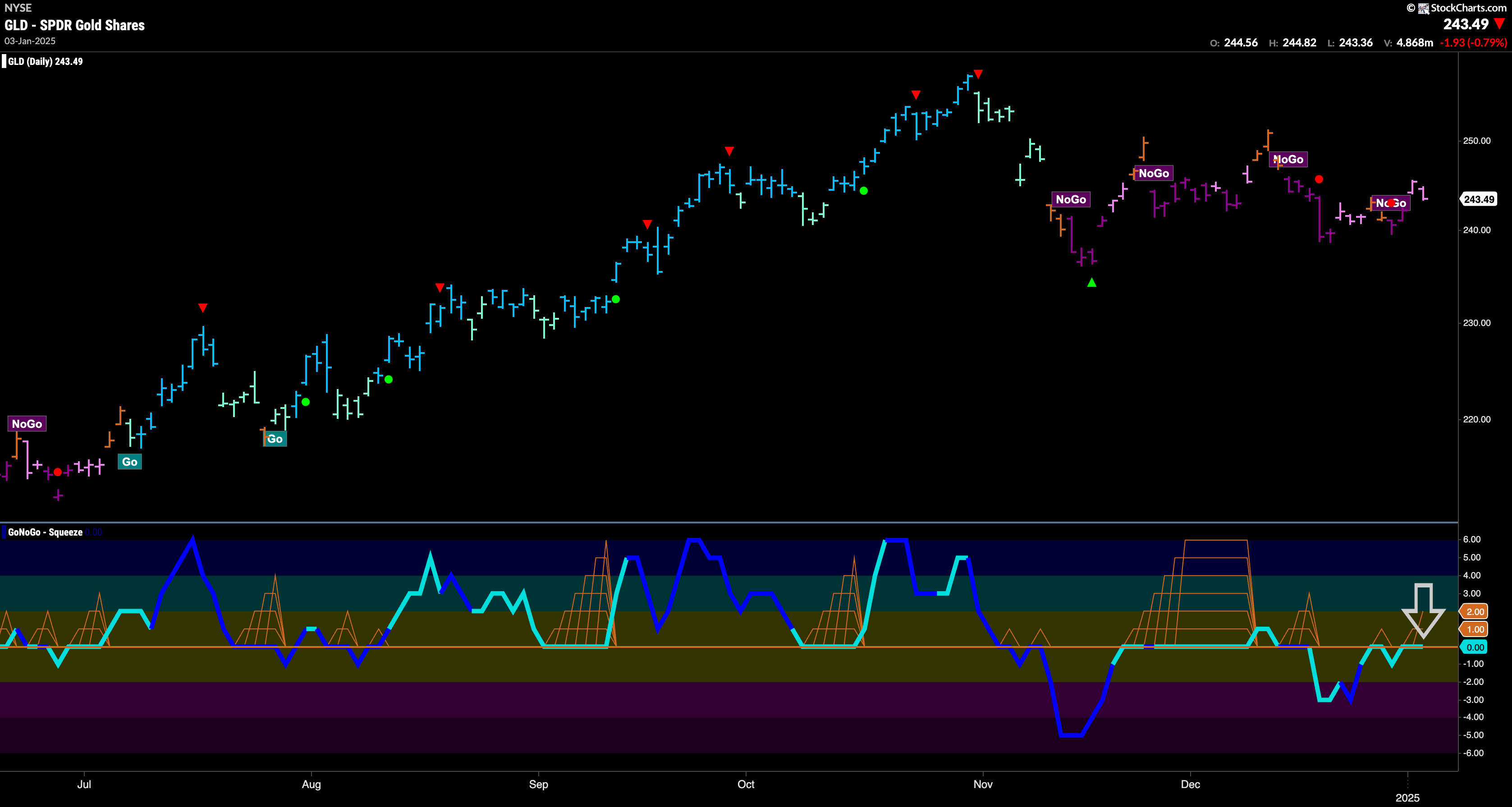

“NoGo” Continues amid Sideways Movement

GoNoGo Trend shows that the “NoGo” trend was able to remain however there were some signs of uncertainty in the form of “Go Fish” bars at the end of last week and the beginning of this one. GoNoGo Oscillator is back testing the zero line from below and it will be important to see in which direction momentum turns. If it falls back into negative territory we can expect the “NoGo” to continue and perhaps make an attempt to attack prior lows. If the oscillator climbs into positive territory that could lead to a return of “Go” bars in the price panel.

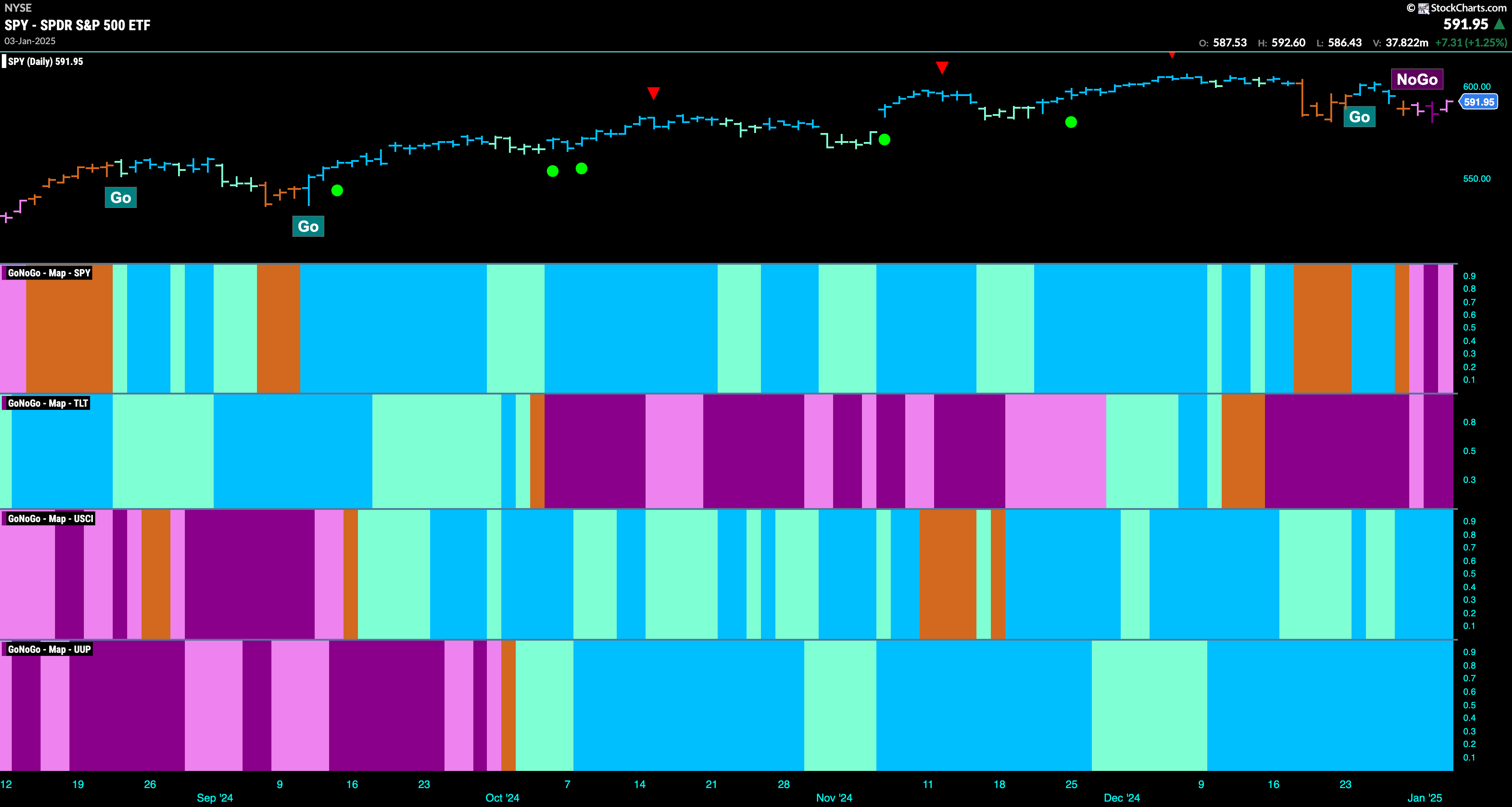

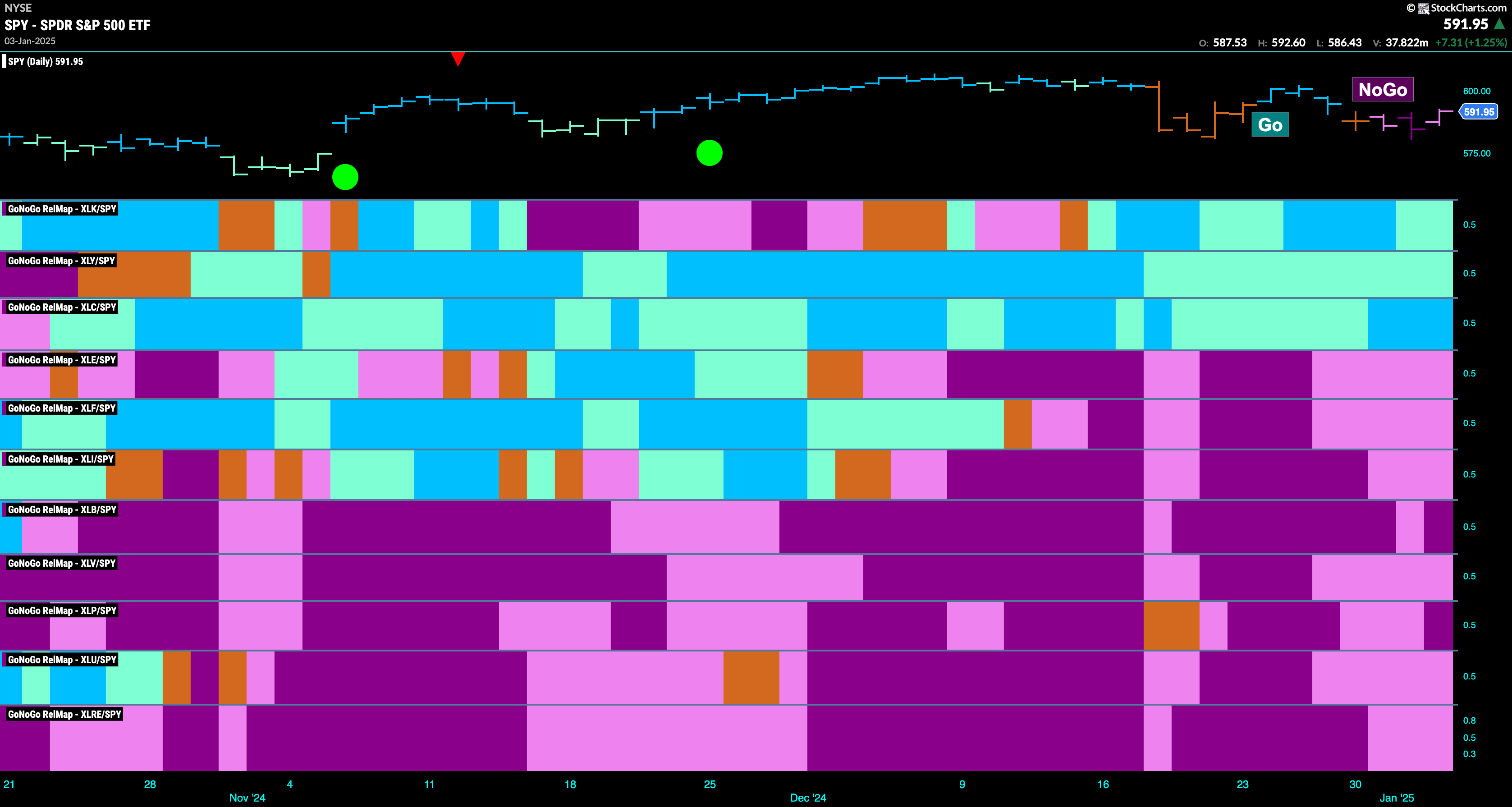

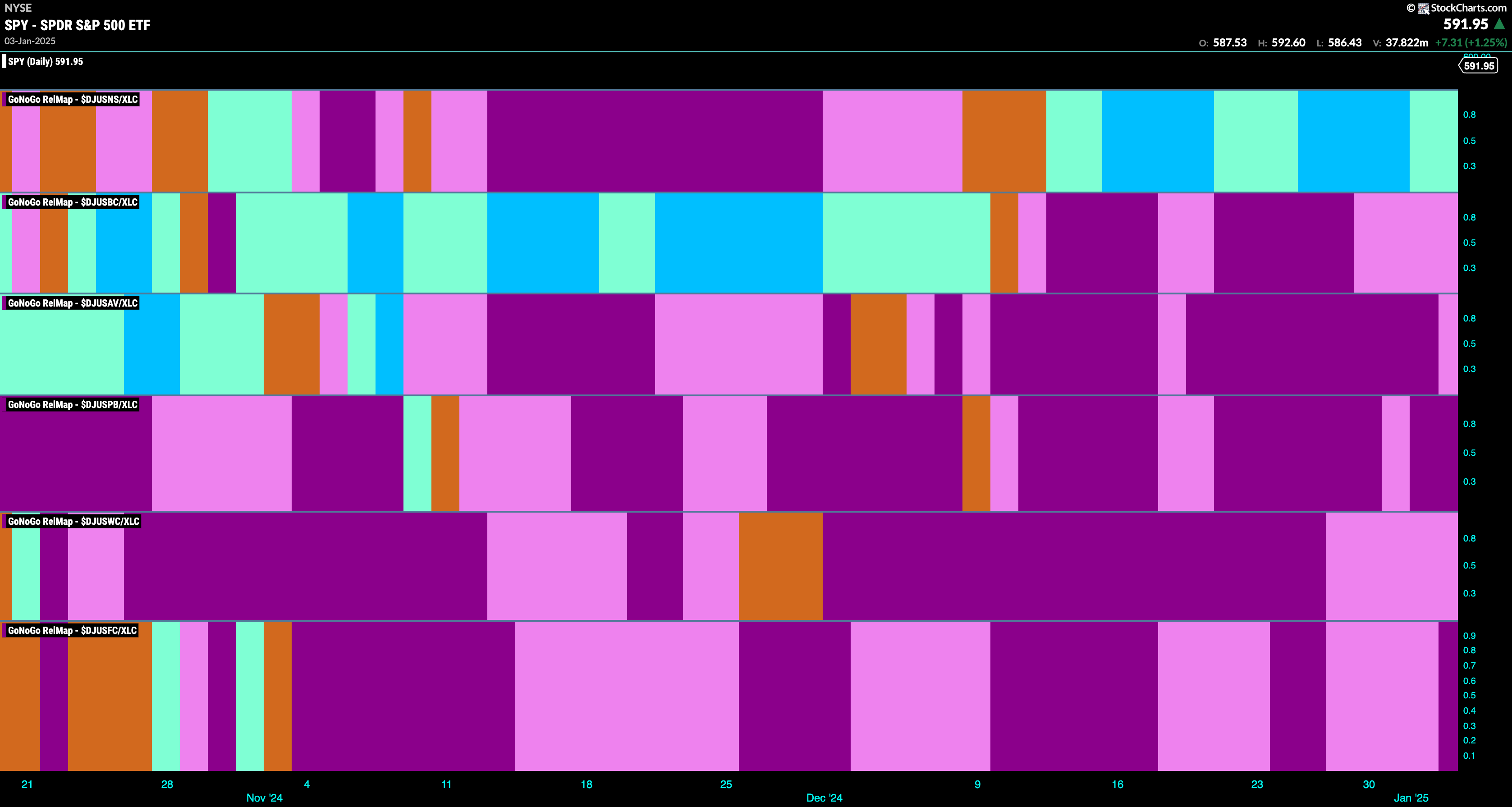

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 3 sectors are in relative “Go” trends. $XLK, $XLY, and $XLC, are painting relative “Go” bars.

Communications Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the communications sector this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLC. We saw in the above GoNoGo Sector RelMap that $XLC is strong relatively speaking as it paints bright blue relative “Go” bars to the S&P 500. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting “Go” bars in the top panel is the internet index sub group.

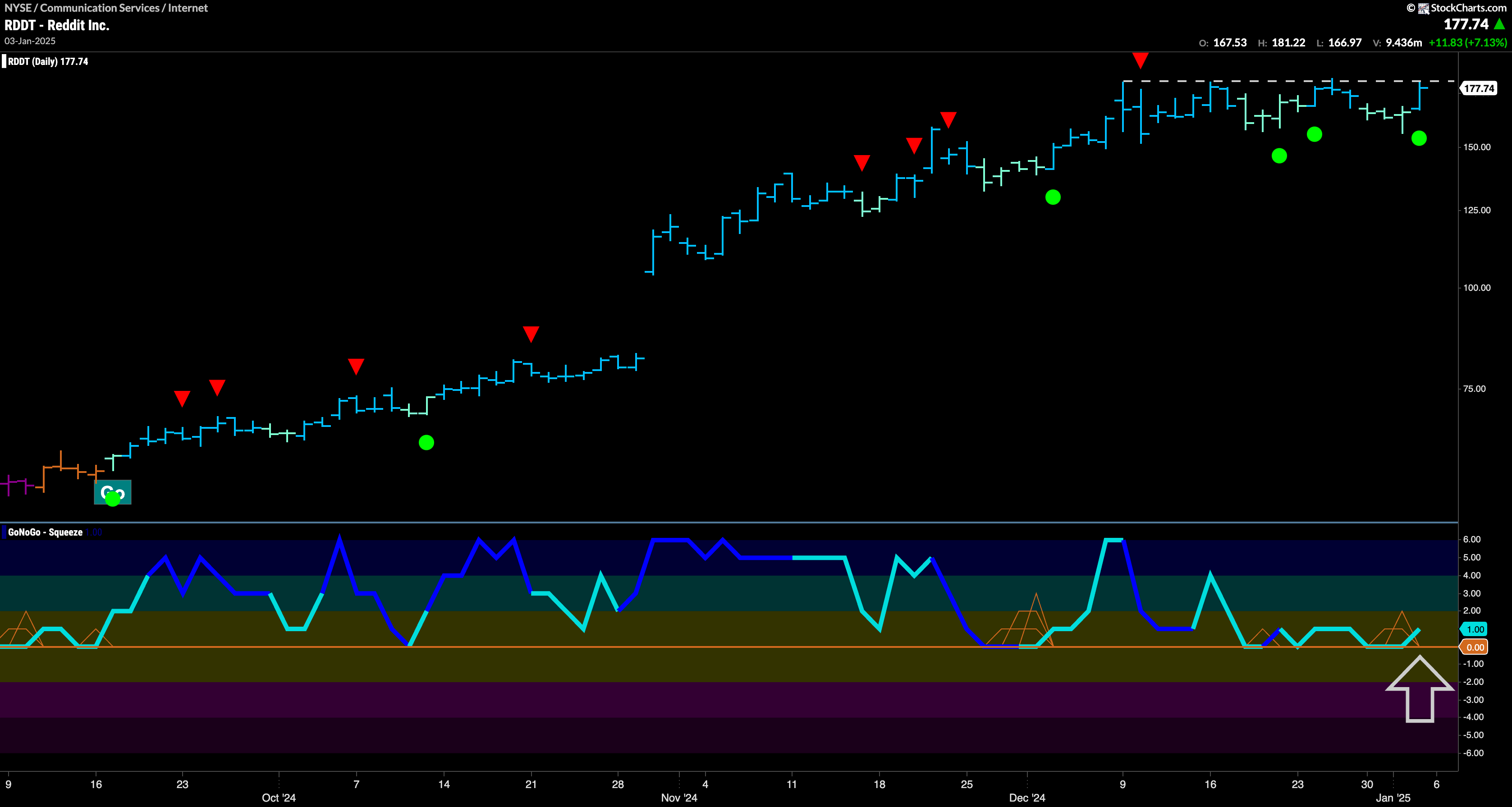

$RDDT Sets up For New High?

The chart below shows that price has been in a “Go” trend for several months now and we have seen a series of higher highs and higher lows. At the last higher high, we saw a Go Countertrend Correction Icon (red arrow) indicating that price may struggle to go higher in the short term and indeed we have seen price move mostly sideways since. GoNoGo Trend has painted several weaker aqua bars during this time. We have not seen a new lower low however, with price holding at horizontal support. Now, we see GoNoGo Trend painting a stronger blue bar as it tests prior highs again. During the trend so far, GoNoGo Oscillator has been at or above zero finding support at that level each time tested. We see the oscillator has just retested that level once more and has rallied back into positive territory. This has caused another Go Trend Continuation Icon (green circle) to appear on the chart. With momentum resurgent in the direction of the “Go” trend, we will watch to see if price can move to a new higher high.

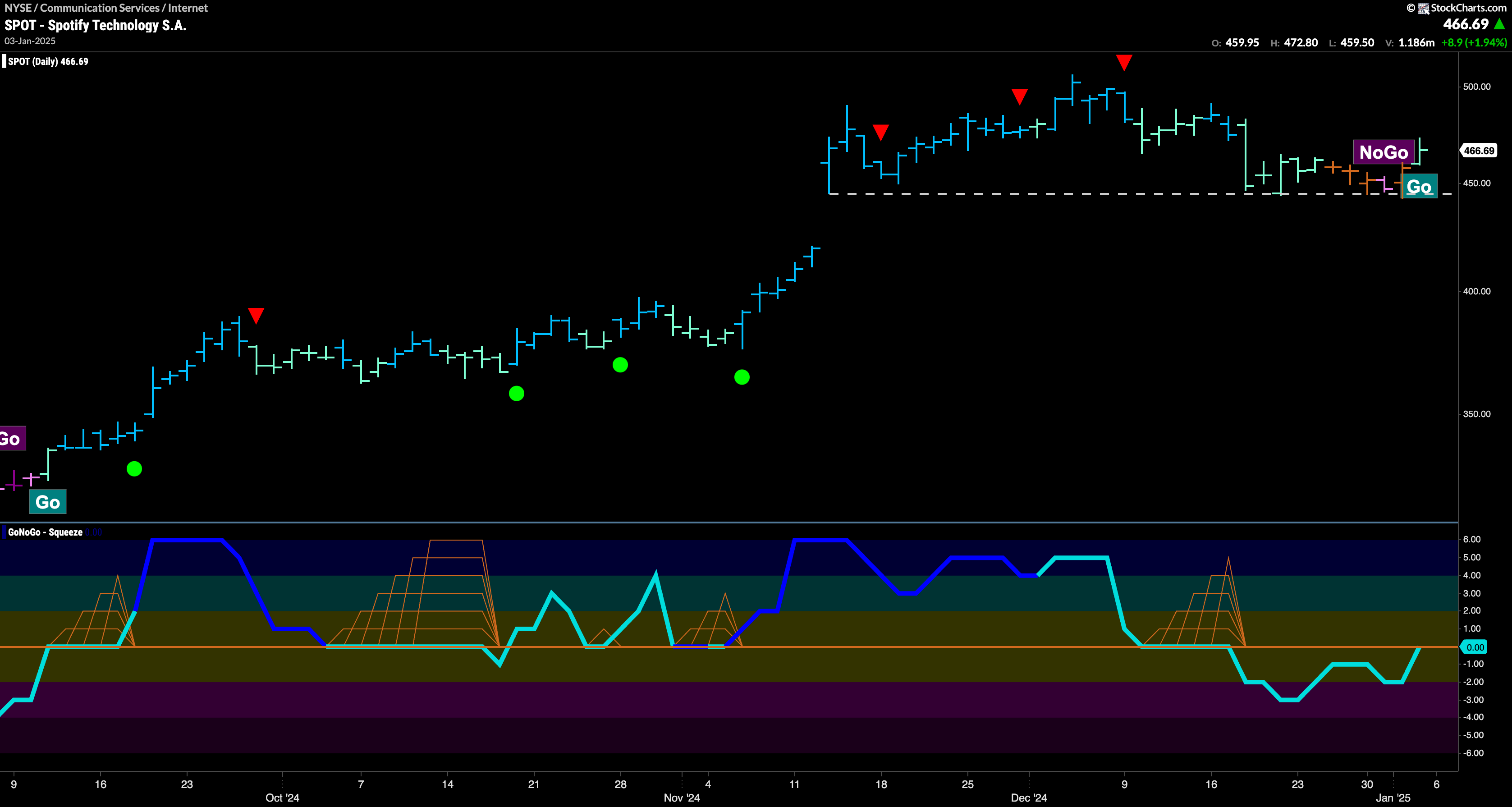

$SPOT Paints a New “Go” Bar

A few weeks ago, after the last higher high, we saw a Go Countertrend Correction Icon (red arrow) telling us that price may struggle to go higher in the short term. This was followed by a majority of weaker aqua bars as price fell from the high. GoNoGo Trend then painted several amber “Go Fish” bars as the market was uncertain about the trend. We even saw a pink “NoGo” bar last week. However, as price found support at the top of the gap from November, we see a new “Go” bar emerge this week. This comes as the oscillator is testing the zero line from below. We would like to see momentum break back into positive territory to confirm the new trend in the price panel.