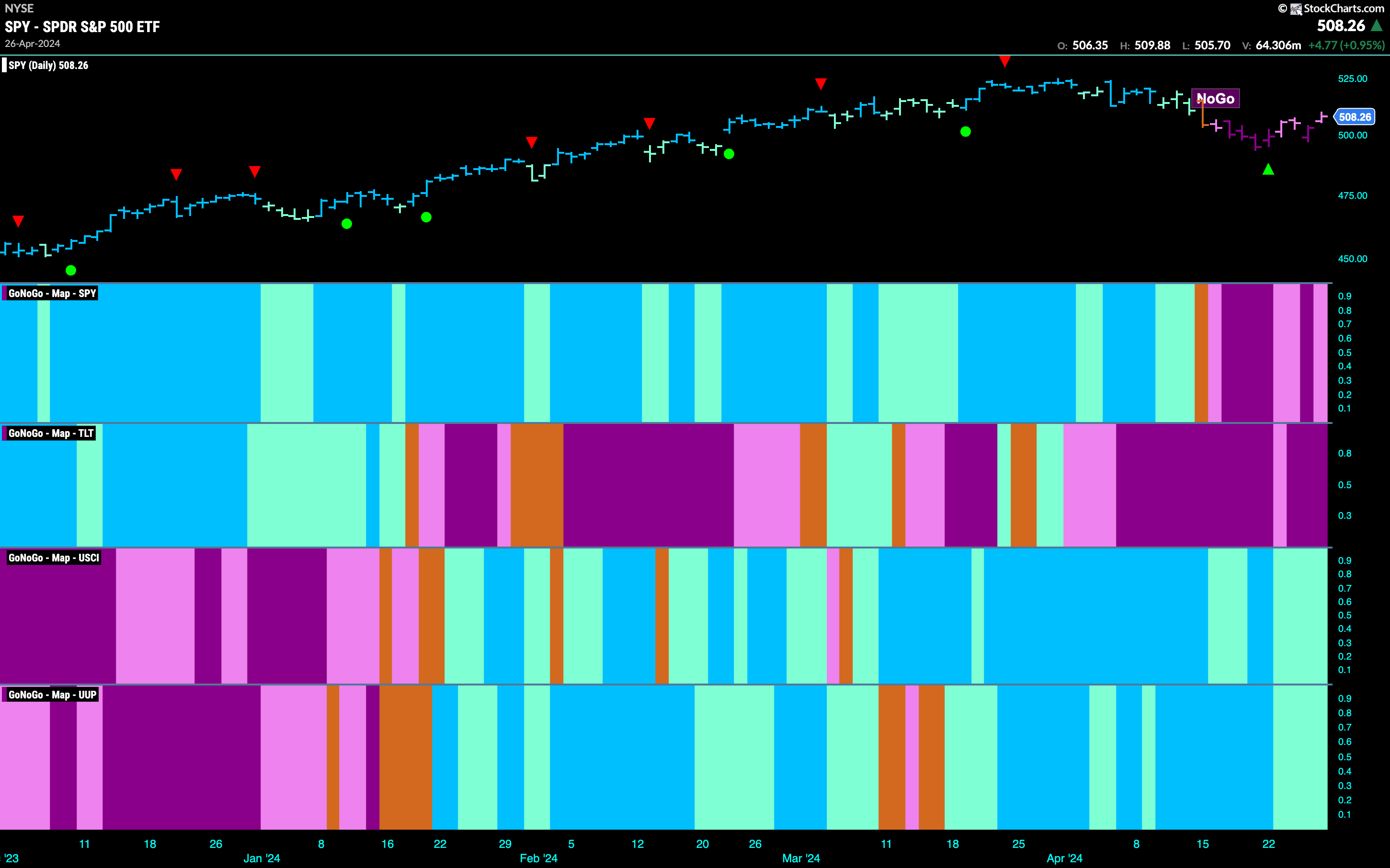

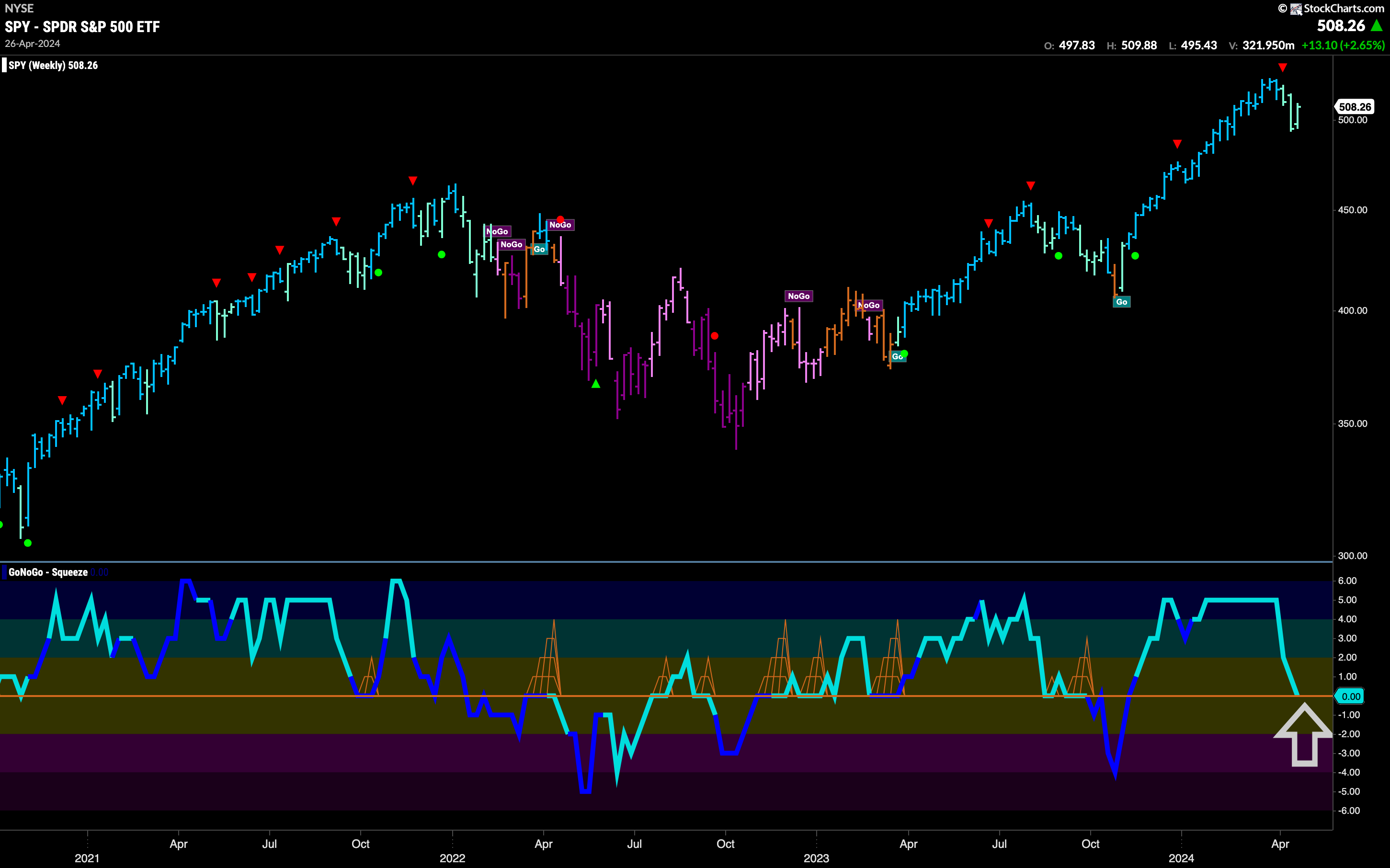

Good morning and welcome to this week’s Flight Path. The equity “NoGo” trend continued this week even with some relief rallies as price attempted to move higher from the recent low. We see GoNoGo Trend painting weaker “NoGo” bars as the week ended. Treasury bond prices remained embroiled in a strong “NoGo” trend with the indicator painting purple bars again this week. GoNoGo Trend showed that the “Go” trend was able to survive in the commodity space, although we do see weakness with paler aqua bars. The dollar, also remained in a “Go” trend, but also painted weaker aqua bars.

Equities New “NoGo” Shows Weakness

The new “NoGo” trend that we spotted in equities last week survived this whole week but we did see weakness as GoNoGo Trend painted several weaker pink bars. This comes as price rallied off the lows. We will now watch the oscillator panel as GoNoGo Oscillator runs up agains the zero line from below. We know that if this “NoGo” trend is to remain healthy, the zero level should provide resistance for the oscillator. If it is turned back into negative territory then we would expect another leg down in price and an attempt at a new lower low.

The larger weekly chart shows that recent price action has been enough to bring out weakness on the chart. We see a third successive pale aqua “Go” bar as price falls from the recent Go Countertrend Correction Icon (red arrow). GoNoGo Oscillator has fallen fast to the zero line and we will now watch to see if it finds support at that level. If it does, then we will know that the “NoGo” trend on the daily will struggle to survive. A break of the zero line into negative territory here though would allow the correction on the daily to last a little longer.

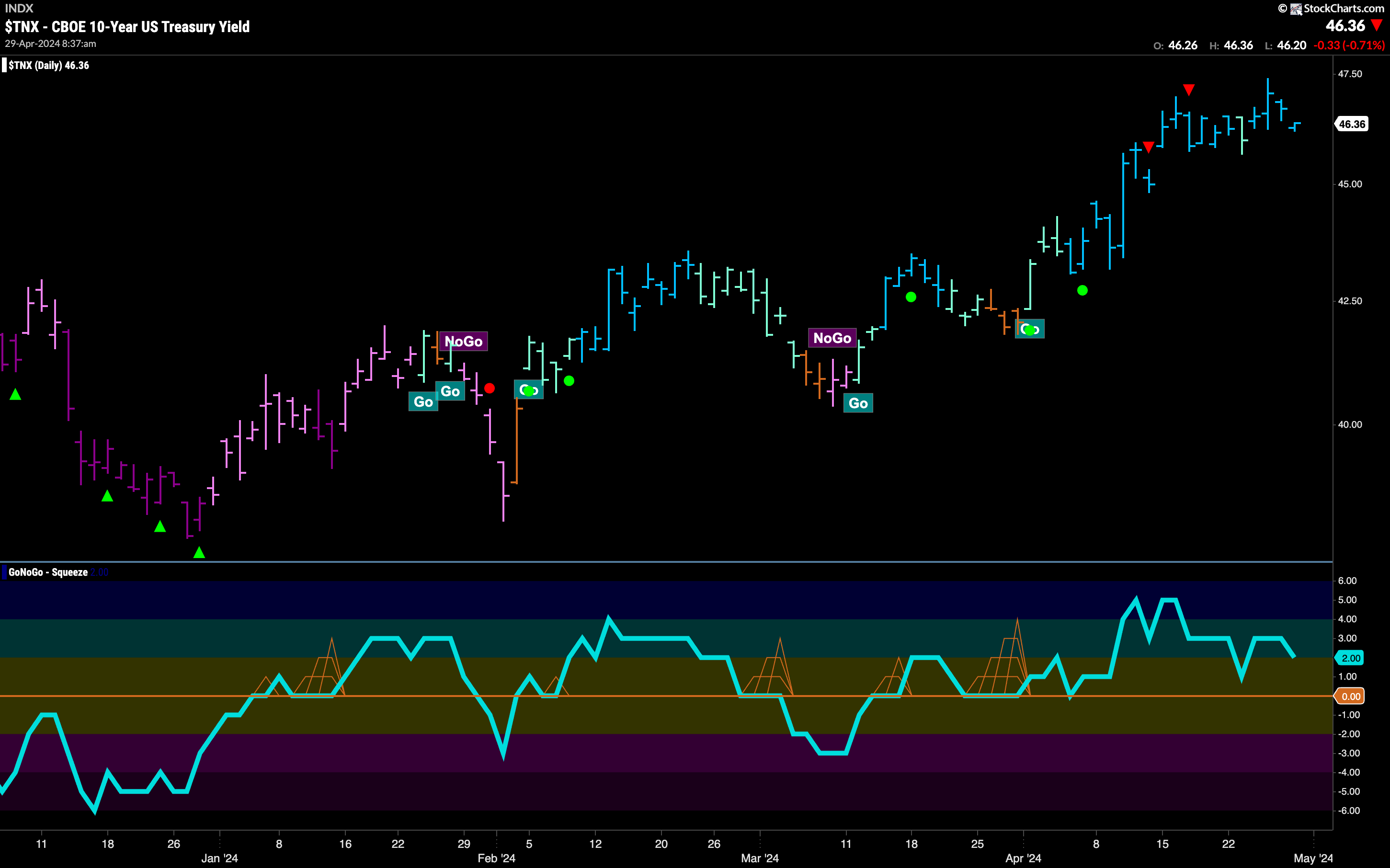

Rates See Continued Strength

More strong blue “Go” bars this week as price made a new intra week higher high. We look now for price to consolidate at these elevated levels. GoNoGo Oscillator is still in positive territory and no longer overbought. We will watch to see if it approaches the zero line and what happens when it does. Currently, a bullish picture, as GoNoGo Trend paints strong blue “Go” bars and momentum is confirming the trend with GoNoGo Oscillator in positive territory.

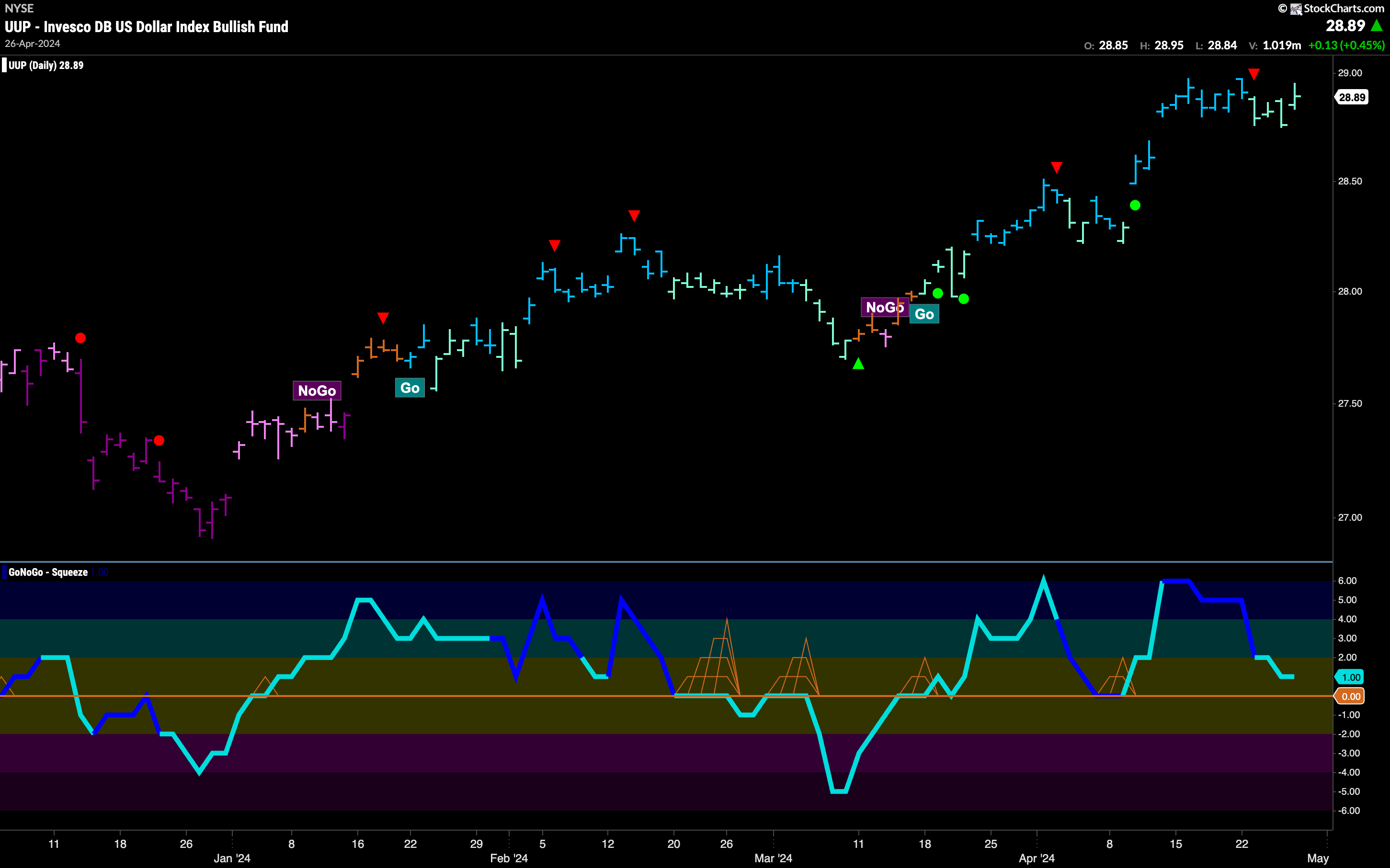

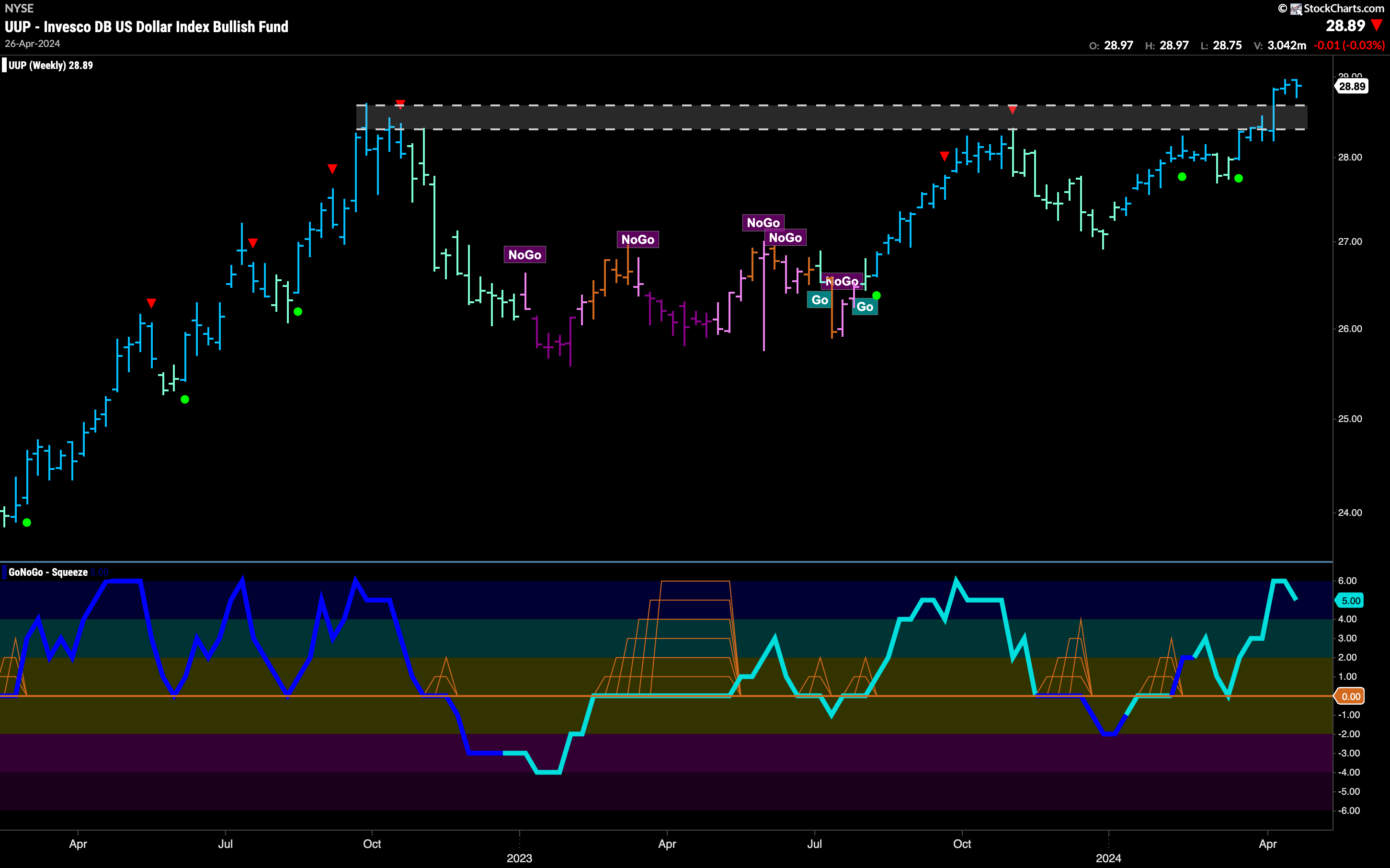

Dollar Consolidates Sideways

The greenback continues to consolidate at these elevated levels. We saw a Go Countertrend Correction Icon (red arrow) earlier in the week and this suggested that price may struggle to higher in the short term as momentum waned. Indeed, since then we have seen GoNoGo Trend paint weakness with paler aqua “Go” bars. GoNoGo Oscillator is fast approaching the zero line where we will watch to see if it can find support. If it does, and rallies back into positive territory then we will know that momentum is resurgent in the direction of the trend and will look for signs of trend continuation and new highs.

The weekly charts shows that there should be support under price at these levels. As we consolidate after the breakout, we see that GoNoGo Trend is painting strong blue bars again this week. GoNoGo Oscillator is in overbought territory and falling. We will watch to see if it moves back below a value of 5. If it does, then we will see a Go Countertrend Correction Icon (red arrow) above price and will expect price to struggle to move higher in the short term. We will then look to the support levels on the chart to provide a launching point for an attack on a new higher high.

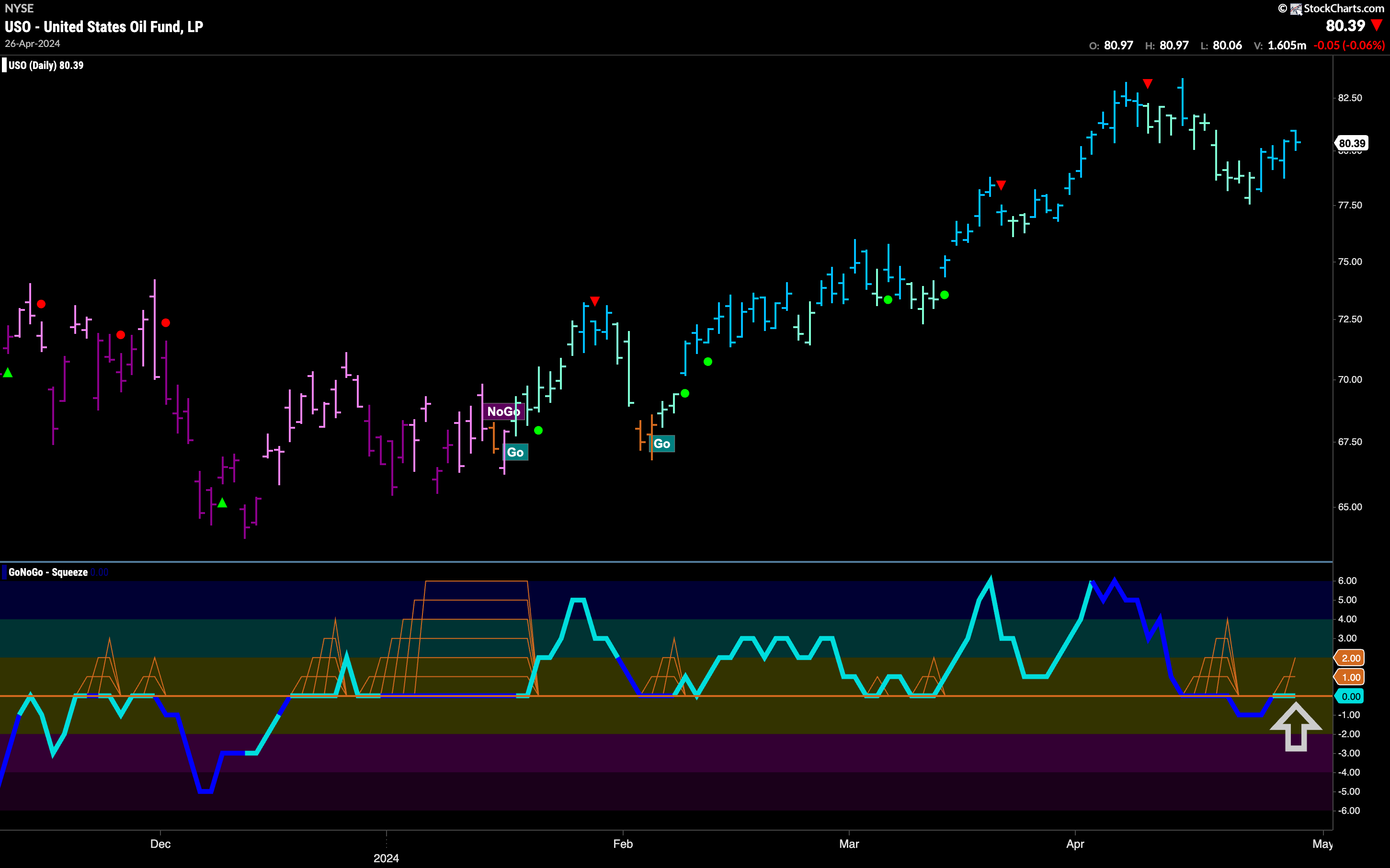

Oil Finds its Feet

Oil prices were able to stop the fall that we had been seeing since the Go Countertrend Correction Icon (red arrow) just after the most recent high. After a string of weaker aqua “Go” bas we saw strength return as the indicator painted mostly strong blue bars this week. This comes as GoNoGo Oscillator quickly retests the zero line from below. It will be important for the oscillator to regain positive territory if the “Go” trend is to remain healthy and mount a charge toward a new high. If it is rejected at the zero level that would be a major concern for the “Go” trend

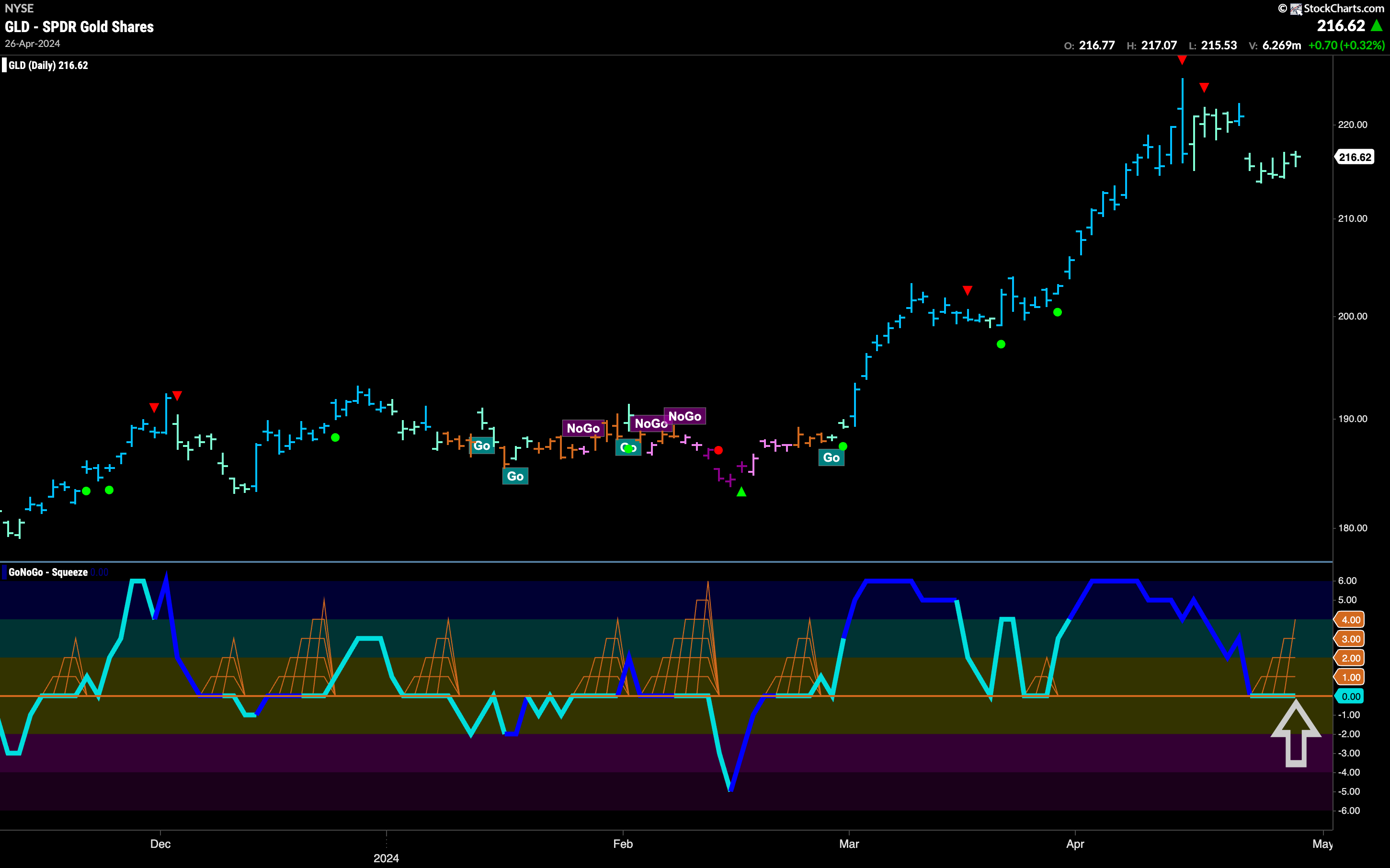

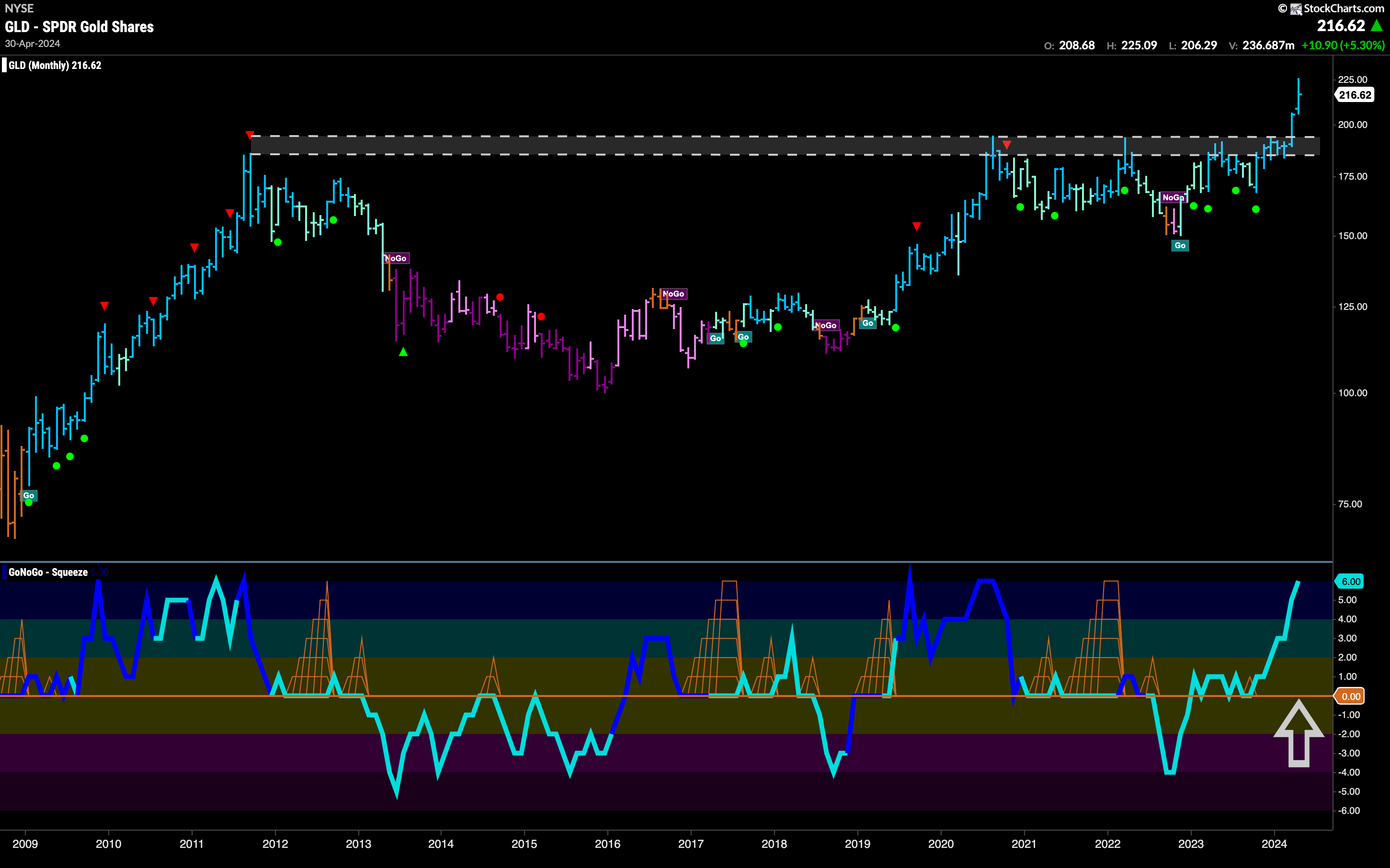

Gold Falls From Highs with Trend Weakness

$GLD gapped lower to start the week and GoNoGo Trend painted consecutive aqua bars as the trend showed its weakness. Since the beginning of the week, price held its ground and crept higher but is still below the lower bound of the gap. GoNoGo Oscillator fell fast to test the zero level and it has stayed there this week allowing the climbing grid of GoNoGo Squeeze to climb. This represents a tug of war between buyers and sellers at this level as there is little directional momentum. It will be important to note the resolution of this GoNoGo Squeeze to help determine price’s next direction.

The monthly chart shows that any weakness on the daily chart pales in comparison to the strength we still see long term. With this month set to close soon, we see price is far above the neckline that we broke through last month. Lower levels should now act as support going forward and so it will be healthy if we can see price consolidate around these levels in the coming weeks..

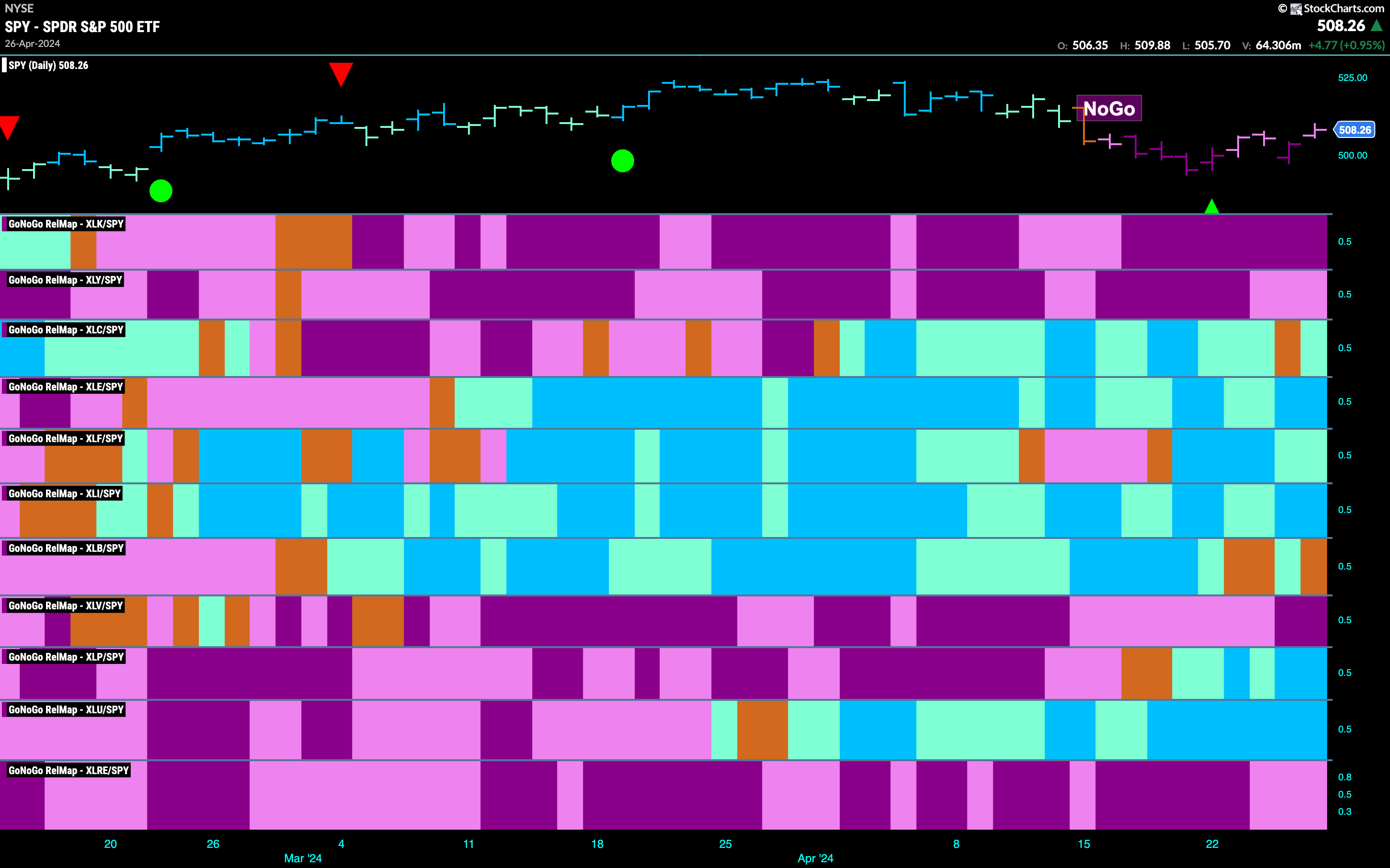

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. Looking at this map, we can quickly see where the relative outperformance is coming from as well as which sectors are lagging on a relative basis. 6 sectors are outperforming the base index this week. $XLC, $XLE, $XLF,$XLI, $XLP, and $XLU are painting relative “Go” bars.

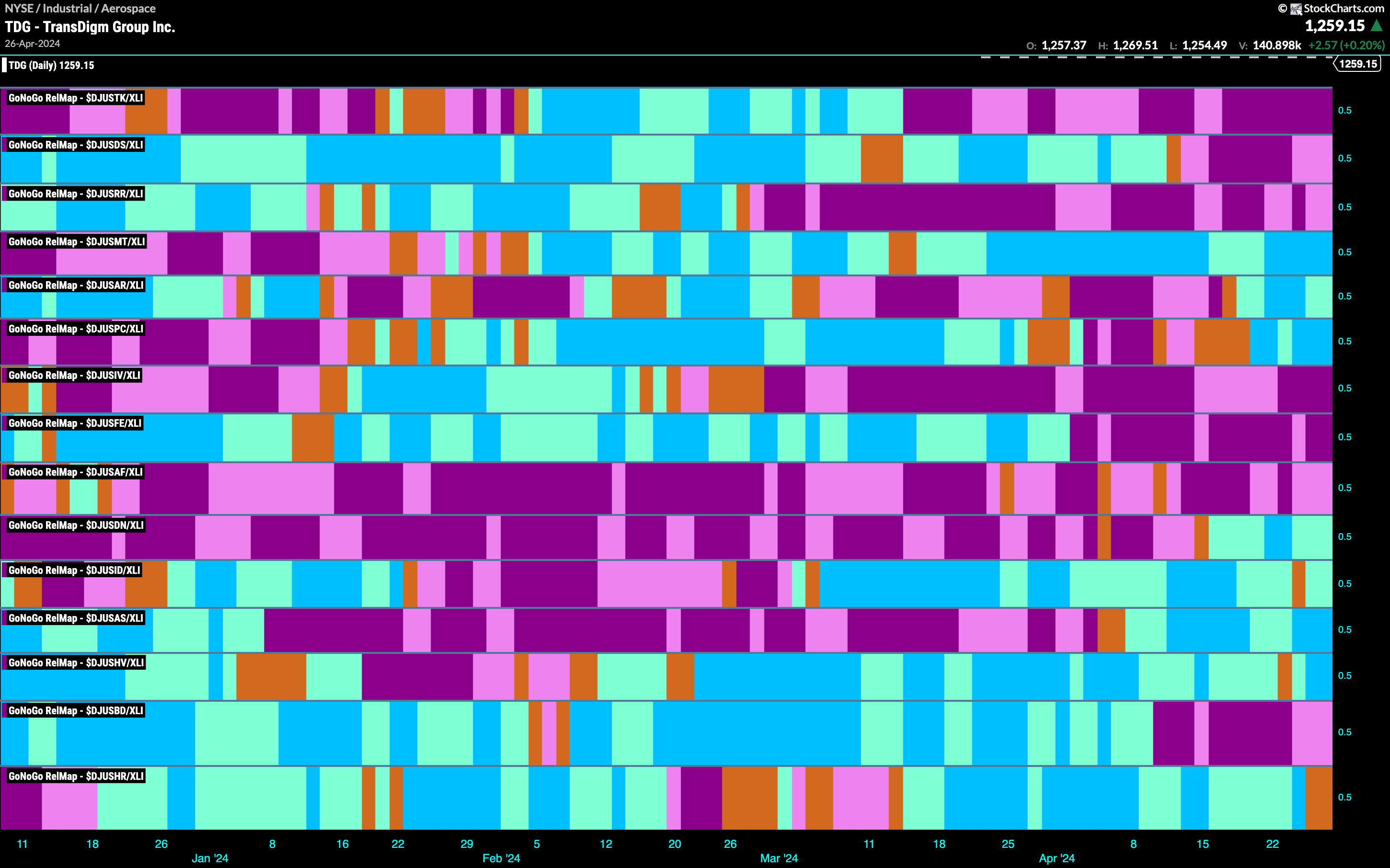

Industrials Sub-Group RelMap

The GoNoGo Sector RelMap above shows that it is the middle section of the chart that continues to demonstrate consistent outperformance on a relative basis to the wider index. The Industrials sector in the 6th panel showed renewed strength this week as it returned to strong blue “Go” bars on a relative basis. We will break down the sector below in the GoNoGo Sector Sub-group RelMap. We can see that there are several areas of outperformance and we will look at the Aerospace group today as it is showing strong blue “Go” bars in the 4th panel from bottom.

$ERJ Sees Go Trend Continuation

$ERJ has seen a strong run since mid February as the “Go” trend took price to over $27 on a series of higher highs and higher lows. Late March saw a high that was followed by a Go Countertrend Correction Icon (red arrow). This suggested that price would struggle to go higher in the short term and indeed, GoNoGo Trend then painted predominantly weaker aqua “Go” bars as the trend showed weakness. During this time, GoNoGo Oscillator tested and ultimately failed to hold the zero line and this allowed price to fall further. Importantly, it did not lose the “Go” trend colors and now GoNoGo Oscillator has been able to recapture positive territory. This has triggered a Go Trend Continuation Icon (green circle) under price, and with GoNoGo Trend painting strong blue bars again, momentum is resurgent in the direction of the underlying “Go” trend. We will look for price to make an attack on the prior high.

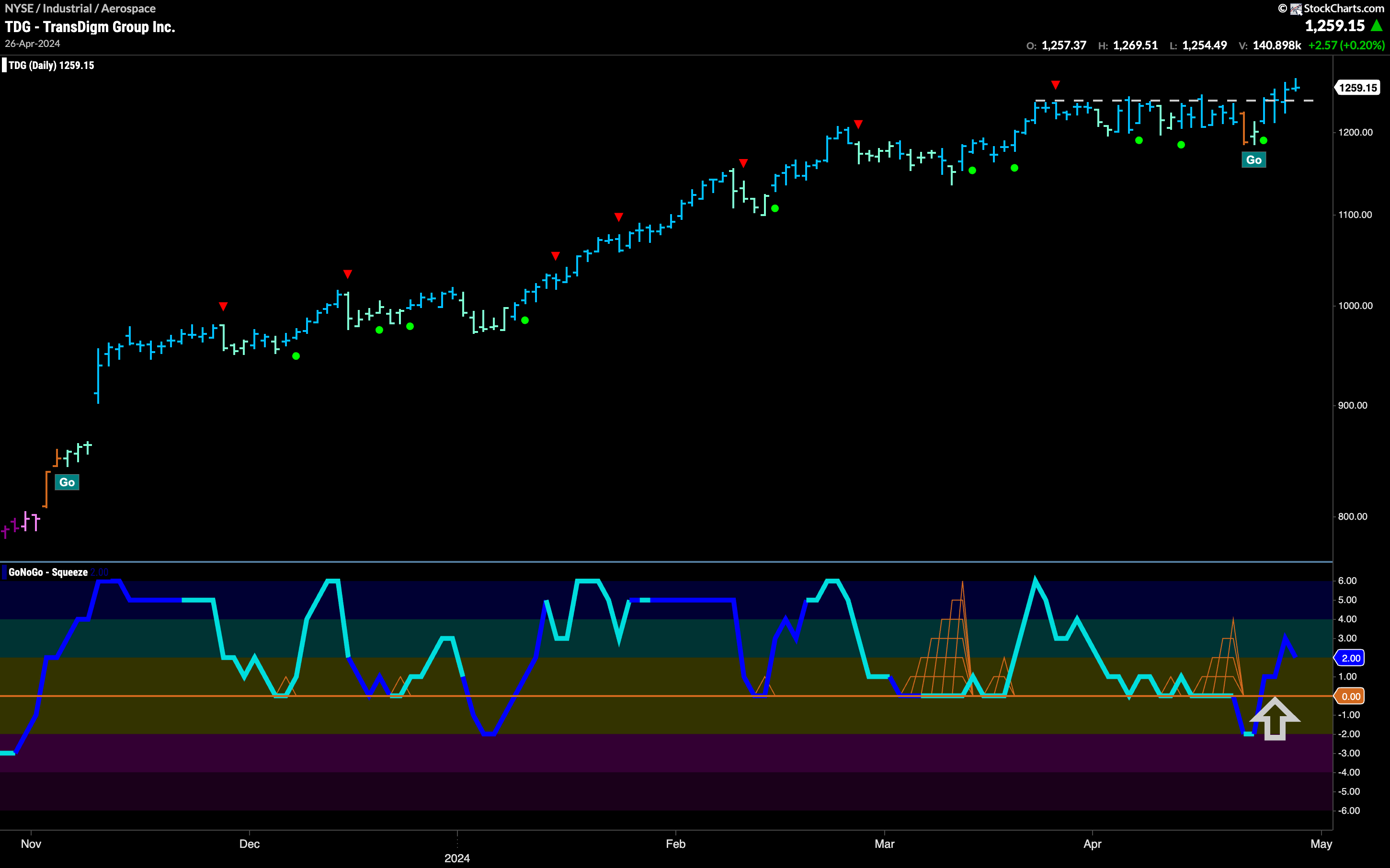

$TDG Quietly Breaks to New Highs

$TDG has been moving mostly sideways for several weeks and we can see the horizontal overhead resistance that formed on the chart. During this period, GoNoGo Trend fell out of trend once and painted an amber “Go Fish” bar as GoNoGo Oscillator quickly dipped into negative territory. It quickly reversed course however, and burst back through the zero line on heavy volume. This suggests strong market participation as momentum comes back in the direction of the “Go” trend. This gave price the push it needed to break above resistance. We will look for price to find support at these levels going forward as it looks for higher highs.