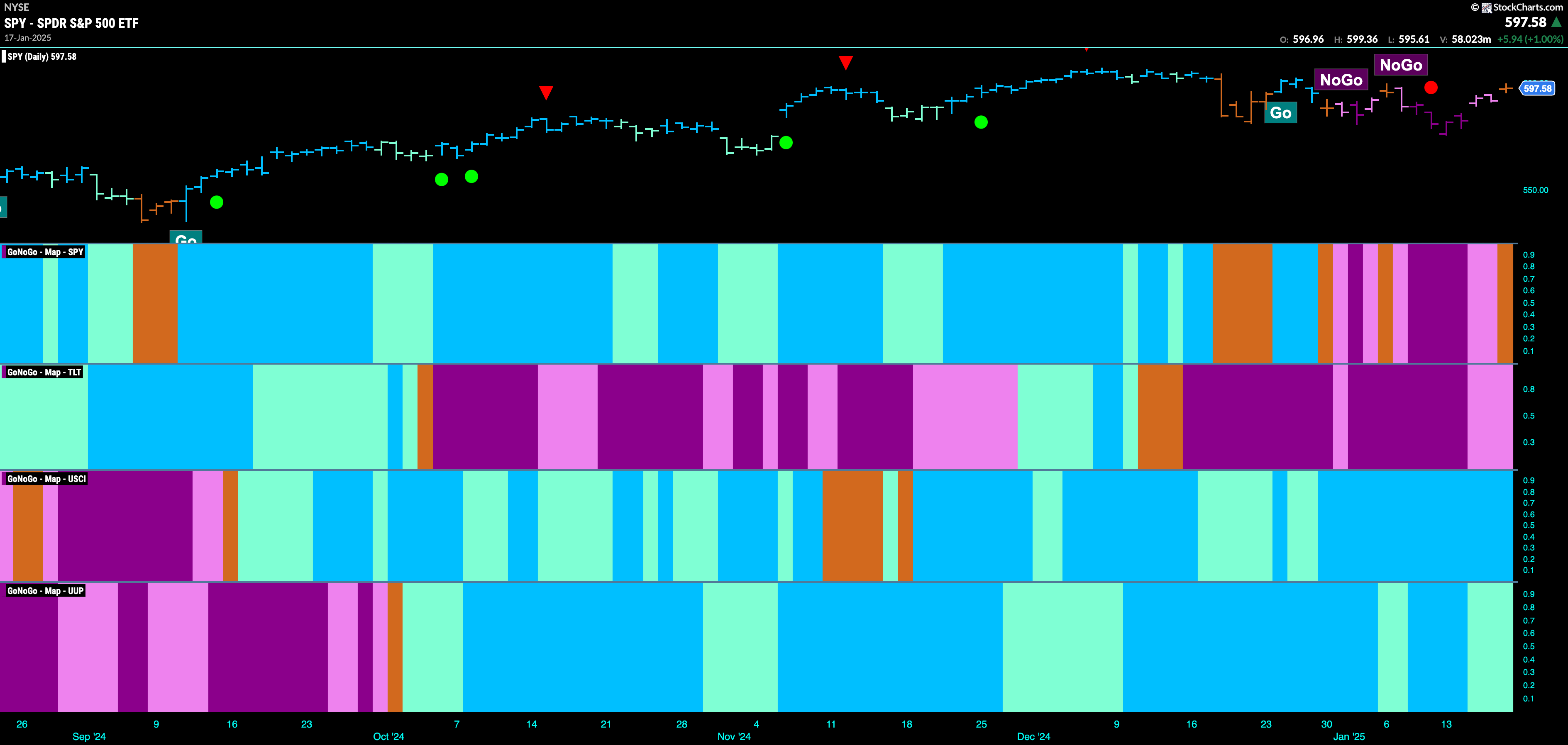

Good morning and welcome to this week’s Flight Path. The equity trend has faltered. We have seen strong purple “NoGo” bars give way to weaker pink bars and now an amber “Go Fish” bar of uncertainty. Treasury bond prices remain in a “NoGo” trend but we see weakness with pink bars. The trend in U.S. commodities remains strong with another uninterrupted week of bright blue bars. The dollar hangs on to its “Go” trend as well but we are seeing some weakness with aqua bars.

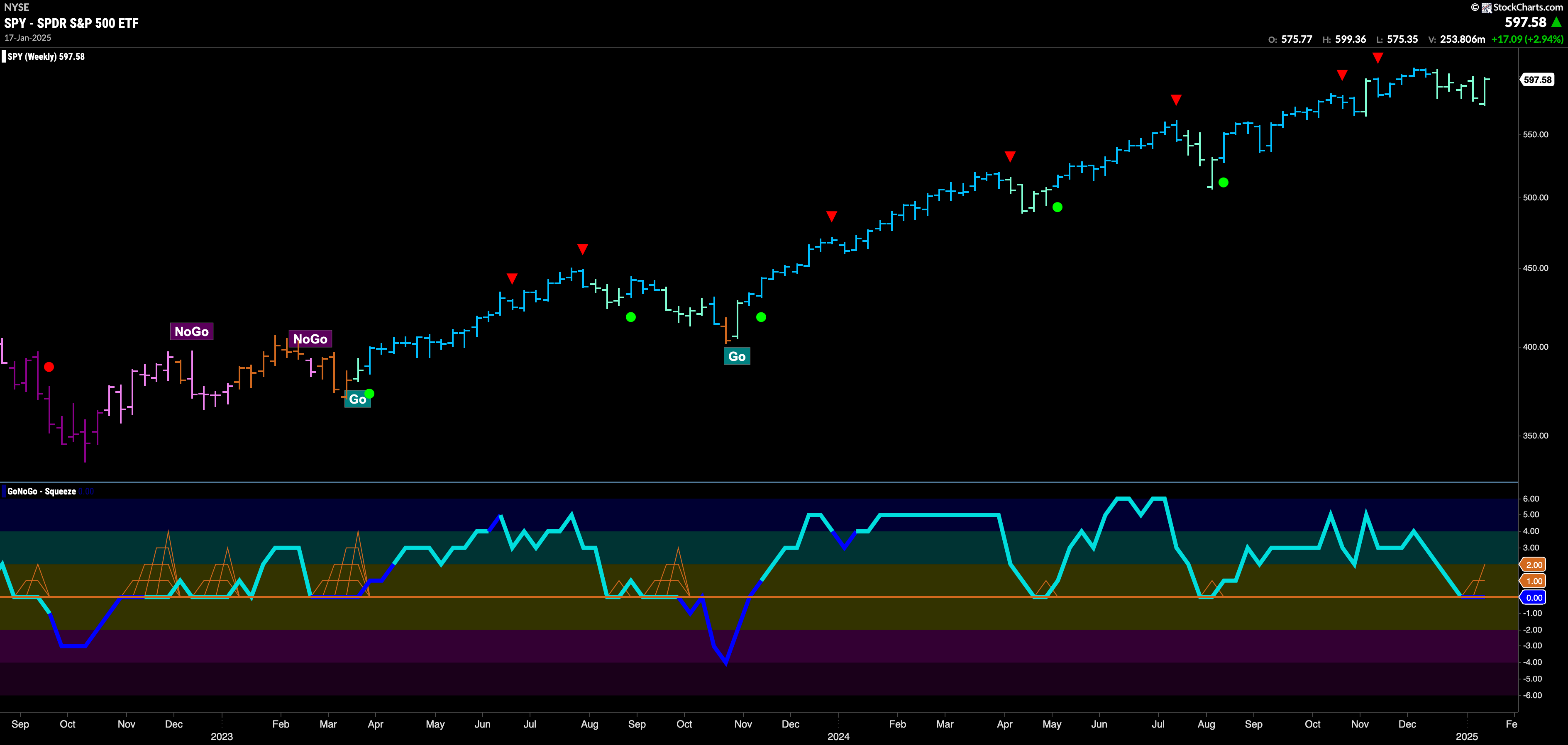

$SPY Tries to Halt the Correction and Paints an Amber “Go Fish” Bar

The GoNoGo chart below that there some uncertainty as it relates to the equity trend at the moment. After a few weeks of “NoGo” colors, we see an amber “Go Fish” bar indicating market confusion. If we turn our eye to the oscillator panel we see that GoNoGo Oscillator has broken back above the zero line and is in positive territory. This may give price the push it needs to recover its “Go” trend.

On the longer term chart, GoNoGo Trend paints yet another aqua bar. This week saw a strong recovery though and we will watch to see if this has been a new higher low. GoNoGo Oscillator has fallen to the zero line from above and remains there momentarily unable to find a direction. Volume has picked up (dark blue of the oscillator) and we will watch closely to see if it can bounce back into positive territory which would be a good sign for the “Go” trend.

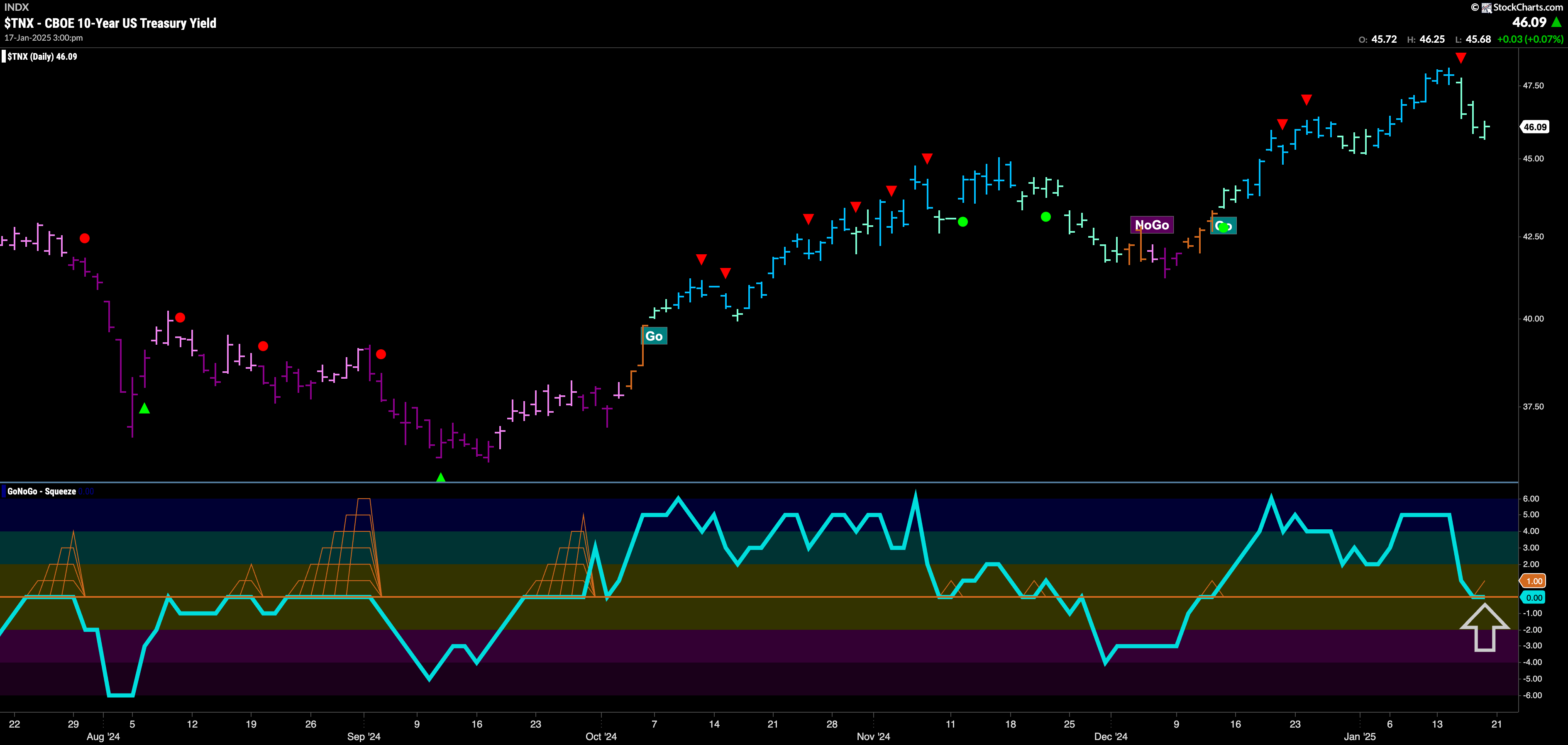

Treasury Rates Cool after Higher High

GoNoGo Trend showed another higher high mid week. We have since seen a Go Countertrend Correction Icon (red arrow) that suggested price may struggle to go higher in the short term. Indeed, we have fallen away from that high and GoNoGo Trend is painting weaker aqua bars. GoNoGo Oscillator is at the zero line where we will watch to see if it can find support and if it does we can expect price to make another attack at a higher high.

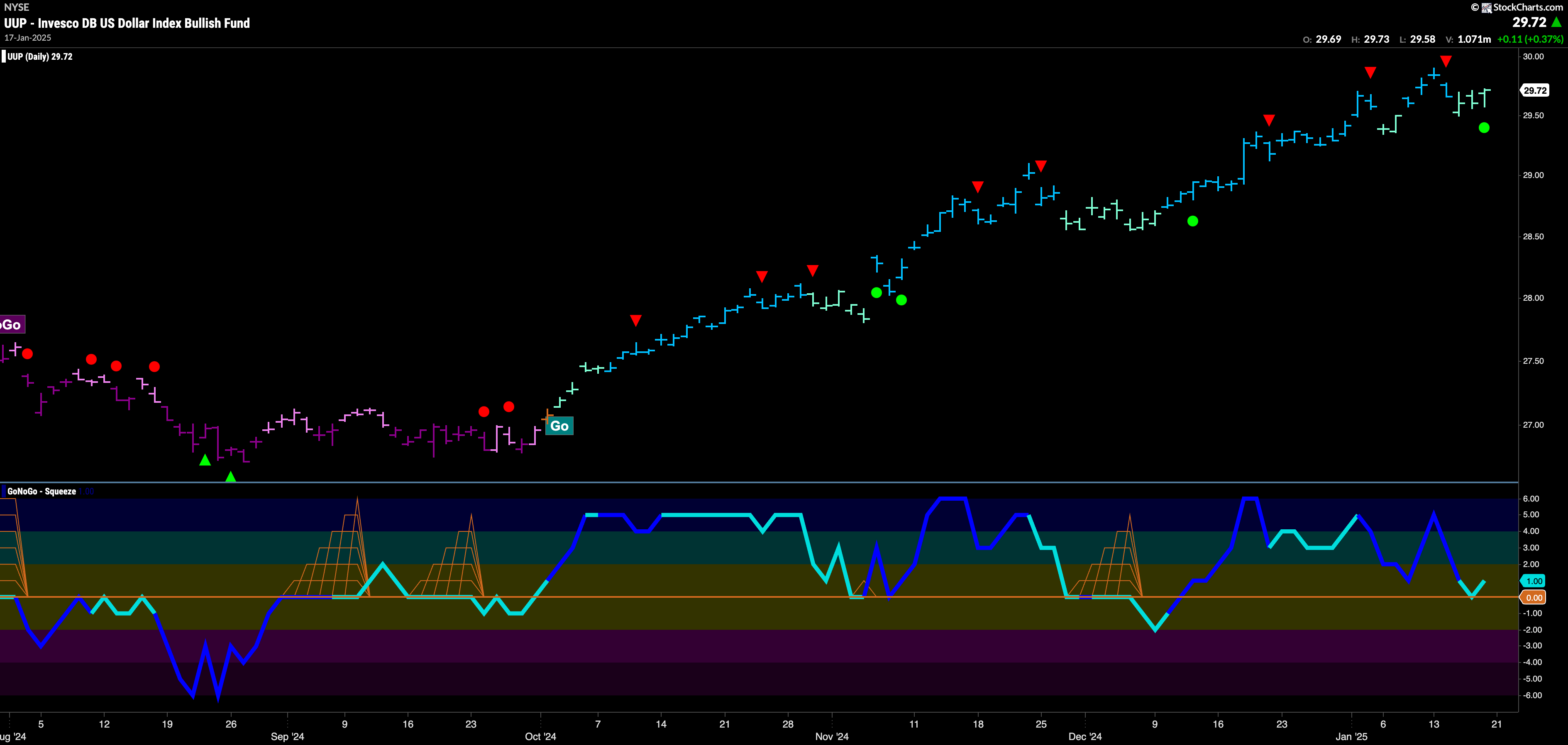

The Dollar Falls from Recent High on Aqua Bars

GoNoGo Trend showed that the dollar hit another higher high this week on strong blue bars. However, a Go Countertrend Correction Icon (red arrow) told us that the trend may struggle in the short term and we have seen weaker aqua bars as price fell from the high. GoNoGo Oscillator fell sharply to the zero line but has found fast support there and has bounced back into positive territory immediately. This is a good sign for the dollar’s “Go” trend.

$USO Succeeds Again at Surpassing Resistance

$USO passed another test this week as it took out resistance from prior July highs. We can see that it did this without relinquishing its grip on strong blue “Go” bars. We do see a Go Countertrend Correction Icon (red arrow) which suggests temporary struggles to go higher. GoNoGo Oscillator is falling from overbought territory on heavy volume. We will pay close attention as it nears the zero line to see if it will find the support this “Go” trend needs.

The New “Go” Trend Survived this Week

GoNoGo Trend shows that the new “Go” trend strengthened this week as the indicator painted bright blue bars to follow the weaker aqua that had begun the trend. We will watch to see if price can consolidate at these levels which could become future support. GoNoGo Oscillator is in positive territory but not overbought at a value of 3 and volume is heavy.

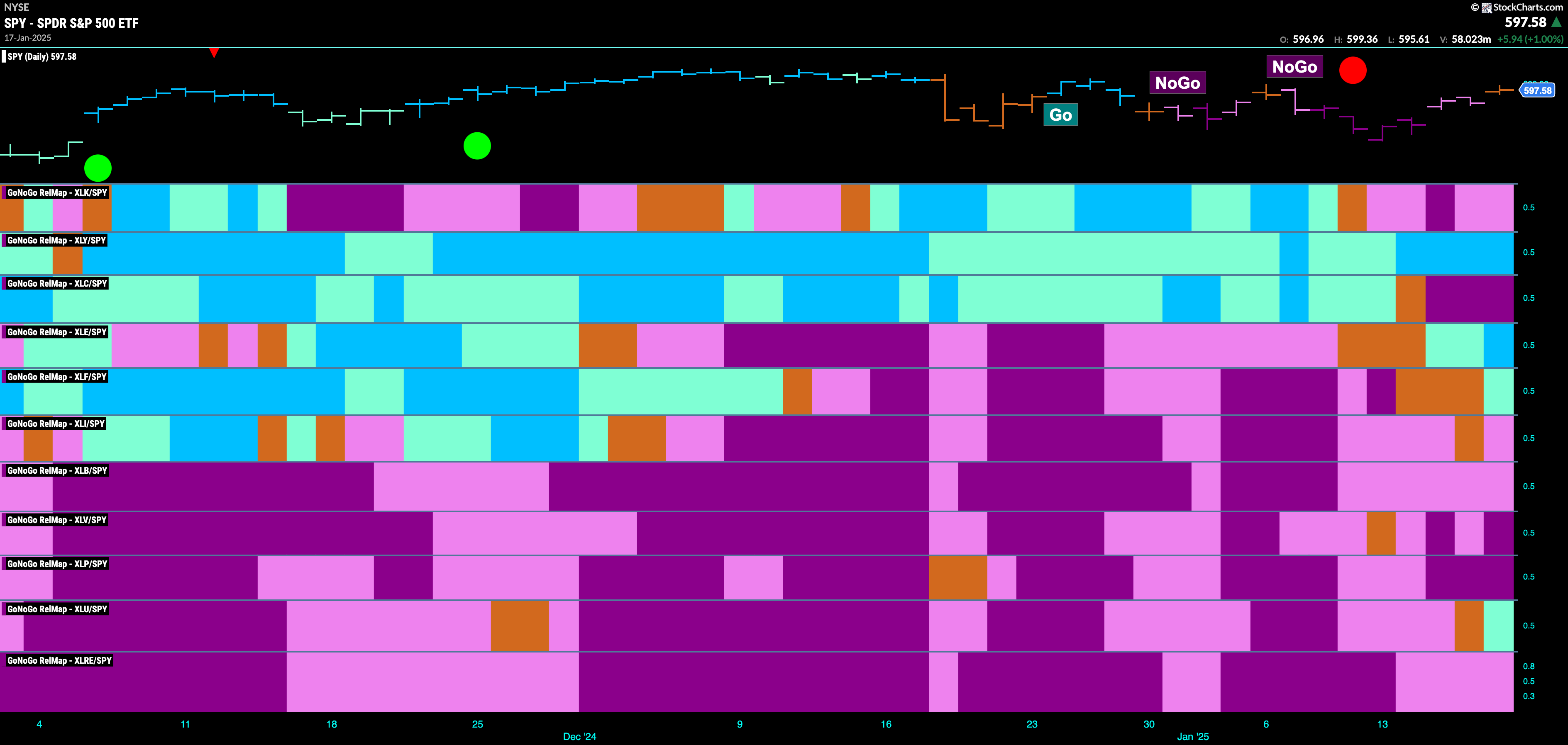

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 4 sectors are in relative “Go” trends. $XLY, $XLE, $XLF, and $XLU, are painting relative “Go” bars.

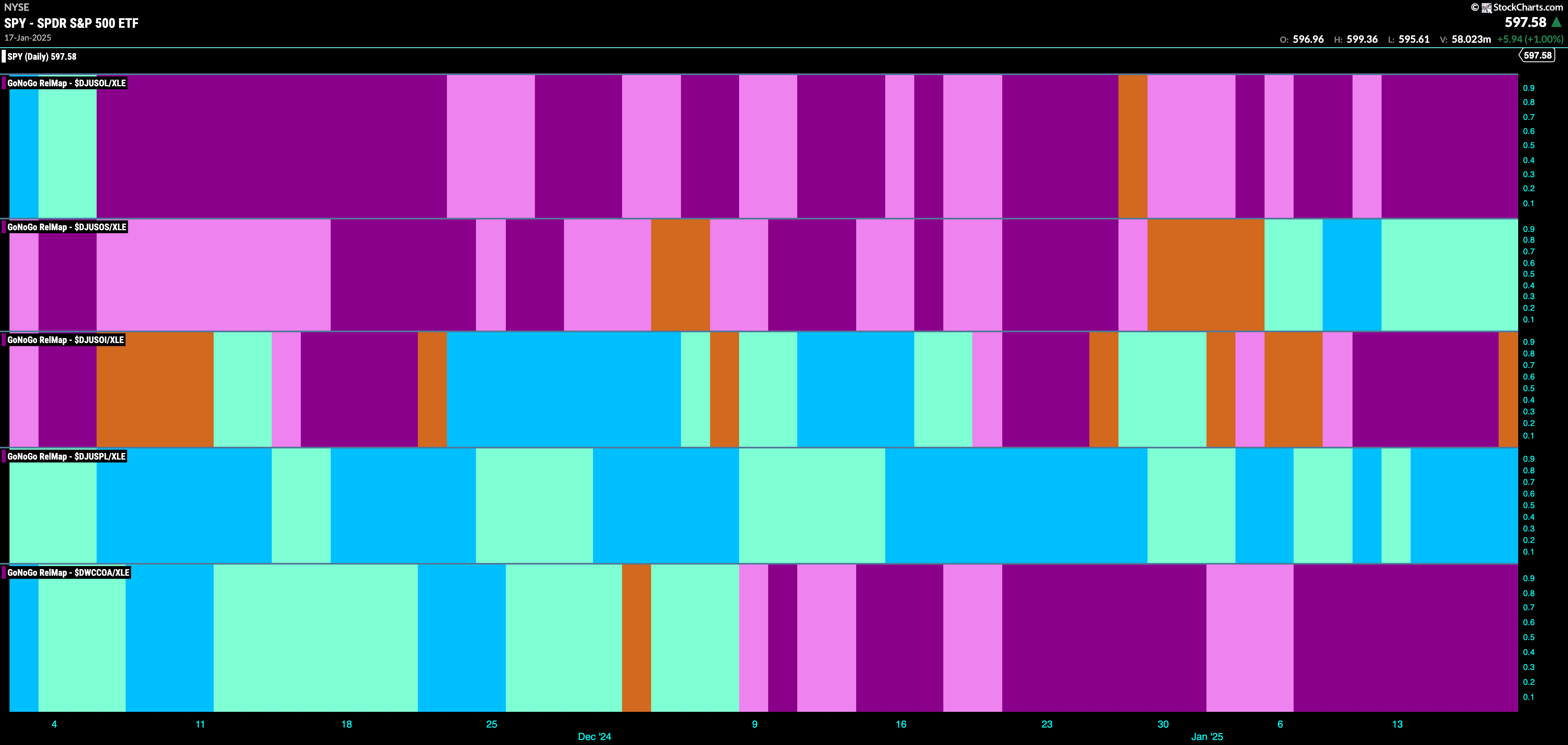

Energy Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the communications sector again this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLE. We saw in the above GoNoGo Sector RelMap that $XLE is strong relatively speaking as it paints blue relative “Go” bars to the S&P 500. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting strong “Go” bars in the 4th panel is the pipelines sub group.

Pipelines Index Breaks to New High

The chart below shows that $DJUSPL has found strength in its new “Go” trend. After GoNoGo Oscillator broke into positive territory we first saw a string of amber “Go Fish” bars that were then followed by aqua “Go” bars. With GoNoGo Oscillator continuing to rise into overbought territory we have seen price break above prior high resistance on strong blue “Go” bars. We will watch to see if price can consolidate at these new higher levels and we will look for higher highs over the next days and weeks.

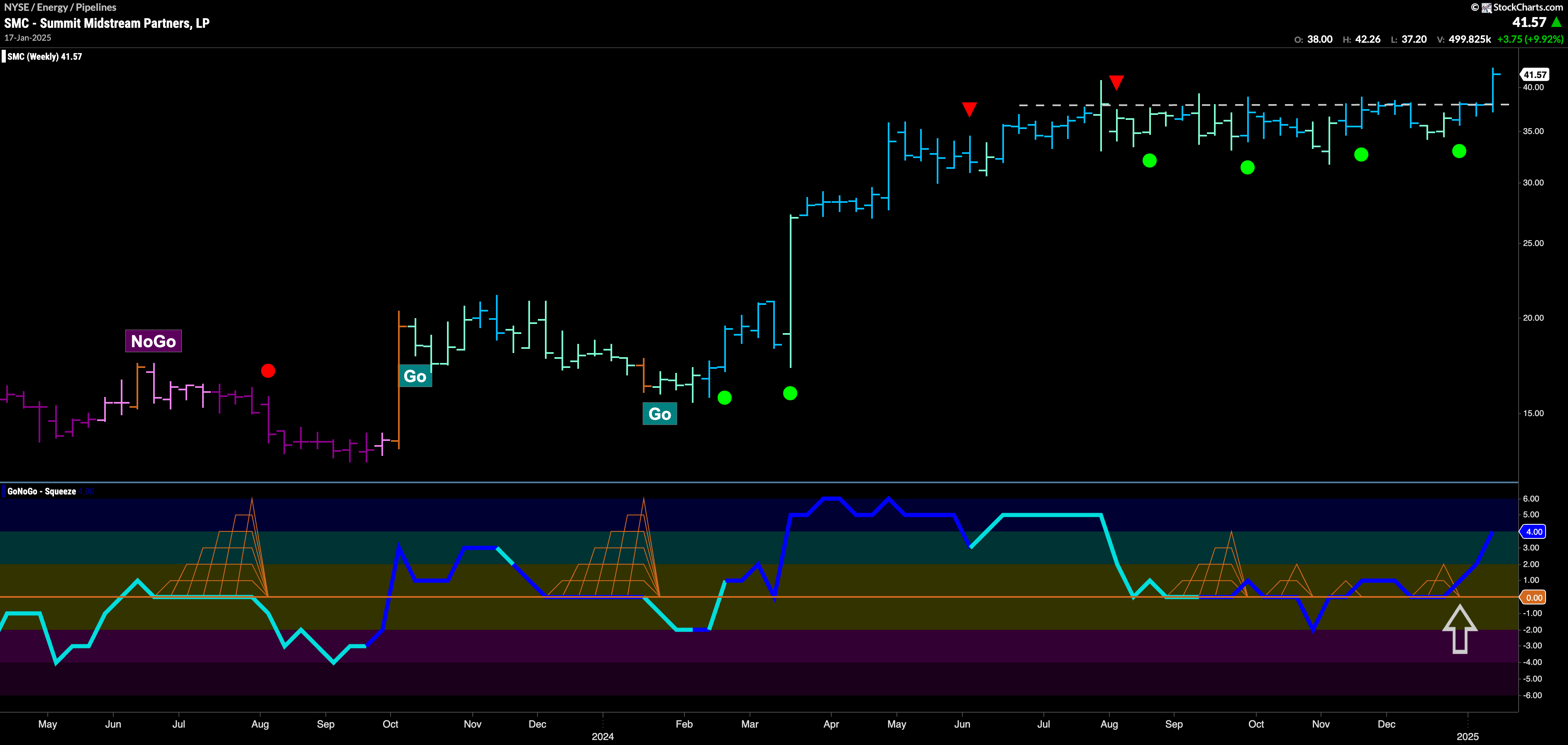

$SMC Breaks Longterm Resistance with Weekly Close

The chart below shows that $SMC has taken out a resistance level that has been a hinderance since early summer of last year. As prices consolidated sideways for over 6 months we saw GoNoGo Trend paint a mix of aqua and blue bars but importantly did not fall out of trend. During that time, GoNoGo Oscillator was primarily supported by the zero line and so we saw several Go Trend Continuation Icons (green circles) as price tried to set up for a break higher. This past week we saw a strong weekly close that significantly broke through that level. This comes after GoNoGo Oscillator found support at zero again on heavy volume.

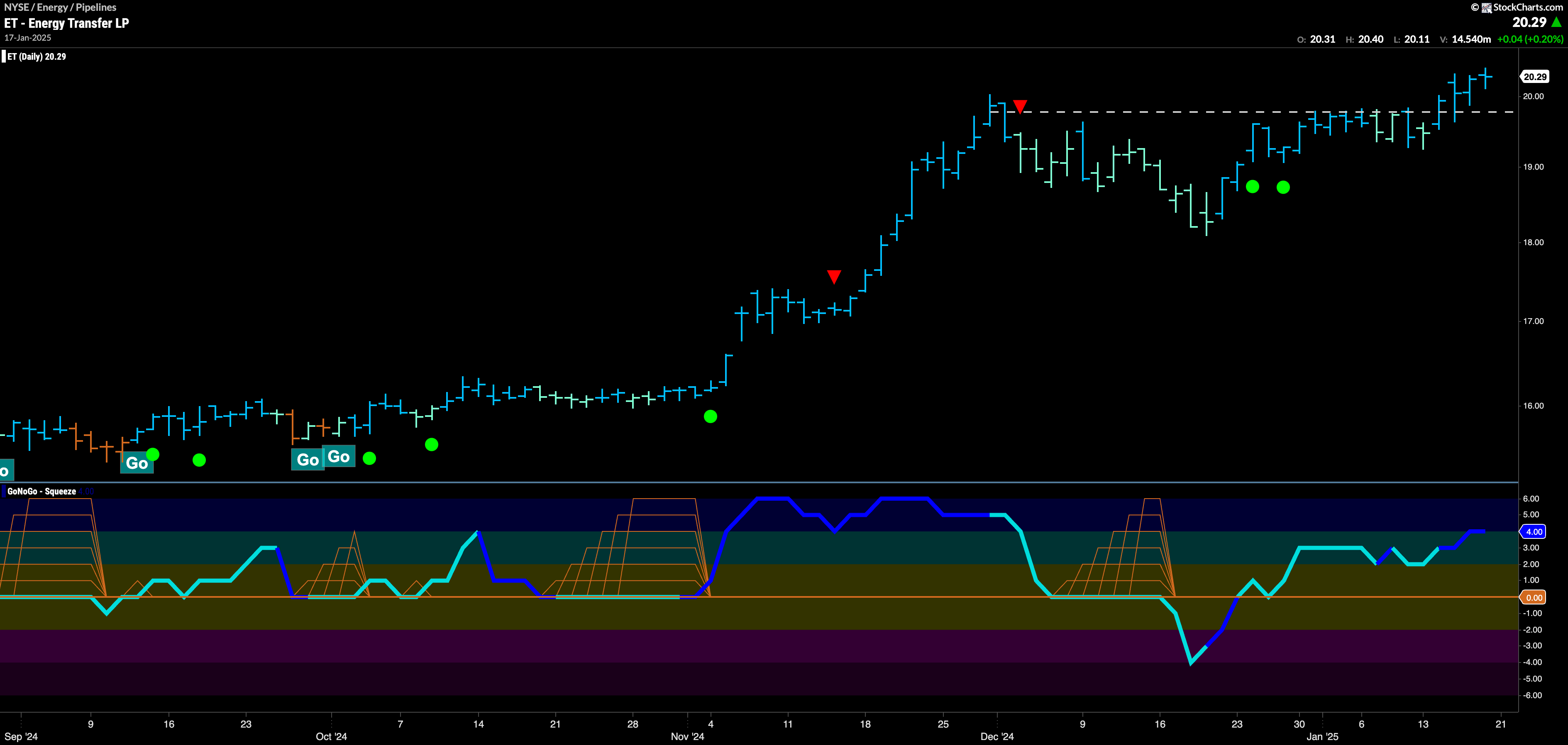

$ET Pushes Higher on Bright Blue Bars

Finally price has taken out the high from December as we can see on the chart below. GoNoGo Trend paints strong blue “Go” bars as price climbed higher for a week straight and we will now be able to use this level as possible support going forward. If price can consolidate above this level then we will watch to see if it can climb further over the coming days and weeks. GoNoGo Oscillator shows that momentum is in positive territory supporting the “Go” trend and volume is heavy.