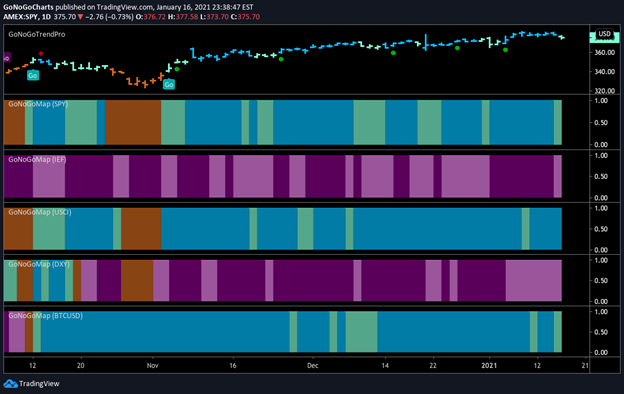

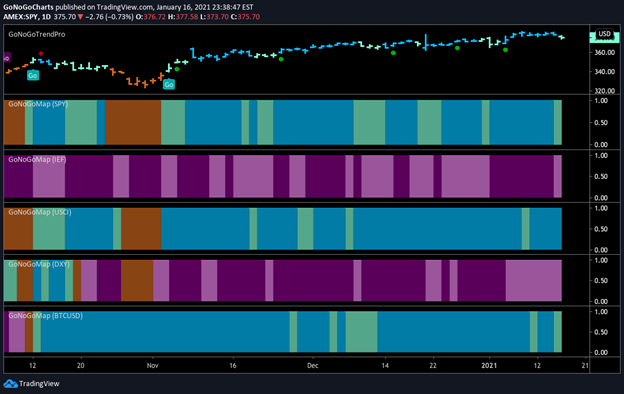

| The takeaway remains the same as it has been for several weeks. Equities, commodities, and the cryptocurrency markets are now in established “Go” trends.

Panel 1 – Global stocks continue in the “Go” trend now in place for several weeks however, the end of the week brought some weakness with aqua bars. SPDR® S&P 500® ETF Trust seeks to provide investment results that correspond generally to the price and yield performance of the S&P 500 Index. It is a diversified large-cap U.S. index that holds companies across all eleven GICS sectors.

Panel 2 – Government bonds, continue to paint “NoGo” bars, although the downward trend conditions have weakened, shown by pink bars. $IEF tracks a market-value-weighted index of debt issued by the US Treasury with 7-10 years to maturity remaining.

Panel 3 – Commodities are a “Go,” continuing to paint strong blue bars. $USCI tracks an equal-weighted index of 14 commodity futures contracts and holds at least one precious metal, industrial metal, energy, livestock, soft, and grain commodity.

Panel 4 – The US Dollar remains in a “NoGo” trend. This week however we have seen a string of weaker pink bars as the dollar makes a countertrend rally. $DXY is an index of the value of the United States Dollar relative to a basket of foreign currencies.

Panel 5 – Bitcoin continues in a “Go” trend but is showing some weakness as price consolidates after its impressive run.

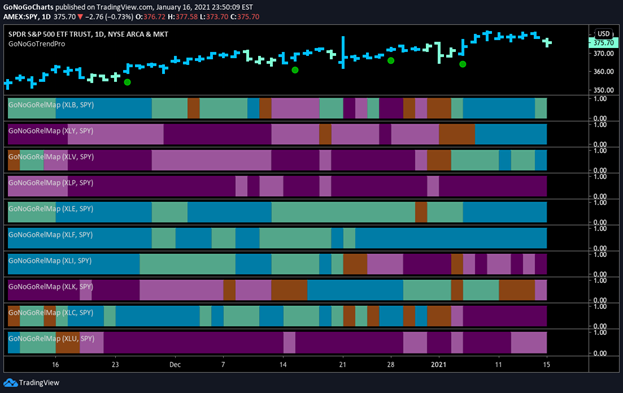

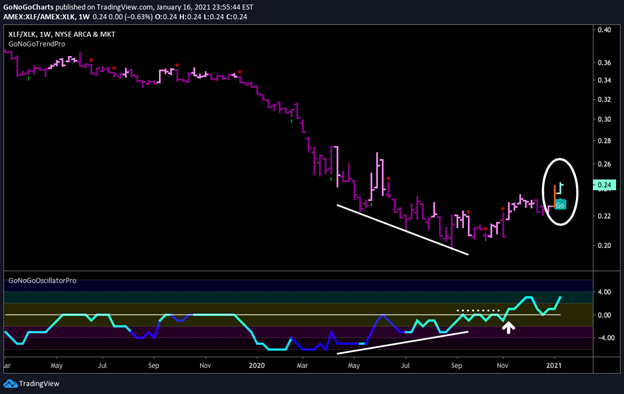

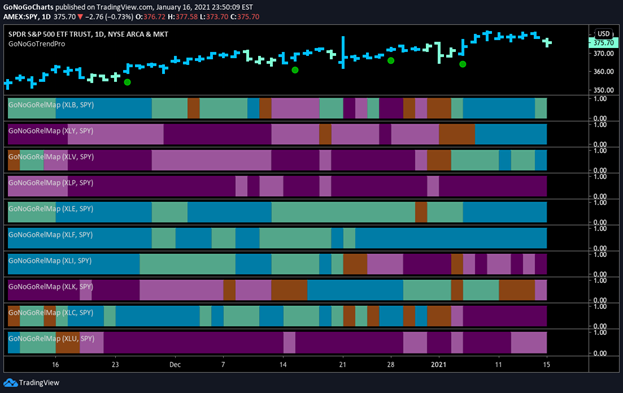

With the risk-on environment clearly shaping the backdrop for trading decisions, there will undoubtedly be countertrend corrections as the market consolidates the incredible gains of recent weeks. What are GoNoGo Charts® highlighting this week and what should investors be on the look-out for as we approach the week of trading? |