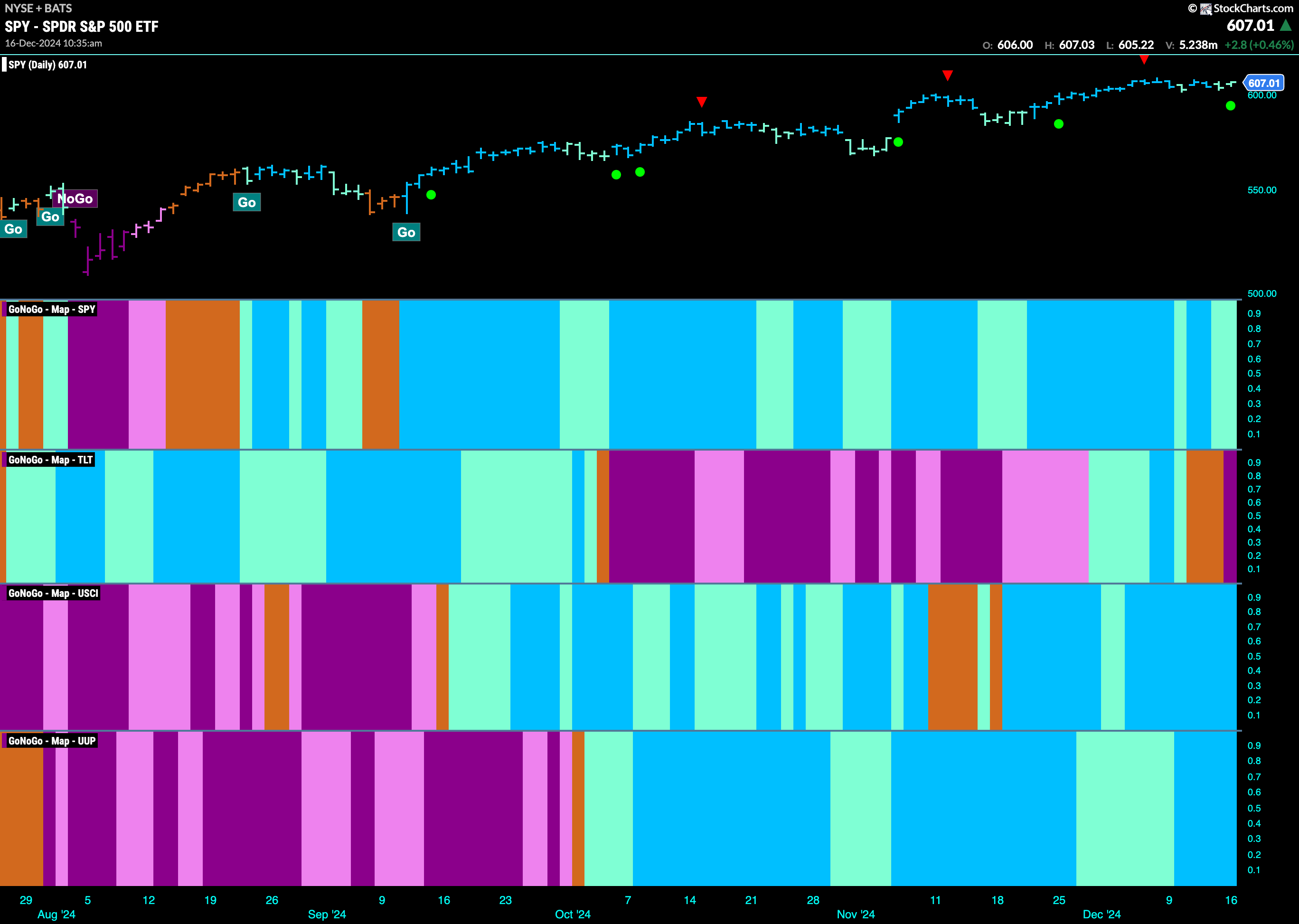

Good morning and welcome to this week’s Flight Path. The “Go” trend in equities continued again this past week but we saw some weakness as GoNoGo trend painted a few weaker aqua bars. Treasury bond prices experienced a change in trend as a few bars of “Go Fish” gave way to a purple “NoGo” bar. U.S. commodities painted a full week of strong blue “Go” bars and the dollar also saw strength return with strong blue bars.

$SPY Shows a Little Weakness with Aqua Bars

The GoNoGo chart below shows that price has moved mostly sideways since the last high and the Go Countertrend Correction Icon (red arrow) that came with it. The waning momentum suggested that price may have a hard time moving higher in the short term. GoNoGo Trend has painted a few weaker aqua bars as well and we see GoNoGo Oscillator testing the zero line from above. It will need to find support here and if it does we will be able to say that momentum is resurgent in the direction of the “Go” trend.

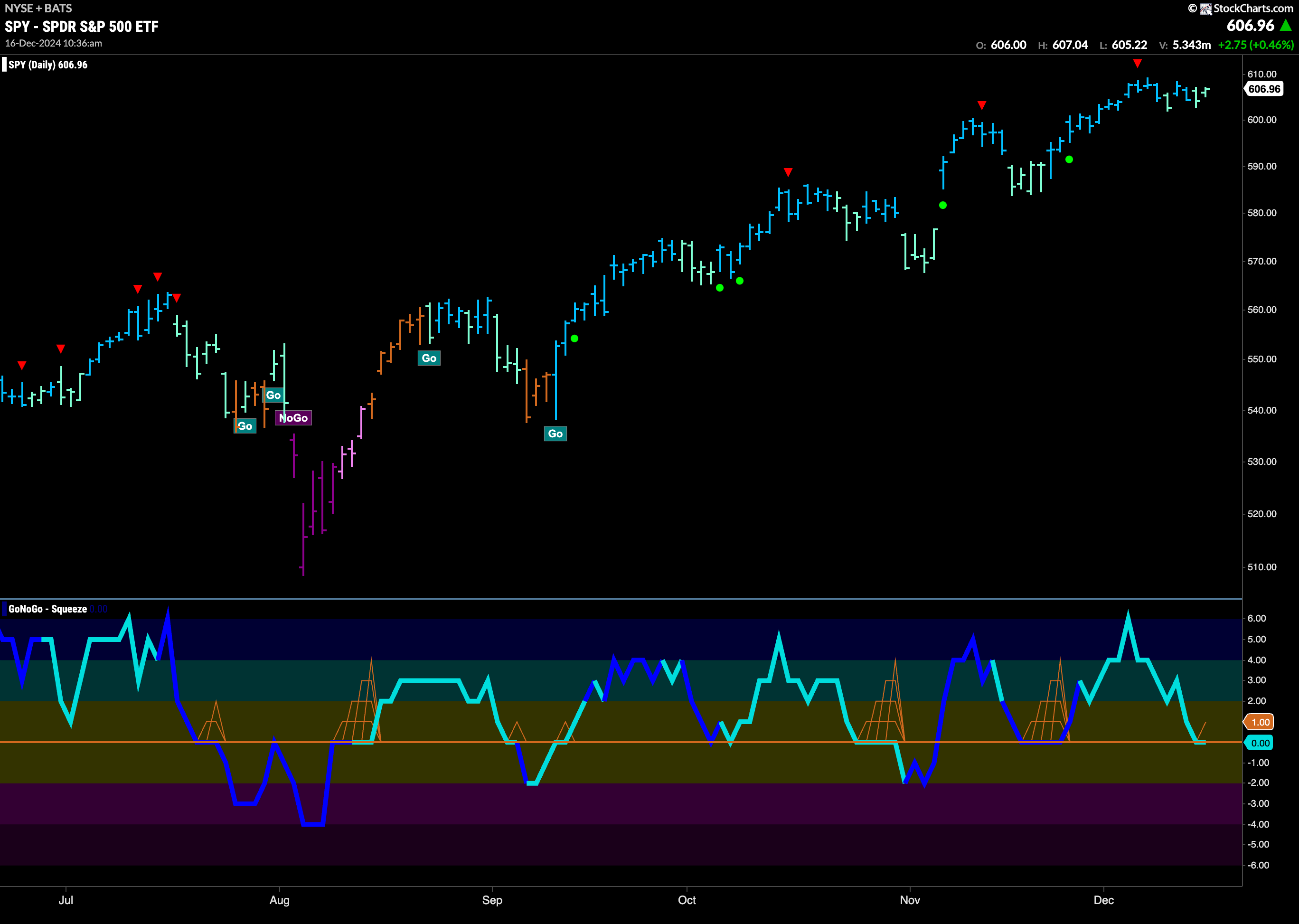

On the longer term chart, the trend continues to be strong. However we are seeing the price range shrink as we edge higher. GoNoGo Oscillator is not in overbought territory and seems to be resting at a value of 3. We will watch to see if the oscillator falls to test the zero line perhaps in the next few weeks.

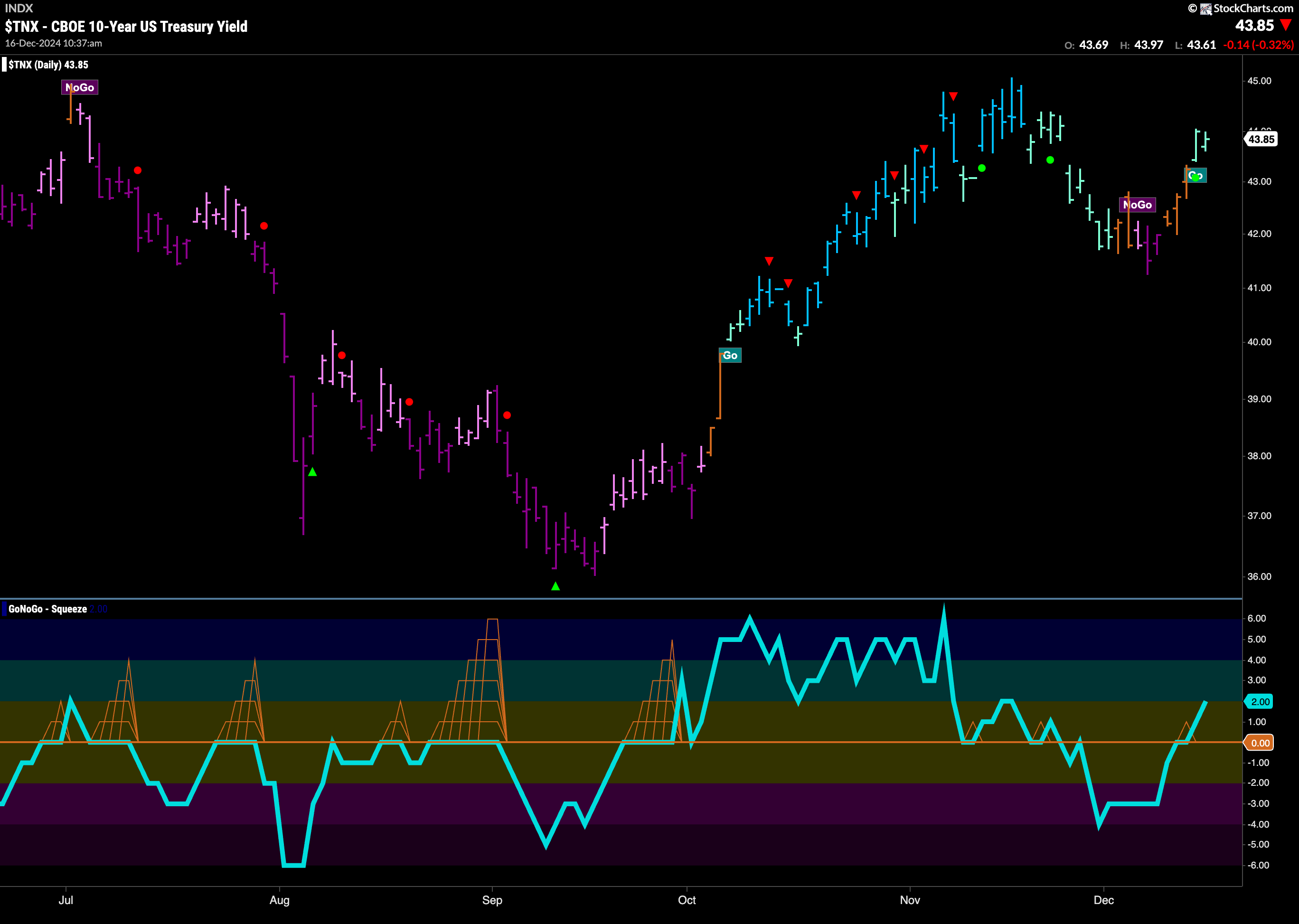

Treasury Rates Return to Paint “Go” Colors

Treasury bond yields reversed course and after consecutive amber “Go Fish” bars that often come as a transition between trends we see the indicator painting “Go” colors again. GoNoGo Oscillator has broken back into positive territory which confirms the trend change that we see in price above.

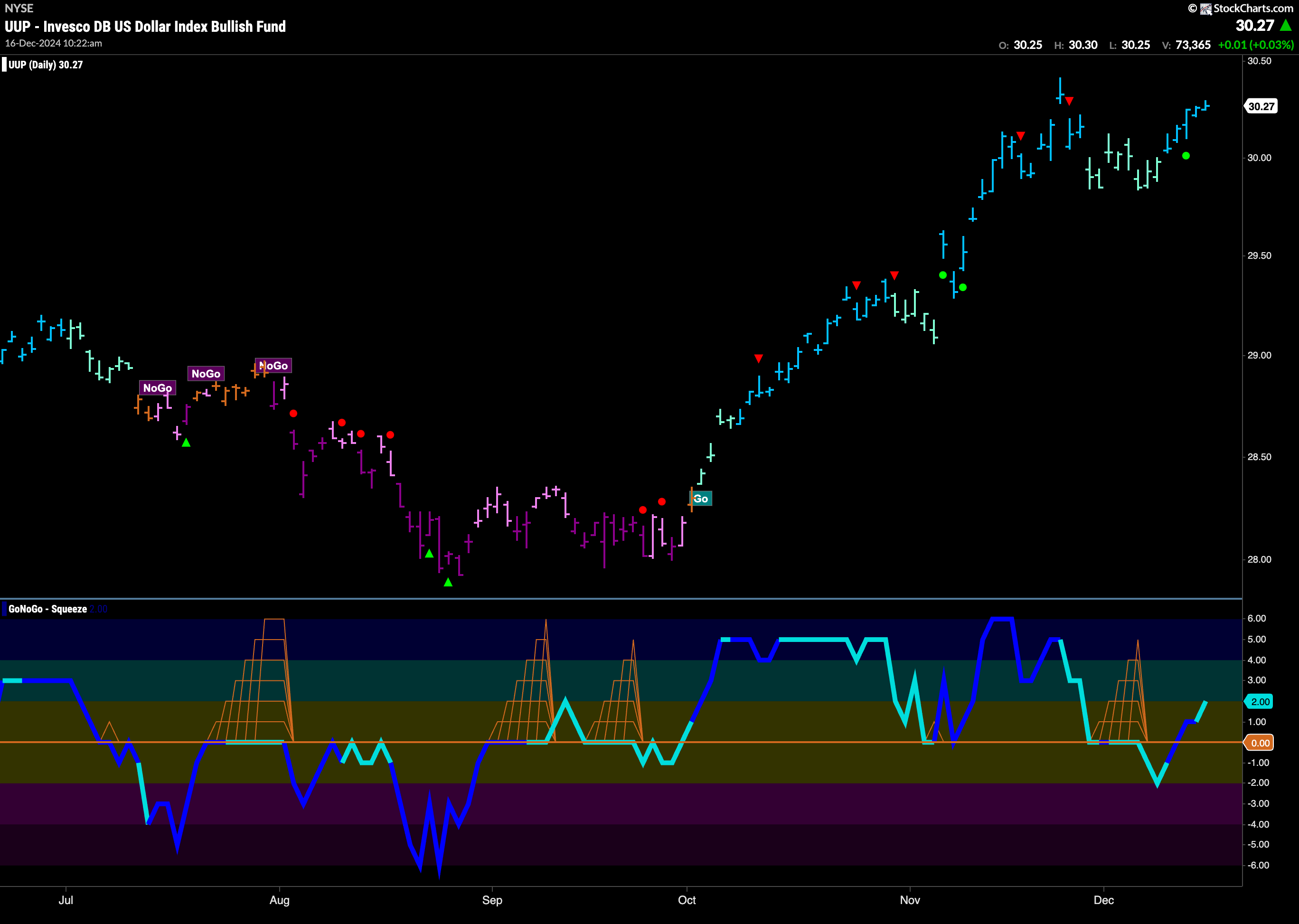

The Dollar Sees a Return to Strength

The dollar rallied this week with a string of uninterrupted bright blue “Go” bars. Price is approaching resistance from prior highs and we will watch to see if it can continue higher. GoNoGo Oscillator broke back into positive territory and we saw a Go Trend Continuation Icon (green circle) indicating that momentum is resurgent in the direction of the “Go” trend. We will watch to see if this will give price the push it needs to make a new high in the coming days and weeks.

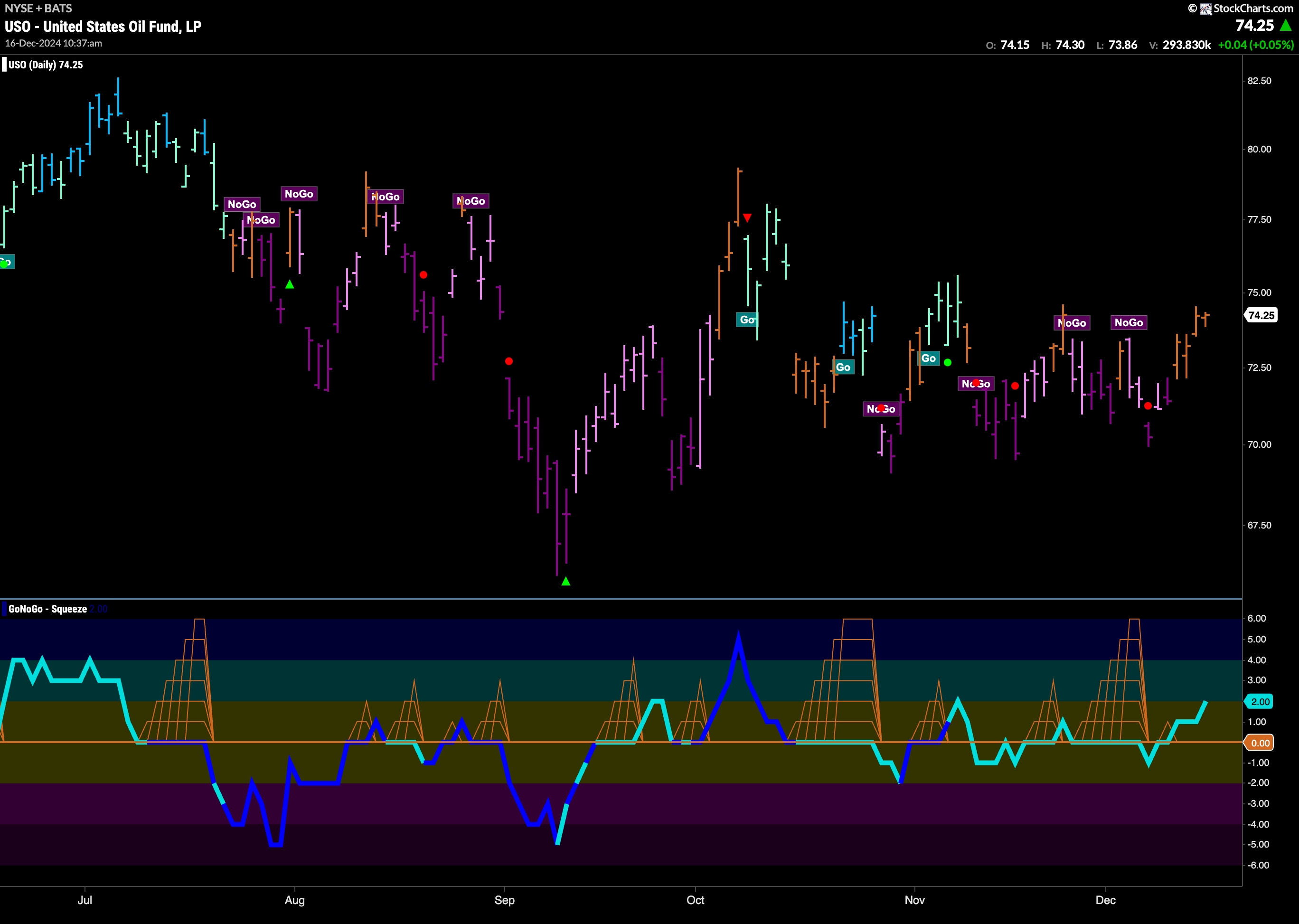

USO Uncertain Again over Trend Direction

Amber “Go Fish” bars abound this week as price rallied from “NoGo” colors. We are in a congestion area and bouncing back and forth between lows and highs. GoNoGo Oscillator has rallied back into positive territory after a false break down out of a Max GoNoGo Squeeze. We will watch to see if price continues higher and if that will lead to a new “Go” trend.

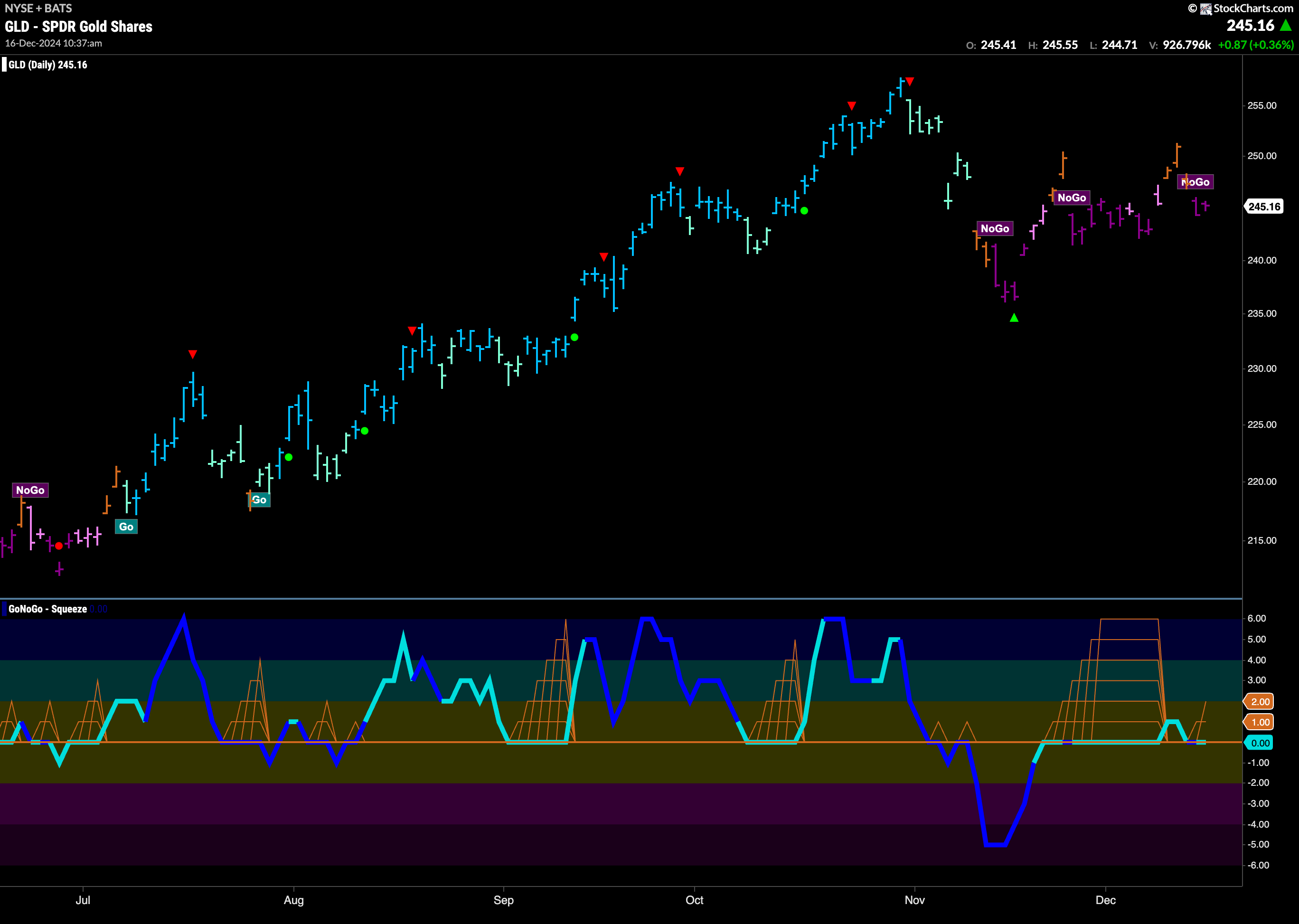

“NoGo” Survives more Uncertainty

After an attempt to break to new highs on an amber “Go Fish” bar we see the “NoGo” returned and the week ended with strong purple bars. However, we are not at prior lows which seem to be edging higher. GoNoGo Oscillator is showing the virtual tug of war between buyers and sellers at this level by immediately retesting the zero line after just breaking out of a Max GoNoGo Squeeze.

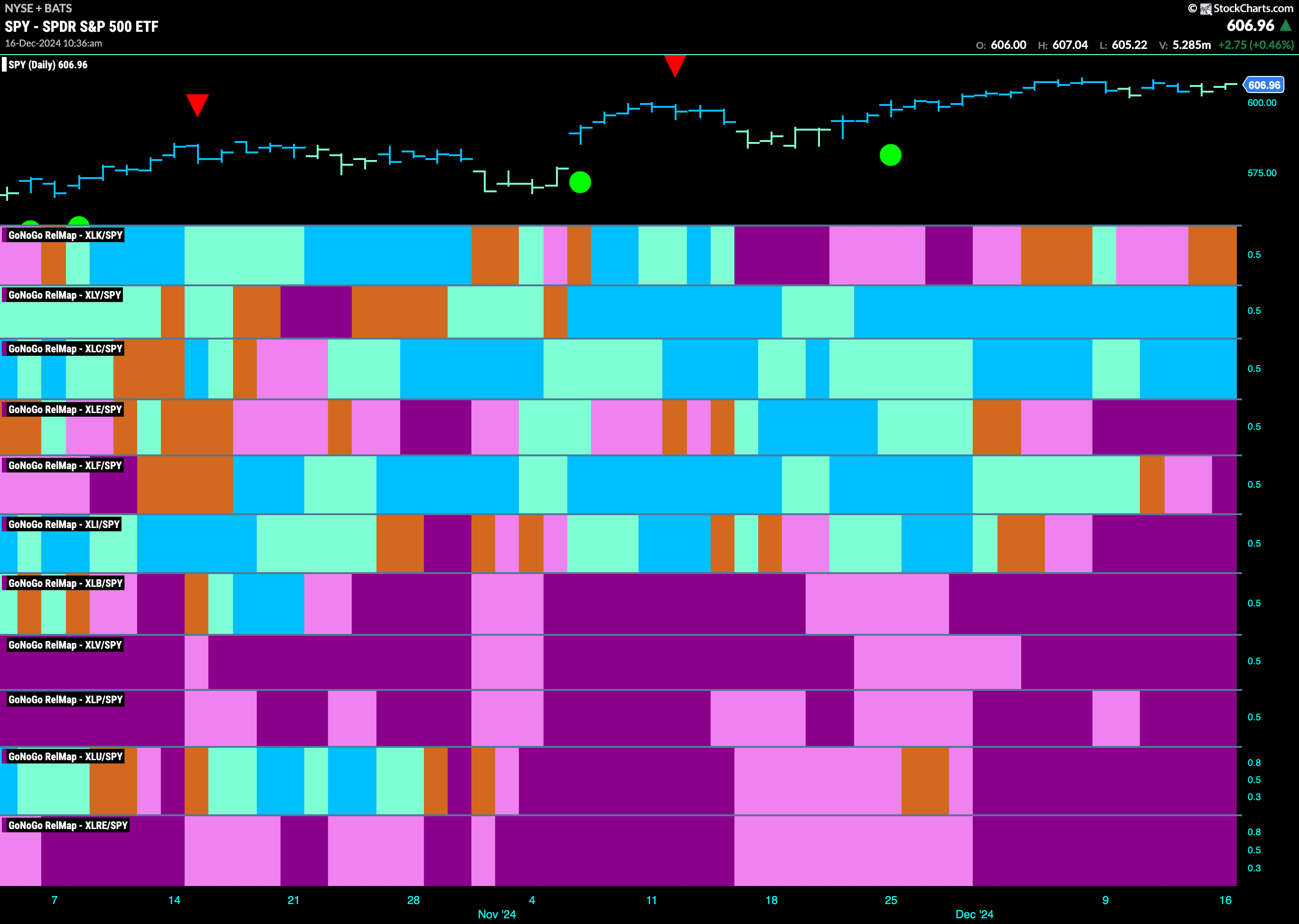

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 2 sectors are in relative “Go” trends. $XLY, and $XLC, are painting relative “Go” bars.

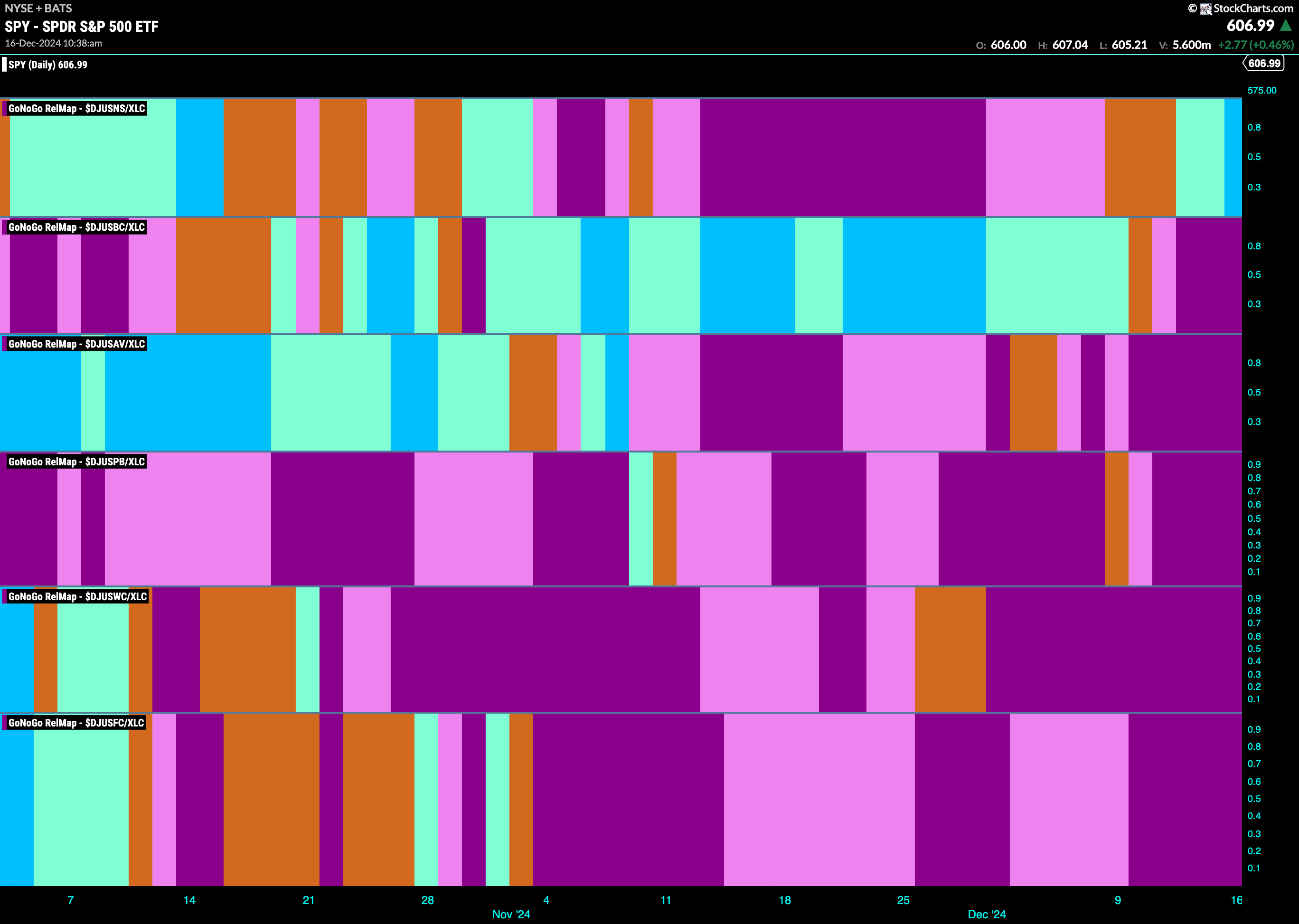

Communications Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the communications sector this week. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLC. We saw in the above GoNoGo Sector RelMap that $XLC remains a strong relative out-performer as it paints bright blue “Go” bars. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting a new strong “Go” bar in the top panel is the internet index sub group.

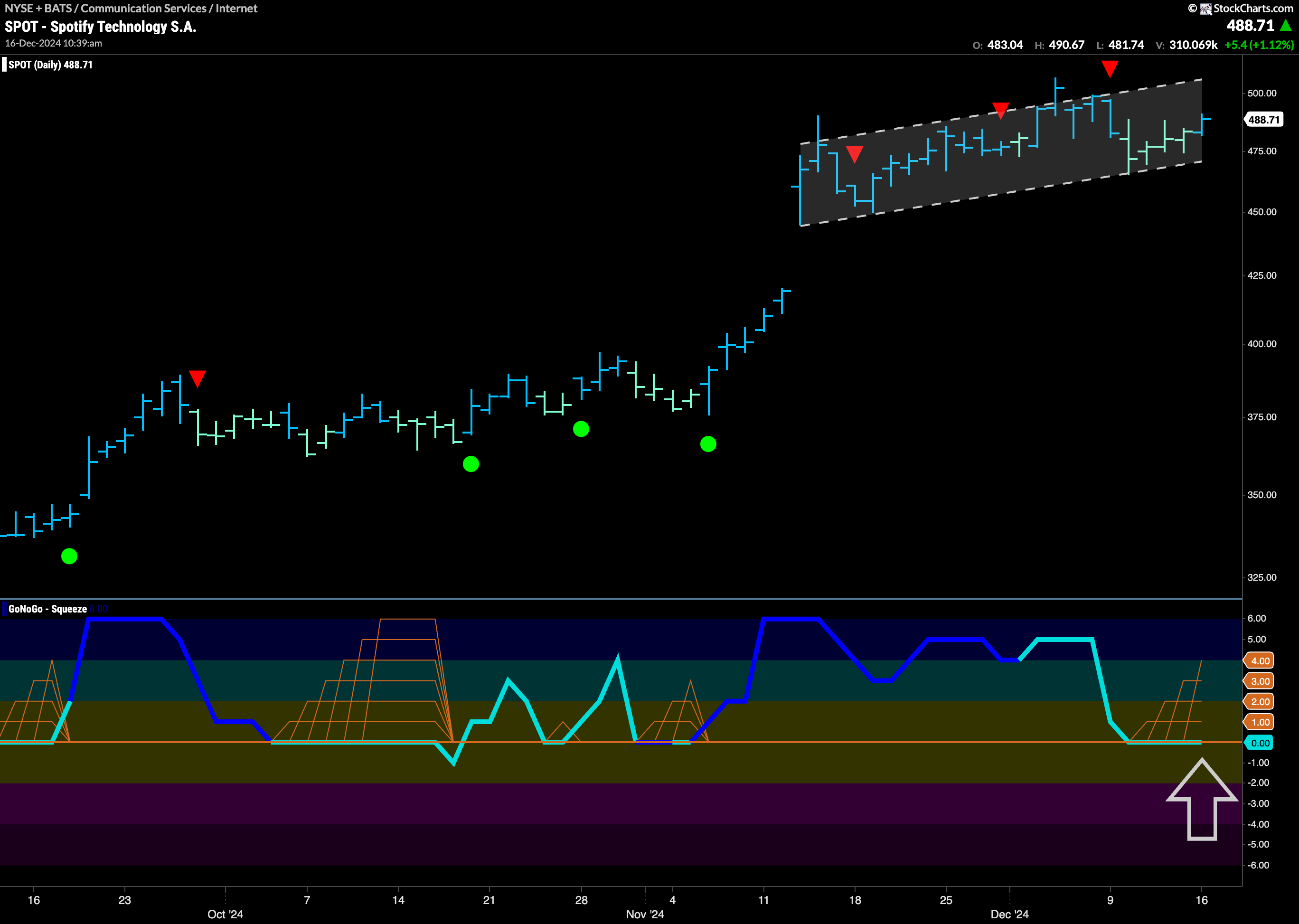

$SPOT Stays in Trend as Lows Climb Higher

The chart below shows the price of $SPOT with the full suite of GoNoGo tools applied. We can see that since gapping higher in mid November price has gradually moved higher with a series of higher highs and higher lows. Now, GoNoGo Trend shows a strong blue “Go” bar after several weaker aqua bars that tested channel lows. GoNoGo Oscillator is riding the zero line and we see a GoNoGo Squeeze building. We will watch for the break of the Squeeze. If the oscillator rallies into positive territory we will know that momentum is resurgent in the direction of the “Go” trend and we will look for price to challenge the upper bound of the channel.

$ORCL Tries to Consolidate Break

$DASH has seen price move sideways since the pair of Go Countertrend Correction Icons (red arrows) that we saw at the most recent highs. We have seen the trading range shrink and GoNoGo Oscillator fell to test the zero line from above. As it has been stuck at that level, we see an extended Max GoNoGo Squeeze. We will watch to see if the oscillator can break out of the GoNoGo Squeeze into positive territory and if it can, we will look for price to climb to new higher highs as momentum will be once again on the side of the underlying “Go” trend.