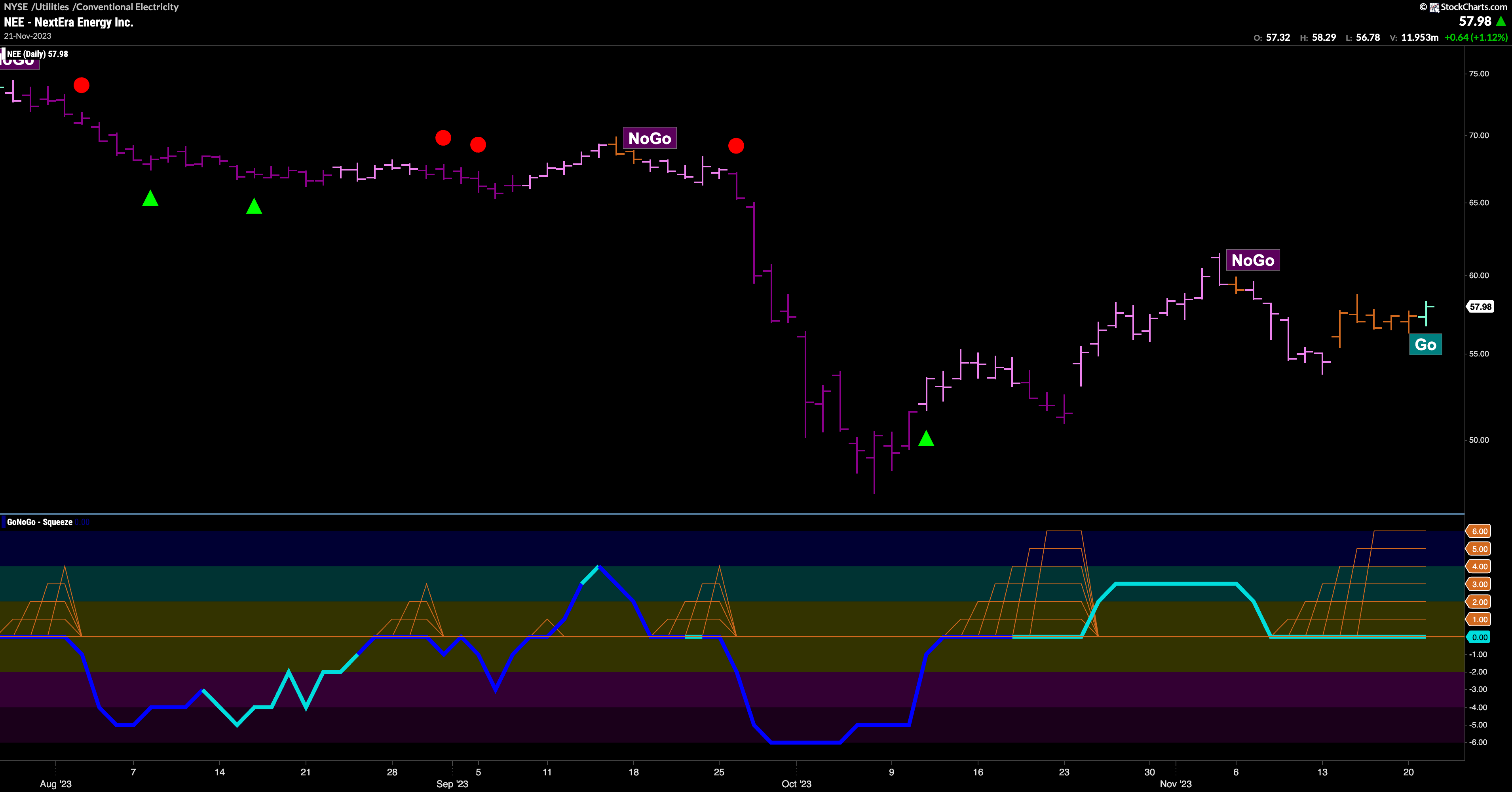

$NEE has seen price fall significantly over the past few months as the stock has been embroiled in a “NoGo”.

In early October, we saw price hit another lower low but since then has rallied enough to paint higher highs and lows. During that time, GoNoGo Oscillator rose to test the zero line and broke out of a Max GoNoGo Squeeze into positive territory which told us that there was pressure on the “NoGo” trend. As price consolidated sideways we saw GoNoGo Trend paint a string of amber “Go Fish” bars, indicating uncertainty in the trend. Concurrently, GoNoGo Oscillator is back at the zero line where it has remained for several bars and so we see the climbing grid of a Max GoNoGo Squeeze. There was a struggle for direction. GoNoGo Trend has finally seen enough criteria met in the backend to determine a new “Go” trend, painting the last bar aqua. We will now look to the Oscillator to see in which direction it breaks out of the Max GoNoGo Squeeze. If it moves into positive territory then we would say that momentum is surging in the direction of the trend and we would look for a new high.