Good morning and welcome to this week’s Flight Path. Equities saw the “Go” trend continued this week and price gapped higher after some weaker aqua bars. We now see GoNoGo Trend painting strong blue bars at new highs. Treasury bond prices remained in a “NoGo” trend but the week ended with a weaker pink bar. The U.S. commodities index saw a strong end to the week as bright blue “Go” bars returned and the dollar likewise saw strength with strong blue “Go” bars the second half of the week.

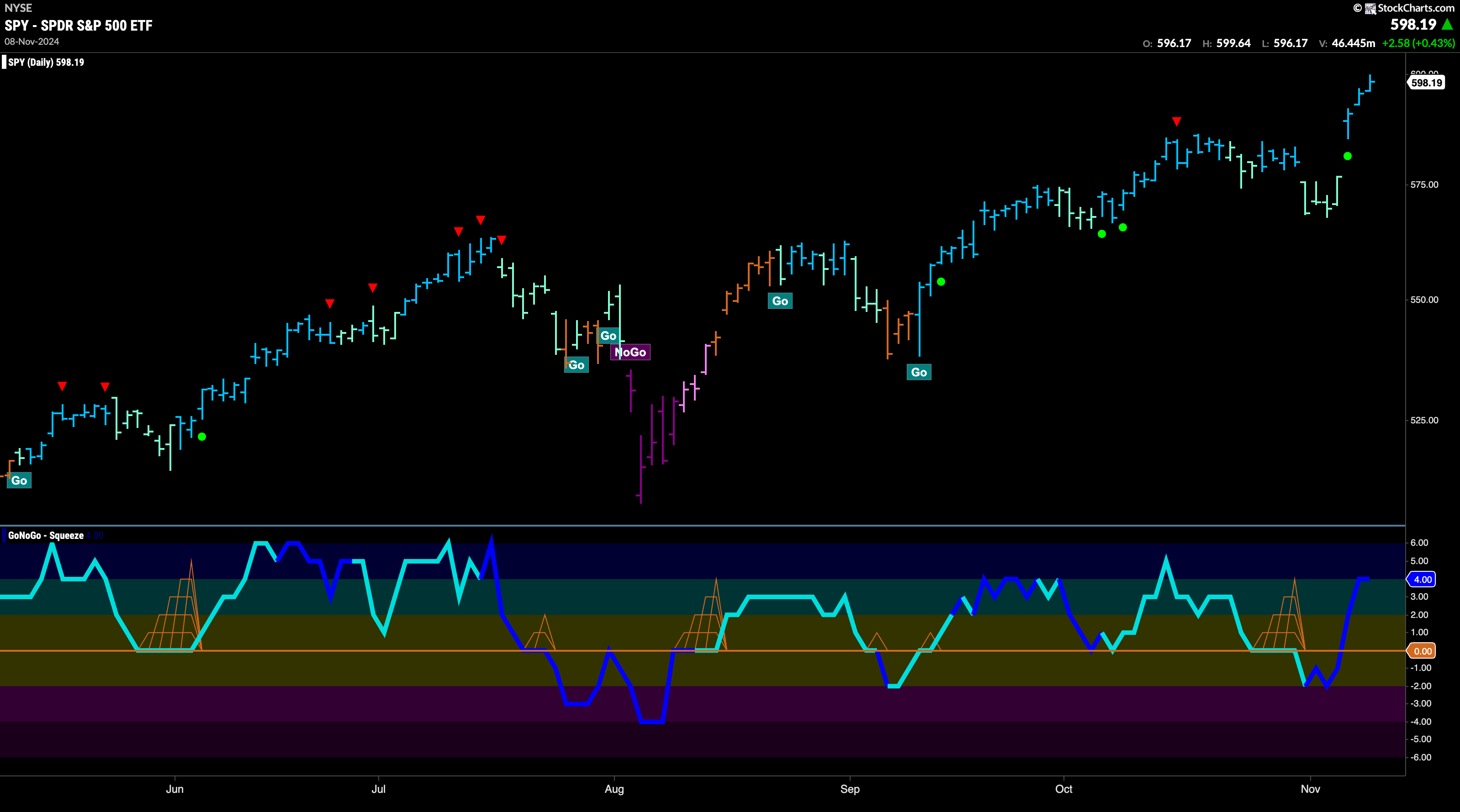

$SPY Gaps Higher on Strong Blue “Go” Bars

The GoNoGo chart below shows that after some weakness that saw price fall from the last Go Countertrend Correction Icon (red arrow), price gapped higher on Wednesday and prices soared to new highs in the aftermath of the election. GoNoGo Oscillator was able to recover positive territory after having fallen into negative territory the week before. Now, with the oscillator in positive territory at a value 4 on heavy volume, we know that momentum is on the side of the “Go” trend once again.

A new higher weekly close was painted on the chart this past week. After a couple of consecutive lower closes after the recent Go Countertrend Correction Icon (red arrow), we saw price surge to a new higher close. GoNoGo Oscillator had been falling toward the zero level but reversed course sharply this week and is now breaching overbought territory at a value of 5. We will see how much higher price can go from here. We will look for it to at least consolidate at these levels going forward.

Treasury Rates Cool after Higher High

Treasury bond yields saw the “Go” trend continue this week but we saw a little weakness creep in with GoNoGo Trend painting an aqua bar. This comes after we saw a Go Countertrend Correction Icon (red arrow) indicating that price may struggle to go higher in the short term. We will watch to see if price finds support here and sets a new higher low. GoNoGo Oscillator has fallen to test the zero line from above and we know that if the “Go” trend is to remain healthy it should find support at that level. If it can rally back into positive territory then we will know that momentum is resurgent in the direction of the underlying “Go” trend.

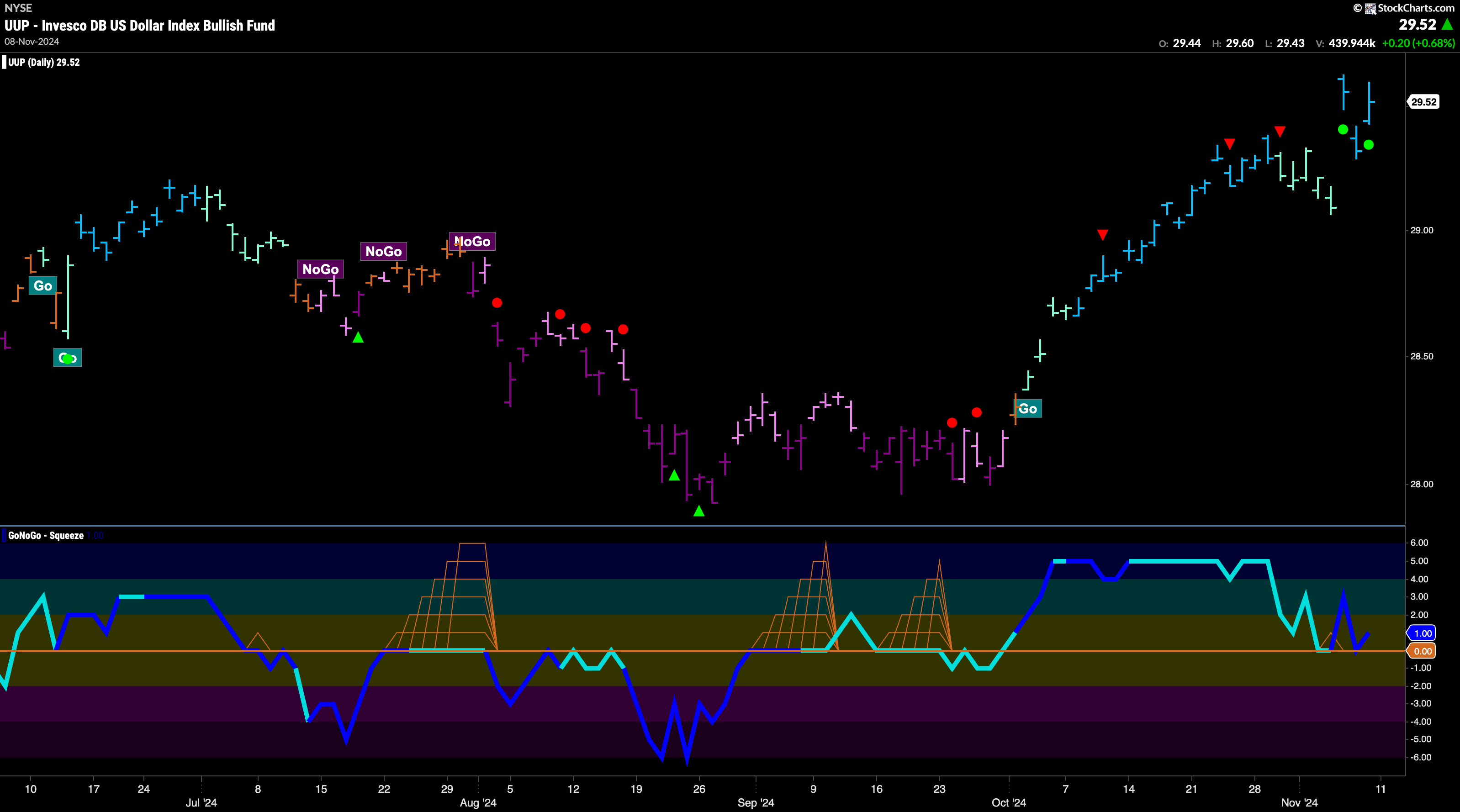

The Dollar Jumps Higher

Last week we saw some weakness in the “Go” trend as the indicator painted a string of weaker aqua bars following a Go Countertrend Correction Icon (red arrow). This Icon warned us that price may struggle to go higher in the short term. As price fell from its most recent high, we turned our attention to the oscillator panel. GoNoGo Oscillator fell to test the zero level and quickly found support as volume increased (darker blue of oscillator line). Now, with price making new higher highs and GoNoGo Trend once again painting strong blue bars we know that momentum is resurgent in the direction of the “Go” trend.

USO Can Not Hold Onto its Trend

$USO is exhibiting difficulty to hold onto a trend again this week. We saw a string of weaker aqua bars but on the last day of the week an amber “Go Fish” bar of uncertainty returned telling us that not enough criteria are being met in either direction for GoNoGo Trend to identify a trend. GoNoGo Oscillator during this time has managed to crawl back into positive territory after a few bars at zero. We will watch to see if the oscillator can stay at or above this level. That will give the “Go” trend a change to return.

“Go” Trend Weakens in Gold

GoNoGo Trend paints more weaker aqua bars this week and we saw price gap lower. We will watch to see if this becomes a new higher low and provides some support going forward. GoNoGo Oscillator finds itself back at the zero line and we see heavy volume. It will be important for the oscillator to recover positive territory if this trend is to continue. If it does, we will know that momentum is resurgent in the direction of the “Go” trend and we can look for price to make an attempt to challenge for new highs.

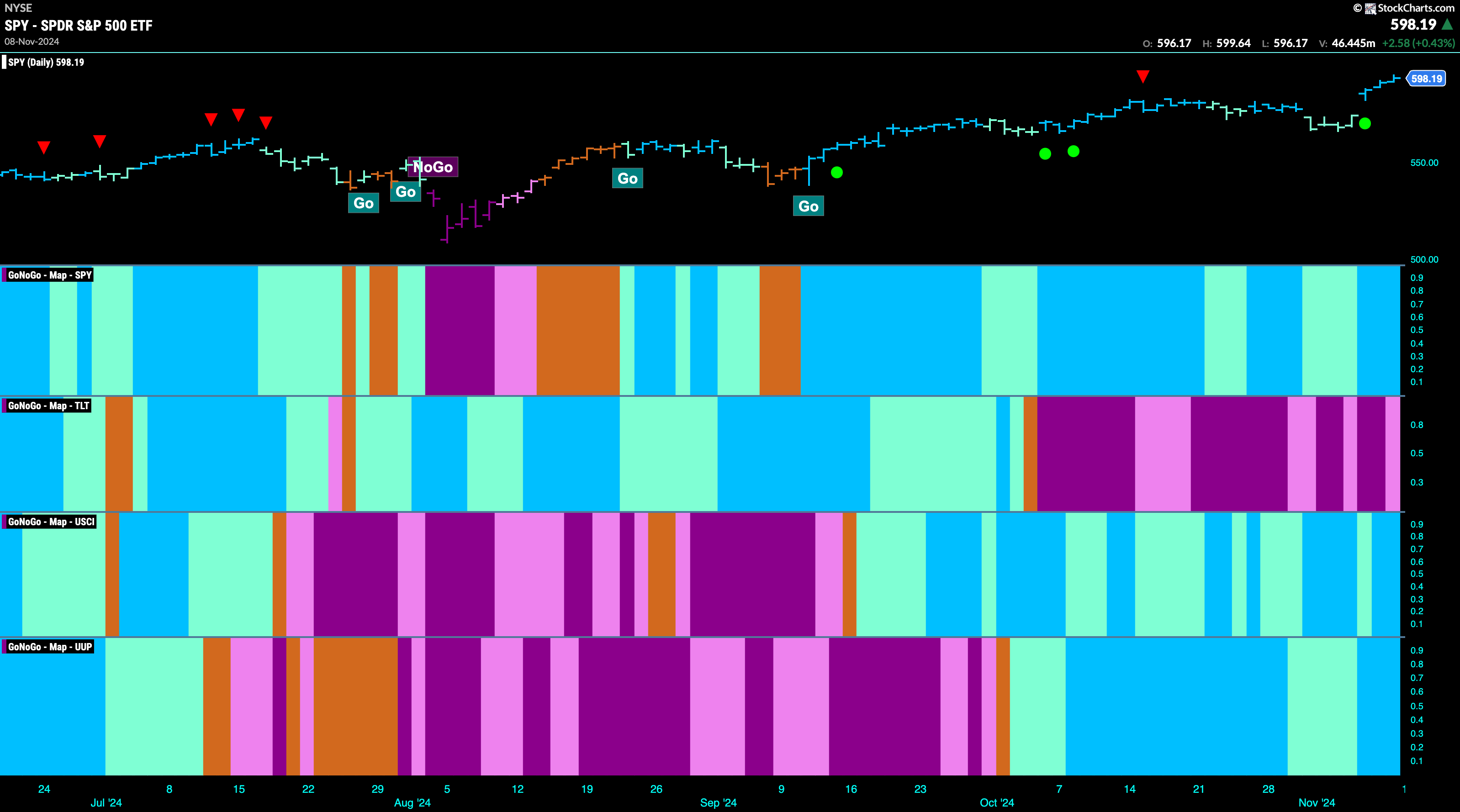

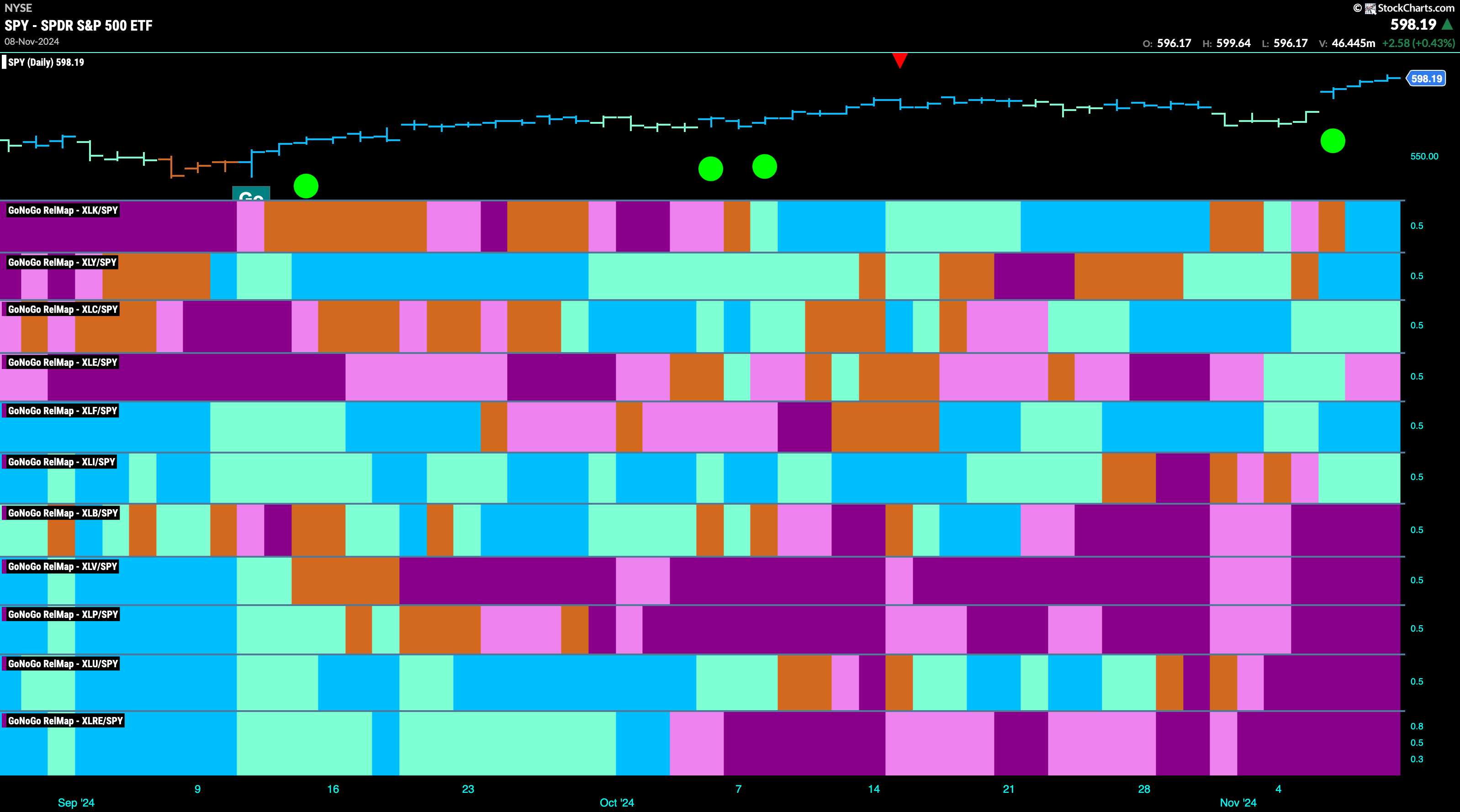

Sector RelMap

Below is the GoNoGo Sector RelMap. This GoNoGo RelMap applies the GoNoGo Trend to the relative strength ratios of the sectors to the base index. With this view we can get a sense of the relative out performance and relative underperformance of the sectors. 5 sectors are in relative “Go” trends. $XLK, $XLY, $XLC, $XLF, and $XLI, are painting relative “Go” bars.

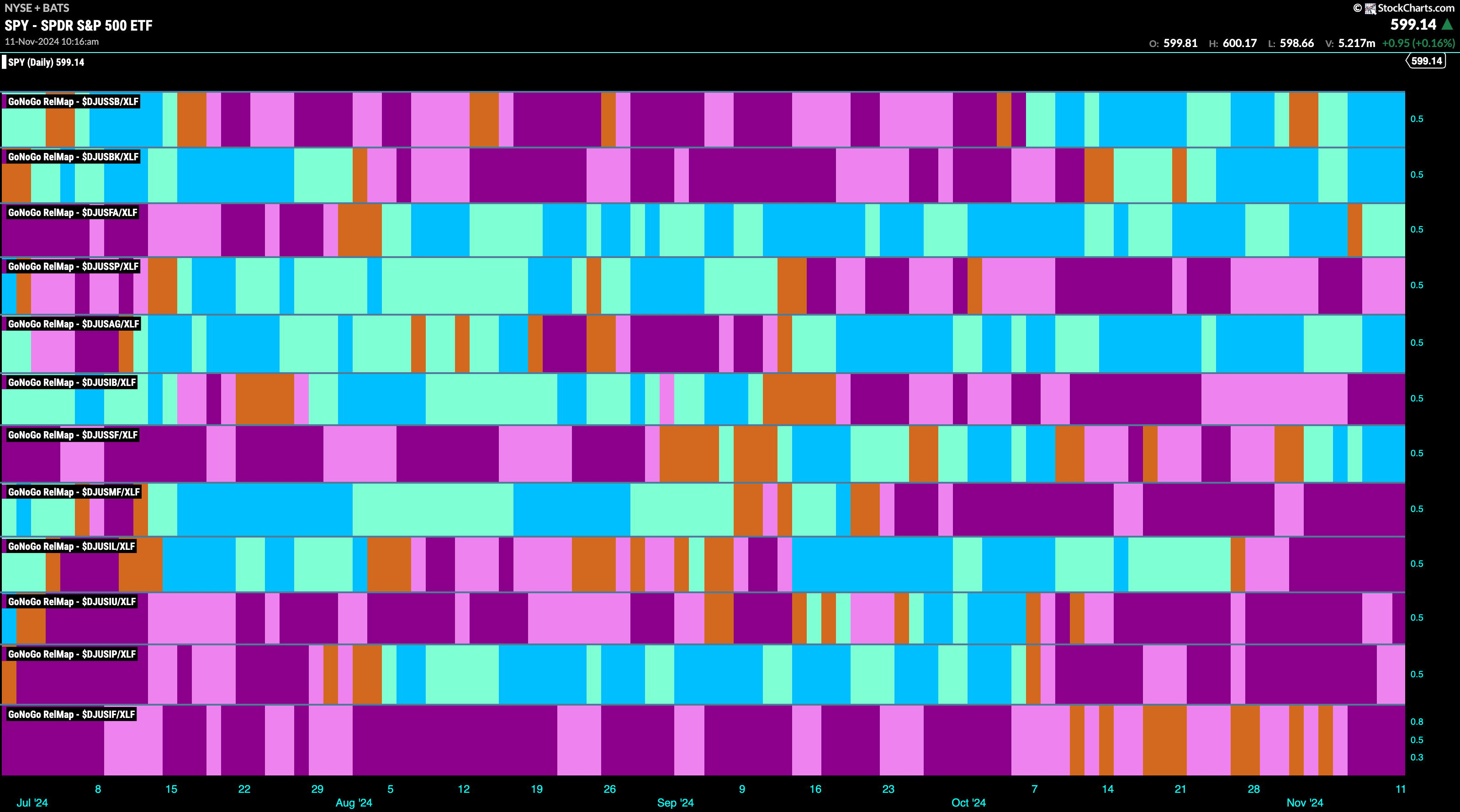

Financials Sub-Group RelMap

The chart below shows a relative trend breakdown of the sub groups within the financials sector. The Sub-Group RelMap plots the GoNoGo Trend of each sub index to the $XLF. We saw in the above GoNoGo Sector RelMap that $XLF is performing strongly relatively to the $SPY, with GoNoGo Trend painting strong blue “Go” bars. If we look at the breakdown of the groups in the map below we can see where that outperformance is coming from. Painting strong blue “Go” bars in the 5th panel and having outperformed for some weeks now is the asset managers sub index.

$WULF Breaks to New Highs

The chart below shows that $WULF has made a significant break higher. We see that after consolidating around July highs and finding support there, price has scampered higher on strong blue “Go” bars. GoNoGo Oscillator provided strong support as it bounced sharply off the zero line back into positive territory. We now see that momentum has surged to overbought territory and volume is heavy.

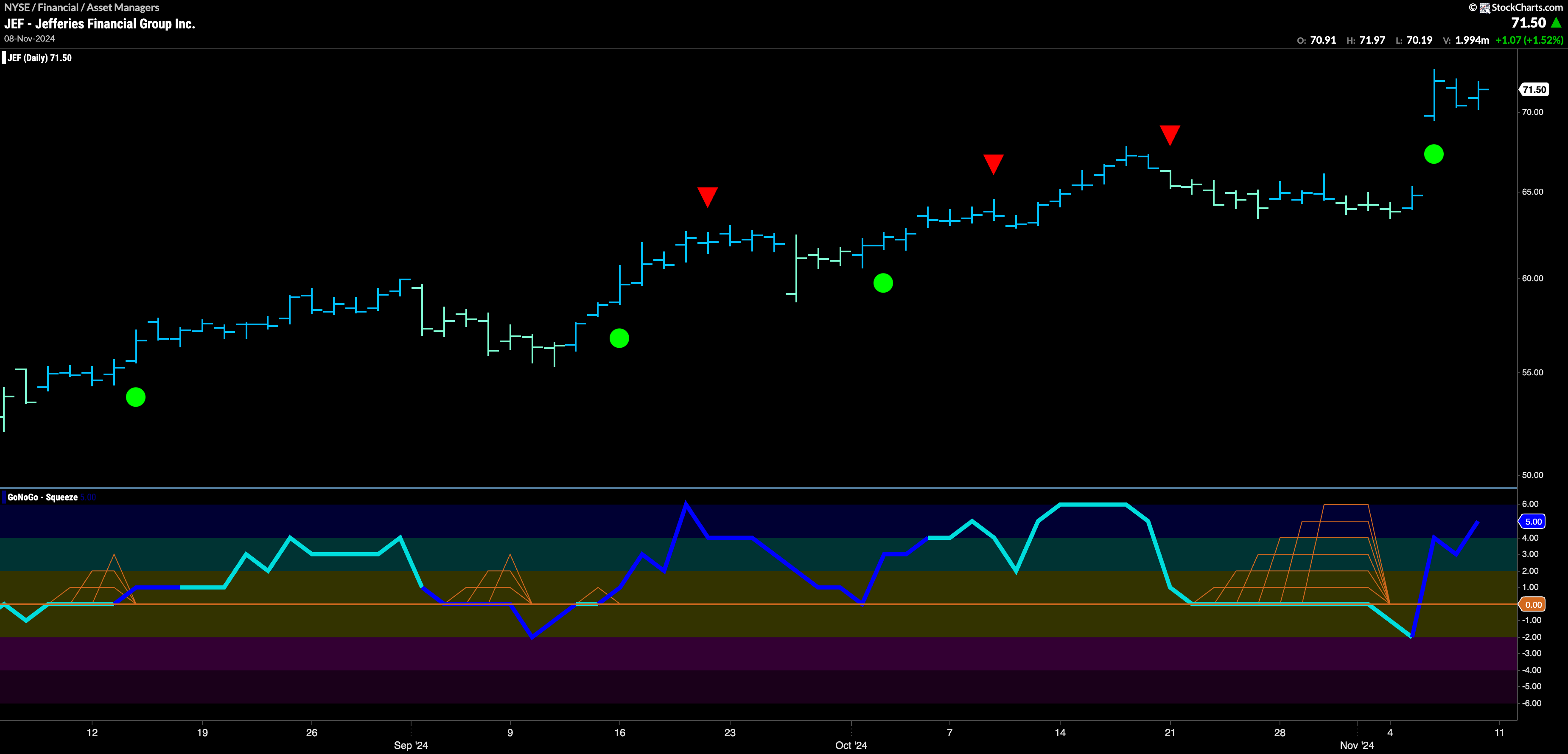

$JEF Gaps to New Highs on Strong “Go” Bars

$JEF has been in a “Go” trend for several months and during that time we see that GoNoGo Oscillator remained primarily at or above the zero line providing support. After the high in mid October, we saw a Go Countertrend Correction Icon (red arrow) that told us price may struggle to go higher in the short term. Indeed, weakness followed as GoNoGo Trend painted mostly weaker aqua bars. GoNoGo Oscillator during this time fell to the zero level and got stuck there as a Max GoNoGo Squeeze was formed. Although the oscillator briefly dipped into negative territory it rallied strongly on heavy volume and is now surging higher into positive territory. With GoNoGo Trend painting strong blue bars, momentum is back on its side.