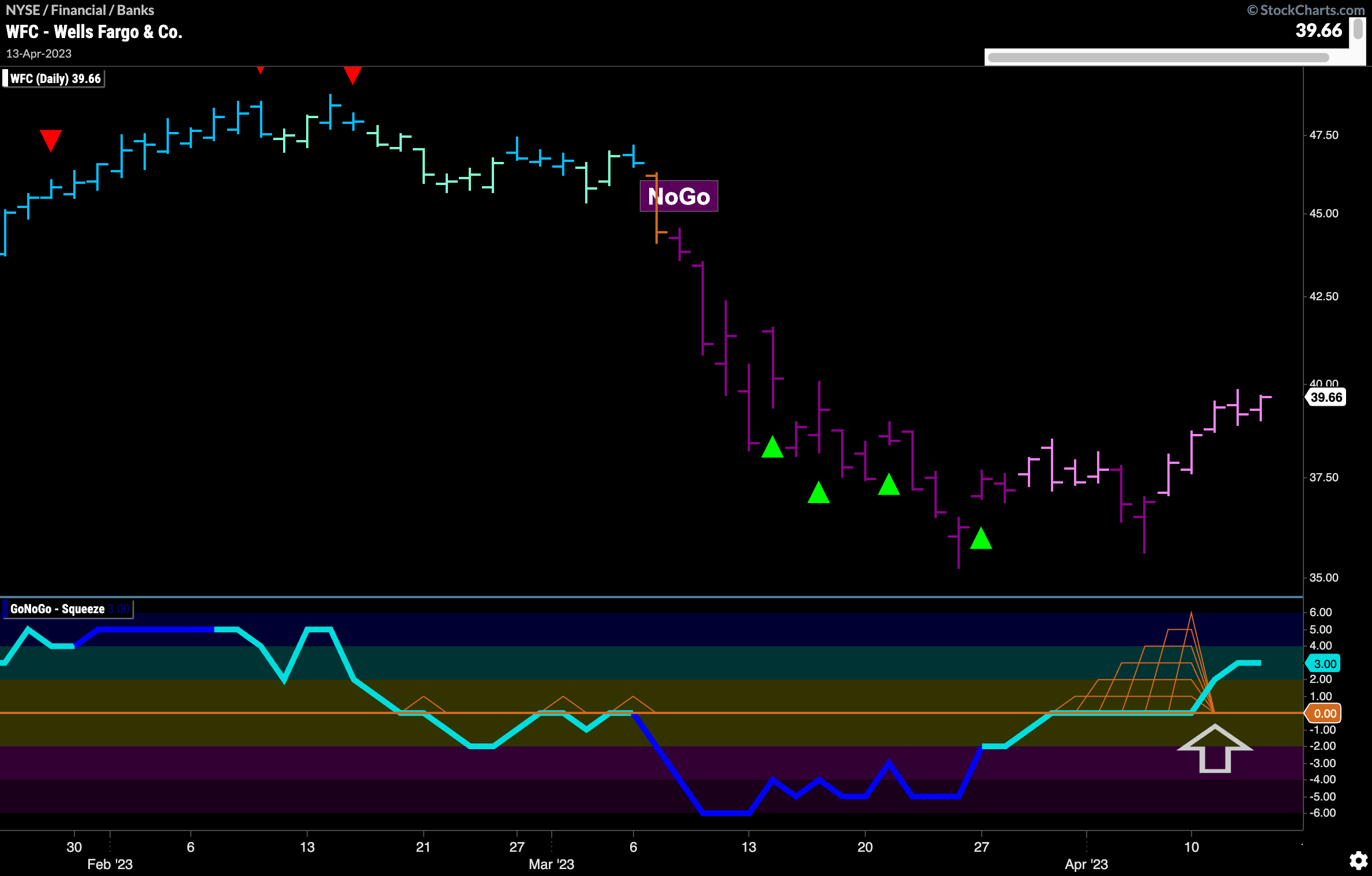

$WFC saw price fall sharply early March.

As with many bank stocks, $WFC entered a “NoGo” trend and prices plummeted to lows in late March. Since then, GoNoGo Oscillator rose to challenge the zero line and it remained there for several bars, causing the climbing grid of GoNoGo Squeeze to rise to its max. This Max GoNoGo Squeeze indicated a tug of war between the bulls and bears as there was little directional momentum. A few bars ago, we saw GoNoGo Oscillator break out of the Max GoNoGo Squeeze into positive territory. This contradicts the “NoGo” trend and as price rallies off the lows we will watch to see if this positive momentum leads to trend change in the panel above.