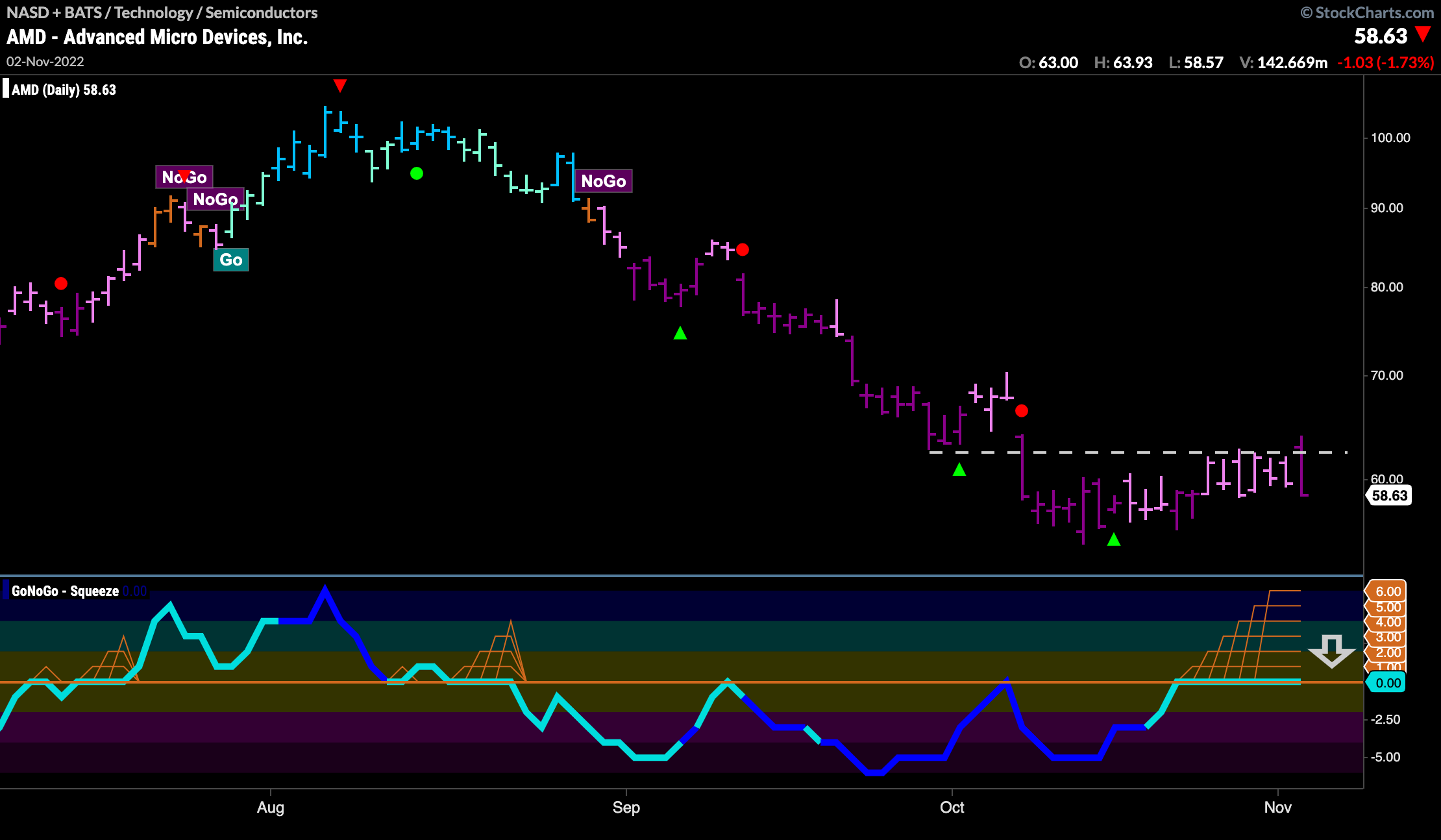

$AMD has seen a “NoGo” trend moving price lower by over 40%.

A series of lower highs and lower lows throughout this time culminated with a low in mid October around $55. Price has moved sideways since, consolidating against the “NoGo” trend. We have seen the GoNoGo Oscillator rally to test the zero line from below. It is riding the zero line and so we see a GoNoGo Squeeze climb to its max. This volatility squeeze is due to compressed price action and we will watch closely to see in which direction the Squeeze is broken. Should it be broken to the downside then we can look for price to attack prior lows. A break out of the Squeeze into positive territory would be a threat to the current “NoGo” trend.