“For the investor who knows what they are doing, volatility creates opportunity.” – John Train

The market pullback sparked by the GameStop mania gave way to a strong rally this week. U.S. stocks posted their best weekly gain since November. The S&P 500, Nasdaq Composite, and small-cap Russell 2000 indexes all reached fresh record highs. Crude oil traded to the highest levels in more than a year, logging an almost 10% gain for the week.

Consumer spending, and therefore the economic recovery, remain well supported by additional fiscal stimulus, accommodative central-bank policies, and the rollout of vaccines.

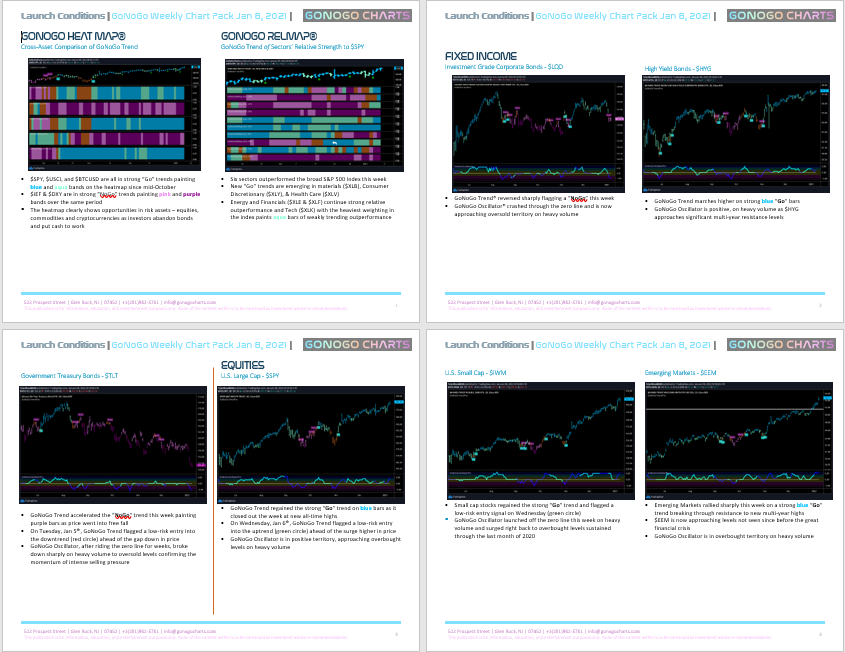

Click here to view your Launch Conditions Chart Pack for the week ending February 5, 2021.

Riskier market segments, including high yield bonds and cryptocurrencies recovered from weakness amid the cooling of the short squeeze trading volatility. See the GoNoGo Trend chart of $VIX above that highlights last week’s spike.

Volatility rose sharply last week flagging a “Go” trend but reversed the spike as it fell consistently this week painting several amber bars. GoNoGo Oscillator broke into positive territory but has since crashed back to the zero line and finally broke down into negative territory.

It is difficult to stay disciplined amid the speculative frenzy, but volatility is a normal part of the markets, particularly in the early phase of a new expansion. That is why it is crucial to step back and look at the long-term trends across asset classes and around the world to better understand the context of the market regime we are in. Take a moment this weekend to look through the 16 GoNoGo Charts included in your lastest Launch Conditions Chart Pack: