Studies have shown that momentum readings are not only useful for mean-reversion strategies but can also add insight within trend. GoNoGo Oscillator is calculated so that when inputs are in neutral territory, it rests at zero. Meaning, when enthusiasm wanes within a trending market, GoNoGo Oscillator® provides an objective point of support/resistance for momentum at the zero line.

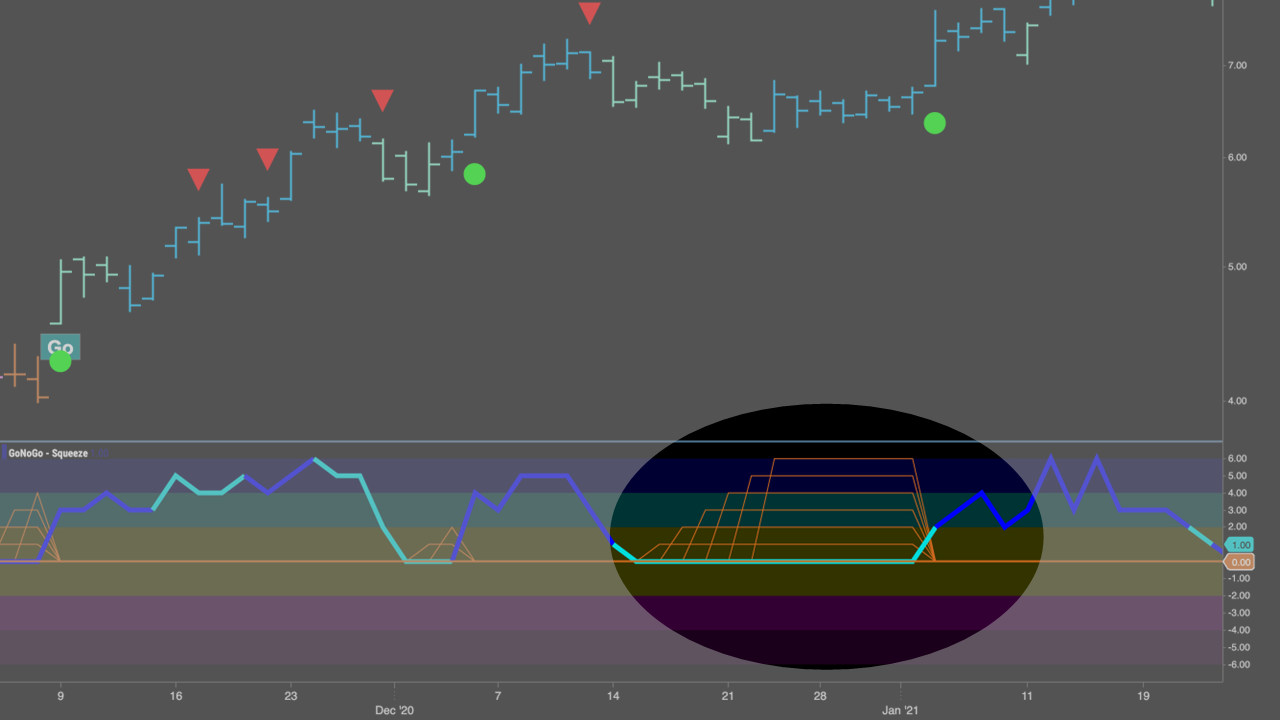

Where there is no excessive buying or selling, price action stagnates, volatility declines, markets move sideways, and GoNoGo Oscillator® rests at the zero line. This volatility compression is highlighted by GoNoGo Squeeze®. A visual grid in the oscillator panel climbs as momentum remains neutral reaching extremes with prolonged reduction in volatility. Like a coiled spring, researchers have shown that following these stalemates between buyers and sellers, a breakout can be expected.